Institutional adoption of Bitcoin has reached a new peak, with over 10% of the total BTC supply now held by public companies or in exchange-traded funds.

Charles Edwards, CEO of Capriole Investments, shared the update in a July 24 thread on X, noting a significant surge in institutional accumulation.

Edwards pointed out that the share of Bitcoin held by institutions, including ETFs, public companies, and investment trusts, has climbed from 4% over the past 18 months to an all-time high of over 10%.

Data from Bitcoin Treasuries supports this trend, showing that exchange-traded funds now control approximately 1.62 million BTC, while publicly listed companies hold around 918,000 BTC. At current market prices of roughly $118,838 per coin, institutional holdings are valued at more than $250 billion.

According to Edwards, these significant holdings were bolstered by the fact that the institutional purchases have been absorbing Bitcoin at a rate far beyond its natural issuance. In some cases, the daily demand from corporate buyers is ten times greater than the number of new coins mined.

He stated:

“The daily percentage of all Bitcoin in existence that is being acquired by institutions per day (blue) is currently 10X higher than the Bitcoin mining Supply Growth Rate (red)! Notice how every time institutional buying has exceeded the Supply Growth Rate, price went VERTICAL.”

This accelerating trend can be traced back to 2020, when Strategy (formerly MicroStrategy) began converting portions of its balance sheet into Bitcoin.

Since then, a growing number of firms, especially under President Donald Trump’s pro-crypto administration, have adopted Bitcoin as a strategic reserve asset and have acquired the top crypto en masse.

Bitcoin price correlation

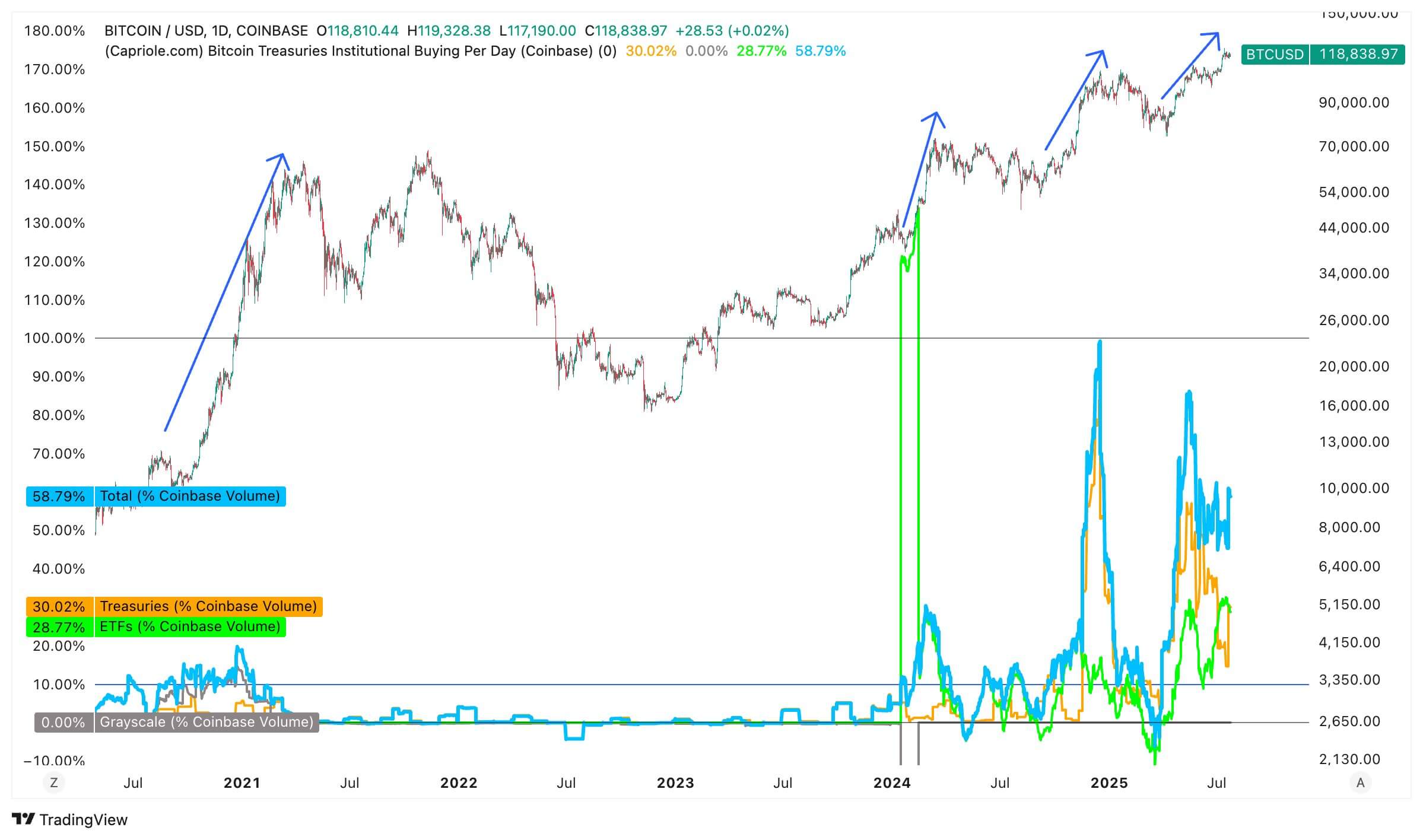

Meanwhile, Edwards also noted a correlation between institutional activity on Coinbase, the largest US-based crypto exchange, and Bitcoin price.

According to him, whenever institutional trading makes up between 10% and 50% of the platform’s daily activity, “price has historically rocketed.”

This shows an increasingly significant correlation between BTC’s price and institutional activity.

Considering this, Edwards believes this trend is fueling a bullish outlook for the top crypto asset, saying:

“It’s hard not to be bullish with the exponential growth in the number of treasury companies, the amount of Bitcoin they are buying, and the frequency at which they are buying. It’s never been seen before in history. The demand these companies have for Bitcoin is striping 1000% of the daily Bitcoin supply out of the market every day.”

As a result, he believes that the Bitcoin price will soon break back above the $118,000 range.