Bloomberg Strategist Says Bitcoin on Track to Revisit Yearly Pivot at $50,000: Here’s Why

A well-known commodity strategist at Bloomberg Intelligence says there’s a chance Bitcoin could collapse 45% from here to its yearly pivot.

Notably, Bitcoin (BTC) has bounced over the past week, but the market still shows signs of stress from a longer timeframe. The price has climbed about 9% in the last 7 days to trade around $92,400, yet it continues to post a sharp drop for November.

With the month showing a decline of roughly 15%, Bitcoin remains on track for its biggest monthly loss since February 2025 unless buyers regain stronger control soon.

Bitcoin Risks Dropping to $50,000

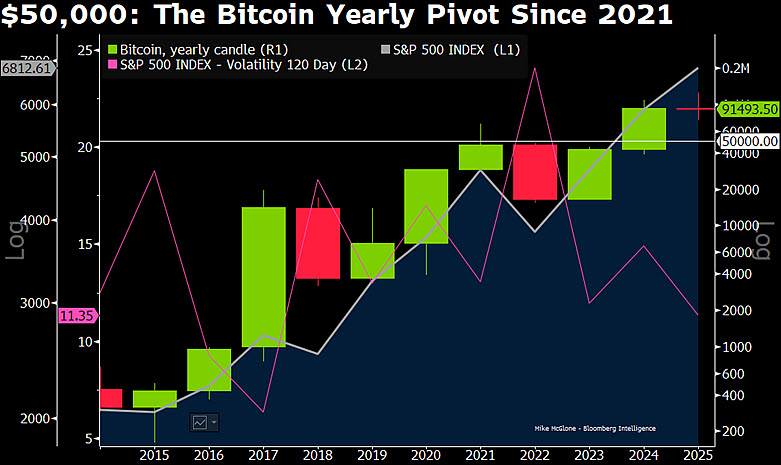

However, Bloomberg Intelligence senior commodity strategist Mike McGlone argues that Bitcoin still risks sliding back toward its yearly pivot near $50,000.

McGlone revealed this in a post on X today, sharing a chart that tracks Bitcoin’s yearly performance from 2014 to 2025 alongside the S&P 500 Index and the S&P 500’s 120-day volatility. Data from the chart shows that Bitcoin often gravitates back to the $50,000 level, which has acted as an important midpoint for the market since 2021.

Bitcoin first claimed this $50,000 mark in March 2021 and has since continued to pull or push toward it. Despite trading roughly 84% higher from this level, past behavior signals that the crypto firstborn frequently returns to the central pivot when global markets tighten.

The chart further highlights how closely Bitcoin tends to move with the S&P 500. At the time of the analysis, the volatility reading sits near 11%, one of the lowest year-end levels since 2017.

According to McGlone, this unusually low volatility may indicate rising pressure. Now, when equity volatility drops to such lows, markets often set up for sharp moves, and he believes Bitcoin could respond by drifting back toward $50,000. Bitcoin last saw this price in August 2024.

For perspective, a decline to this level would mark a 45.8% drop from the current price. The last time BTC saw a crash of this magnitude was from April to June 2022, when it collapsed by over 70% within these three months amid the contagion from the Terra implosion.

Analysts Eyeing a Full Bitcoin Recovery

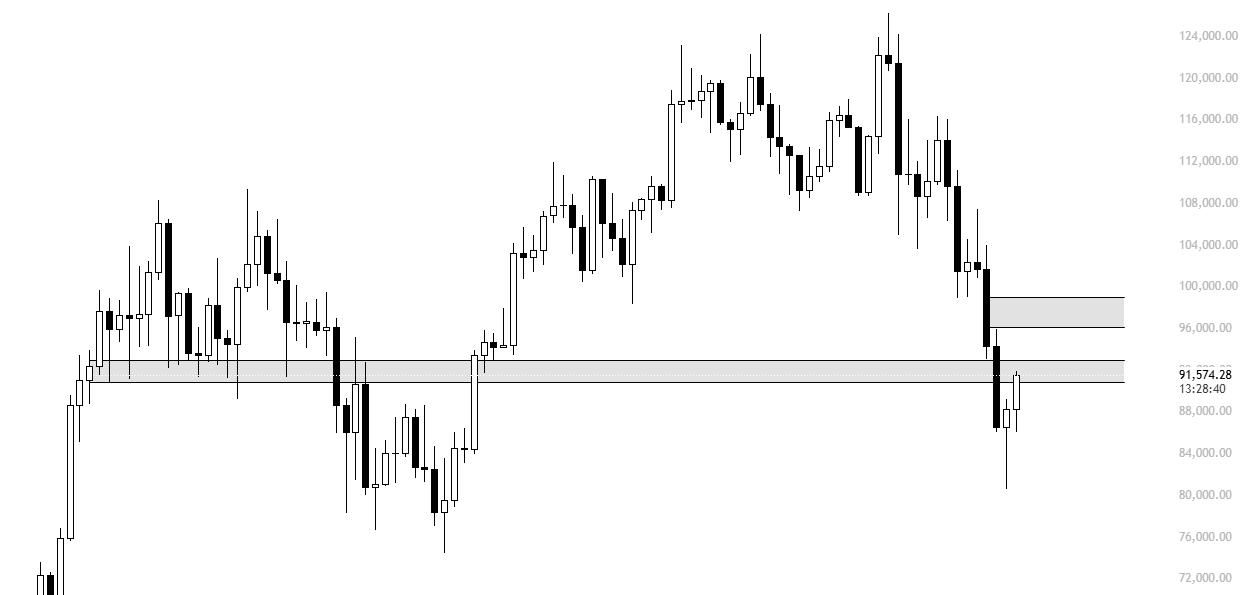

While McGlone warns about the potential downside, several other analysts see room for a full recovery if buyers break through key resistance levels. For instance, Michaël van de Poppe says Bitcoin needs to push above the $91,000 to $94,000 zone to shift momentum upward. If it clears that area, he expects the market to move toward $100,000 and possibly higher.

Nothing has changed. $BTC needs to break this crucial level, and if it does, then we’re looking to be getting into territories of $100K and potentially higher. pic.twitter.com/4PDJ7W62Op

— Michaël van de Poppe (@CryptoMichNL) November 28, 2025

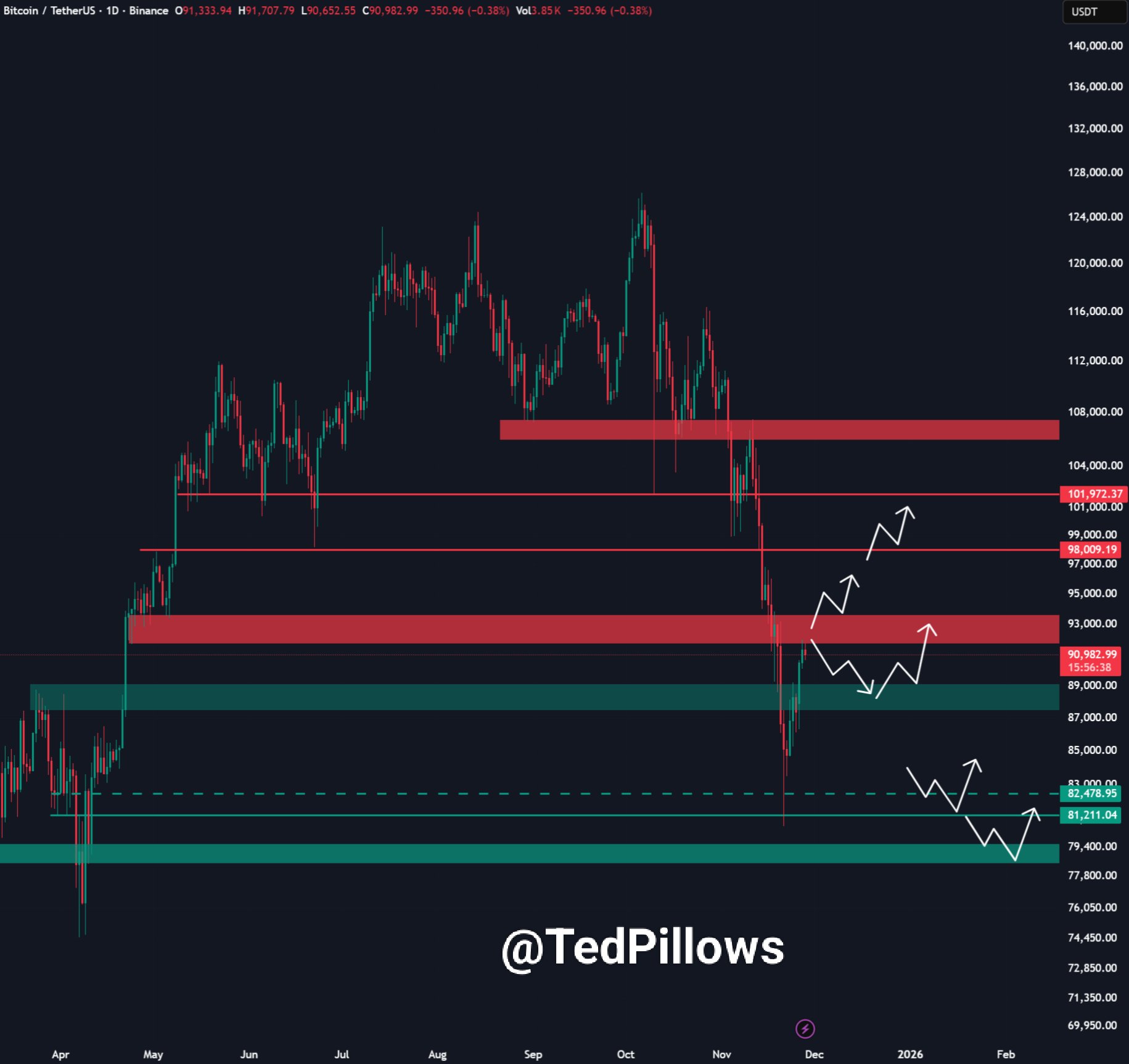

Analyst Ted Pillows presented a similar analysis but focused on the resistance between $92,000 and $93,000. He says Bitcoin must reclaim this region for buyers to target a run toward $98,000 to $100,000. If the market fails to break through, he believes a drop back toward the $88,000 level could ensue.

Meanwhile, market analyst Killa noted that despite Bitcoin’s 15% climb from recent lows in just 7 days, it hasn’t formed a clear higher low. According to him, it now approaches major resistance while trading on declining volume.

He explained that strong downtrends often reject the first attempt to reclaim a major level, which usually sends the price back to retest demand before a real reversal forms. The analyst believes BTC would likely rise from $80,000 to $92,000, then drop to $88,000 before recovering toward $96,000 rather than surging straight from $80,000 to $96,000.