Can Bitcoin Restart a Bullish Trend? Here’s What It Will Take

Bitcoin (BTC) once again fell below the $90,000 mark in early Asian trading hours today, despite positive macroeconomic catalysts.

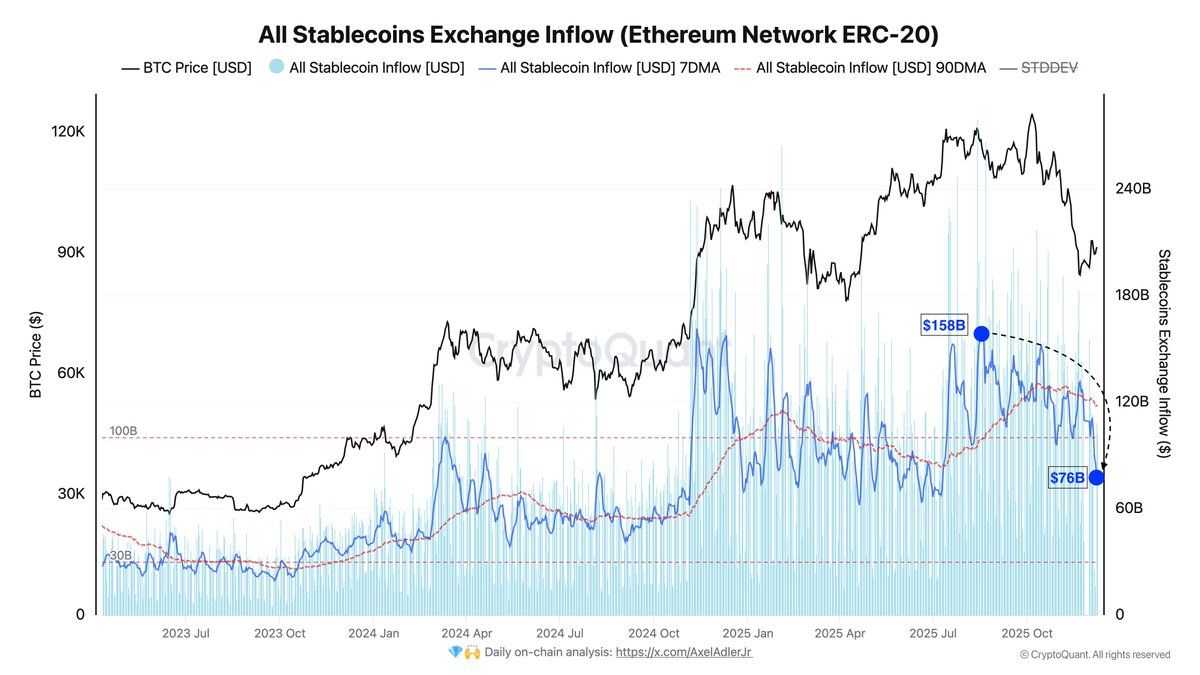

An analyst highlighted the drop in stablecoin inflows as a key factor behind Bitcoin’s ongoing weakness, suggesting fresh liquidity is vital for a bullish rally.

The Key Catalyst Bitcoin Needs to Turn Bullish Again

Data from BeInCrypto Markets showed that December has been a volatile month for the largest cryptocurrency. This follows two consecutive months of losses, with Bitcoin posting its largest monthly decline of the year in November.

At the time of writing, BTC was trading at $89,885, down 2.7% over the past 24 hours. The drop comes despite yesterday’s Federal Reserve decision to cut interest rates for the third time this year.

The bank lowered rates by 25 basis points to a target range of 3.50%–3.75%. Rate cuts are typically viewed as bullish for the crypto market. In fact, many expected a rebound.

However, prices moved in the opposite direction. So, if not this, then what exactly does Bitcoin need to reverse its downtrend?

According to Darkfost, its liquidity. The analyst explained that stablecoin inflows into exchanges have dropped from $158 billion in August to approximately $76 billion today.

This represented a decline of 50% over just a few months. Meanwhile, the 90-day average fell from $130 billion to $118 billion, highlighting a clear downward trend.

“One of the main reasons why Bitcoin is struggling to recover right now is the lack of incoming liquidity. When we talk about liquidity in the crypto market, we’re primarily referring to stablecoins,” the post read.

The analyst added that this steep decline in stablecoin inflows signals weakening demand. Bitcoin now faces ongoing selling pressure that new capital has not absorbed. Furthermore, the trend shows that slight rebounds are driven more by reduced selling than by renewed buying.

“For Bitcoin to restart a genuine bullish trend, the key lies in new liquidity entering the market,” Darkfost noted.

BeInCrypto also highlighted in a recent report that stablecoin issuers continue to mint new tokens, with the market capitalization of major assets such as Tether (USDT) and Circle’s USDC reaching new highs this month.

Nonetheless, data show that a lot of supply is being absorbed by cross-border payment demand. Additionally, a significant share of the inflows is moving toward derivatives exchanges rather than spot platforms.

“Asia leads with the highest volume of stablecoin activity, exceeding North America. Relative to gross domestic product, though, Africa, the Middle East and Latin America stand out. Most of the flow is from North America to other regions,” the IMF wrote in a recent report.

Thus, Bitcoin’s recent decline highlights that macro catalysts alone are no longer driving the market. The data makes it clear that renewed stablecoin liquidity is the missing ingredient for a sustained bullish reversal. Market sentiment also needs to improve. Fearful behavior and low engagement continue to hold back capital rotation into Bitcoin.

The post Can Bitcoin Restart a Bullish Trend? Here’s What It Will Take appeared first on BeInCrypto.