How Bitcoin Price Could Move as Fed December Rate-Cut Odds Hit 87%

Bitcoin is back in rally mode as expectations for a December Federal Reserve rate cut surge to their highest level yet this month.

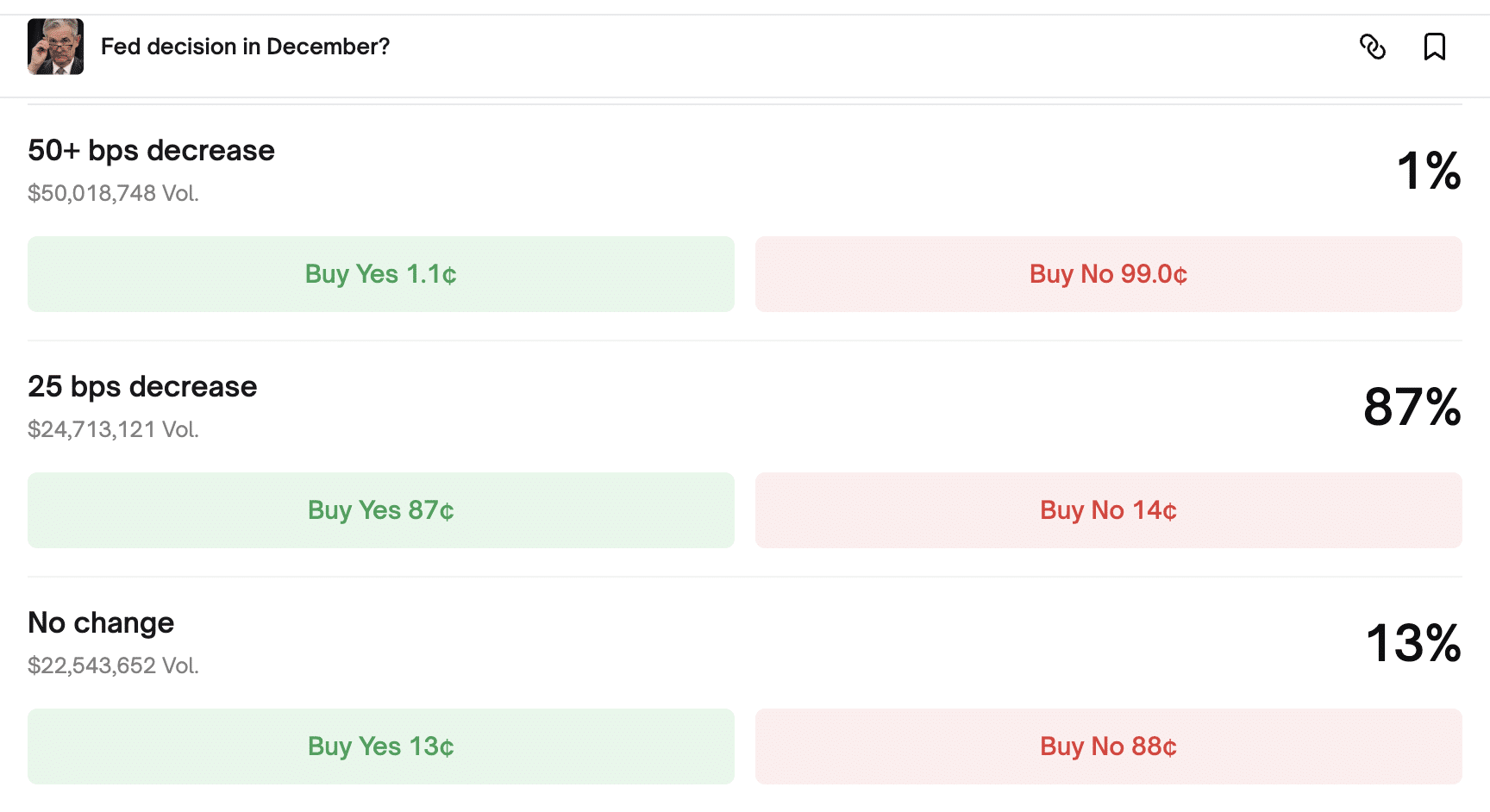

Specifically, traders are now pricing in up to an 87% chance of a rate cut.

Bitcoin Breaks Above $92,000 as Dovish Fed Bets Strengthen

Today, Bitcoin surged past $92,000, climbing more than 1.5% in 24 hours to $92,960 — its highest price this week. The rally comes as investors increasingly believe President Donald Trump will appoint a more dovish Federal Reserve chair before Christmas.

Treasury Secretary Scott Bessent confirmed that Fed chair interviews are in their final round, signalling that the decision is “moving along very well.”

The possibility of a new, more rate-friendly Fed leader, combined with growing bets on a December cut, has boosted risk appetite.

The global crypto market cap rose 1.5% to $3.14 trillion, although it has only recovered a fraction of last week’s losses.

Why Surging 87% Rate-Cut Odds Matter for BTC

Prediction markets such as Kalshi and Polymarket now show probabilities above 80–87% for a 25-basis-point cut at the Fed’s Dec. 9–10 policy meeting. Financial markets also assign an 87% probability of a rate cut, according to CME’s FedWatch tool.

In other words, traders see very little chance that the Fed will hold rates steady (only 13% are betting on no change), and almost no chance of a larger cut, with just 1% expecting a reduction of 50 basis points or more.

Lower interest rates typically weaken the dollar, boost liquidity, and improve risk sentiment across the crypto market. Bitcoin price has already shown signs of stability around the $90,000 level, and a confirmed December cut could strengthen the case for BTC to retest the $100,000 mark.

In such a scenario, some analysts see potential for Bitcoin to break new all-time highs. For instance, Dr. Whale, a widely followed market commentator, has predicted that Bitcoin could reach $130,000 to $150,000 in the next four months.

Tom Lee on His $250K Bitcoin Prediction

Meanwhile, BitMine chairman Tom Lee has softened his long-standing call for Bitcoin to hit $250,000 by the end of 2025. He now says only that BTC may reclaim its October all-time high of $126,200, though he still expects Bitcoin to finish the year above $100,000.

Lee previously stood by his $250,000 target through early October, even as other industry figures, including Galaxy Digital’s Mike Novogratz, argued that such a move would require “crazy” conditions.