Strategy will sell Bitcoin as ‘last resort’ if mNAV drops, capital is unavailable: CEO

Strategy would consider selling Bitcoin only if its stock falls below net asset value and the company loses access to fresh capital, CEO Phong Le said in a recent interview.

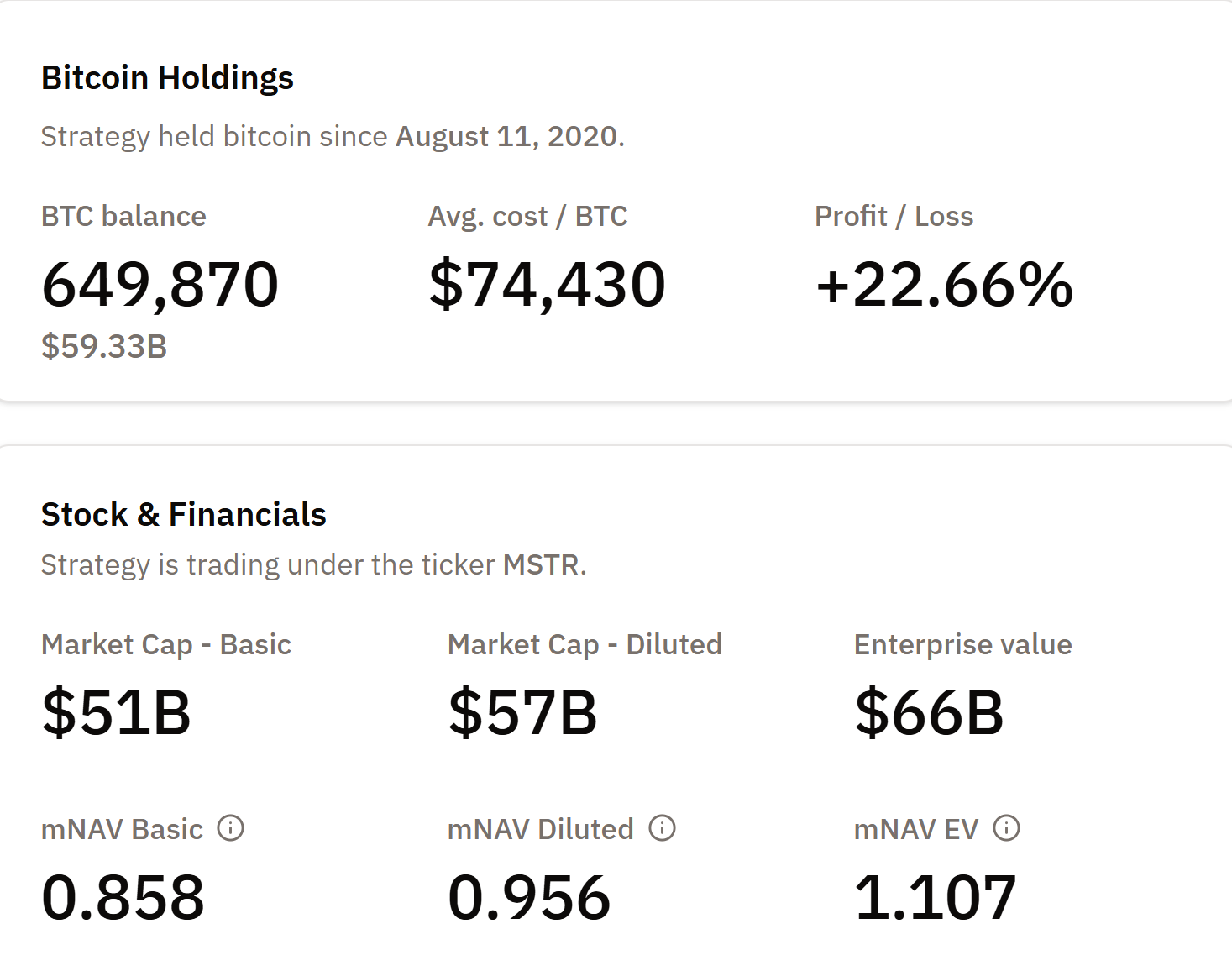

Le told the What Bitcoin Did show that if Strategy’s multiple to net asset value (mNAV) were to slip under one and financing options dry up, unloading Bitcoin becomes “mathematically” justified to protect what he calls “Bitcoin yield per share.”

However, he noted that the move would be a last resort, not a policy shift. “I would not want to be the company that sells Bitcoin,” he said, adding that financial discipline has to override emotion when markets turn hostile.

Strategy’s model hinges on raising capital when its shares trade at a premium to NAV and using that money to buy Bitcoin (BTC), increasing BTC held per share. When that premium disappears, Le said, selling a portion of holdings to meet obligations can be acceptable to shareholders if issuing new equity would be more dilutive.

Related: Bitcoiners accuse JPMorgan of rigging the game against Strategy, DATs

Strategy faces $800 million annual dividend bill

The warning comes as investors scrutinize the company’s expanding fixed payments tied to a suite of preferred shares introduced this year. Le put annual obligations near $750 million to $800 million as recent issues mature. His plan is to fund those payouts first through equity raised at a premium to mNAV.

“The more we pay the dividends out of all of our instruments every quarter, that’s seasoning the market to realize that even in a bare market, we’re going to pay these dividends. When we do that, they start to price up,” he said.

Beyond balance-sheet mechanics, Le defended the long-term thesis on Bitcoin as a scarce, non-sovereign asset with global appeal. “It’s non-sovereign, has a limited supply… people in Australia, the US, Ukraine, Turkey, Argentina, Vietnam and South Korea — everyone likes Bitcoin,” he added.

Related: Strategy unveils new credit gauge to calm debt fears after Bitcoin crash

Strategy unveils BTC credit dashboard

Last week, Strategy launched a new “BTC Credit” dashboard to reassure investors after Bitcoin’s latest drop and a sell-off in digital-asset treasury stocks. The company, the largest corporate holder of BTC, says it has enough dividend coverage for decades, even if Bitcoin’s price stays flat.

Strategy claims its debt remains well-covered if BTC falls to its average purchase price of about $74,000, and still manageable even at $25,000.

Magazine: 2026 is the year of pragmatic privacy in crypto — Canton, Zcash and more