Ether ETFs Lead Weekly Gains as Bitcoin and Solana Stay Green

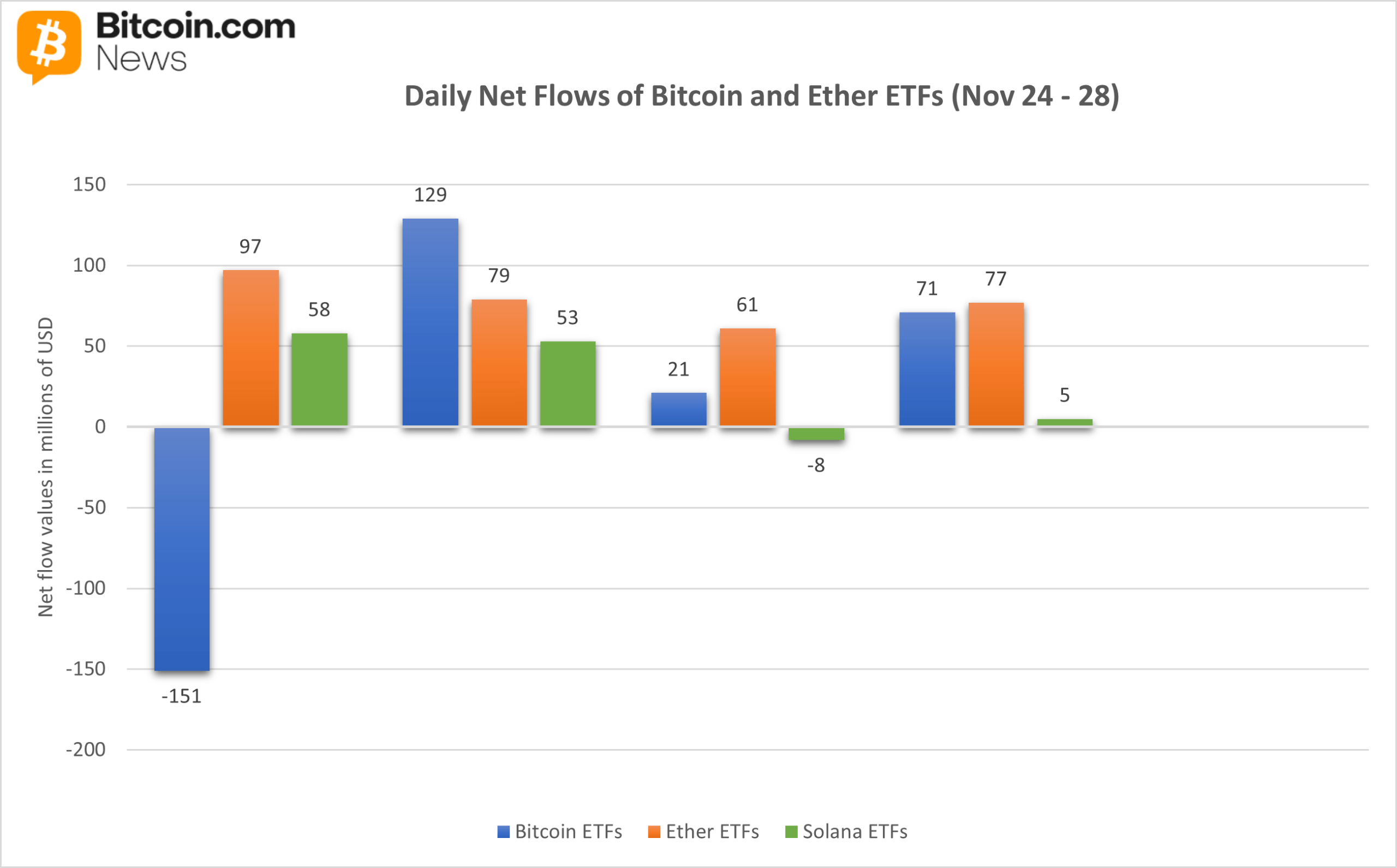

Ether ETFs roared back to life with their strongest week in a month, while bitcoin funds ended a four-week outflow streak and solana funds extended their multi-week surge. Across all three sectors, the tone shifted decisively toward accumulation.

ETF Revival Week: Ether Dominates, Bitcoin Edges Up

A calmer macro backdrop and renewed appetite across digital assets reshaped exchange-traded fund (ETF) flows this week, transforming what had been a month of persistent exits into a widespread resurgence. Spot ether ETFs led the charge with a $313 million net inflow, marking an emphatic reversal after three straight weeks in the red. Bitcoin ETFs followed with a modest but meaningful $70.05 million entry, snapping their four-week outflow streak. Solana ETFs once again proved to be the market’s most consistently bid segment, securing $108 million in new capital and extending their inflow run to five consecutive weeks.

Bitcoin ETFs: A Gradual Turn Back to Green

For bitcoin ETFs, the week was defined by uneven yet ultimately positive flows. Fidelity’s FBTC delivered the bulk of the inflows with a $230.44 million entry for the week. Grayscale’s GBTC and Bitcoin Mini Trust added $16.33 million and $8.88 million, each. The inflows were wrapped up with a $6.44 million addition from Ark & 21Shares’ ARKB.

The week wasn’t all green with Blackrock’s IBIT shedding -$137.01 million for the week. Vaneck’s HODL saw a -$36.95 million exit with a further exit of -$18.10 million from Bitwise’s BITB. While the daily push-and-pull underscored lingering market caution, the week closed with net inflows, just enough to break a month-long downturn.

Ether ETFs: A Dominant, Broad-Based Rebound

Ether products delivered the most coordinated recovery by far. Blackrock’s ETHA led with a $257.18 million entry. Fidelity’s FETH added $45.32 million for the week. Grayscale’s Ether Mini Trust brought in $24.37 million at the end of the week. 21Shares’ TETH and Bitwise’s ETHW rounded up the week’s inflow with $742.32K and $66.13K. Only one fund recorded an outflow, with Grayscale’s ETHE seeing a -$15.05 million exit for the week. With every major fund participating, ether ETFs clearly led the week’s resurgence.

Solana ETFs: Strong Momentum Continues

Solana ETFs added another week in the green. Bitwise’s BSOL dominated with $83.76 million for the week. Grayscale’s GSOL was equally solid with a $35.38 million weekly entry. Fidelity’s FSOL added $19.49 million, with Vaneck’s VSOL bringing in $4.47 million. The only disruption for the week came from 21Shares’ TSOL with a -$34.77 million exit, its first major exit, but Solana’s inflow momentum held firm overall.

FAQ🚀

-

Why did ether ETFs dominate this week?

Ether saw broad-based demand with over $313 million in inflows, its strongest weekly rebound in a month. -

Did bitcoin ETFs finally recover?

Yes, BTC products ended a four-week outflow streak with a modest $70 million net inflow despite mixed issuer performance. -

How did solana ETFs perform?

Solana secured $108 million in fresh capital, extending its multi-week inflow streak despite one major fund outflow. -

What does this week signal for crypto ETF sentiment?

Investors shifted decisively toward accumulation across ETH, BTC, and SOL after weeks of risk-off behavior.