Bitcoin Price Analysis: BTC’s Next Big Move Is Brewing – Breakout or Breakdown Ahead?

Bitcoin remains stuck in a tightening range just above the $80K mark. Despite the recent bounce from sub-$85K levels, the overall market tone still leans cautious. There’s been no meaningful breakout, and sentiment hasn’t shifted bullish yet.

BTC Technical Analysis

By Shayan

The Daily Chart

On the daily timeframe, the price is still trapped inside the broader descending channel that’s been active over the past couple of months. BTC recently bounced from the $81K support zone and has since printed a series of higher lows. However, each push has been capped at around $95K, right below the channel’s higher boundary and the key bearish order block.

The asset is now trading below both the 100-day and 200-day MAs, which are curving downward around $107K. This is a clear sign that buyers are still fighting the macro trend. Unless a strong daily close above $96K occurs, the structure remains bearish to neutral.

The 4-Hour Chart

Zooming into the 4H chart, BTC is forming a clear ascending triangle between $80K and $95K. This kind of structure often resolves upward, but only if volume and momentum support the breakout. Right now, the breakout attempts near $94K keep getting rejected.

There is a tightening squeeze between the trendline support and horizontal resistance, and the price is nearing the apex. So a breakout or breakdown is likely within the next few sessions.

Buyers would want to see a clean breakout above $95K with volume to target the $100K zone. Sellers, on the other hand, would look to a break below the ascending trendline, aiming for a retest of $85K or even the critical $80K area.

On-Chain Analysis

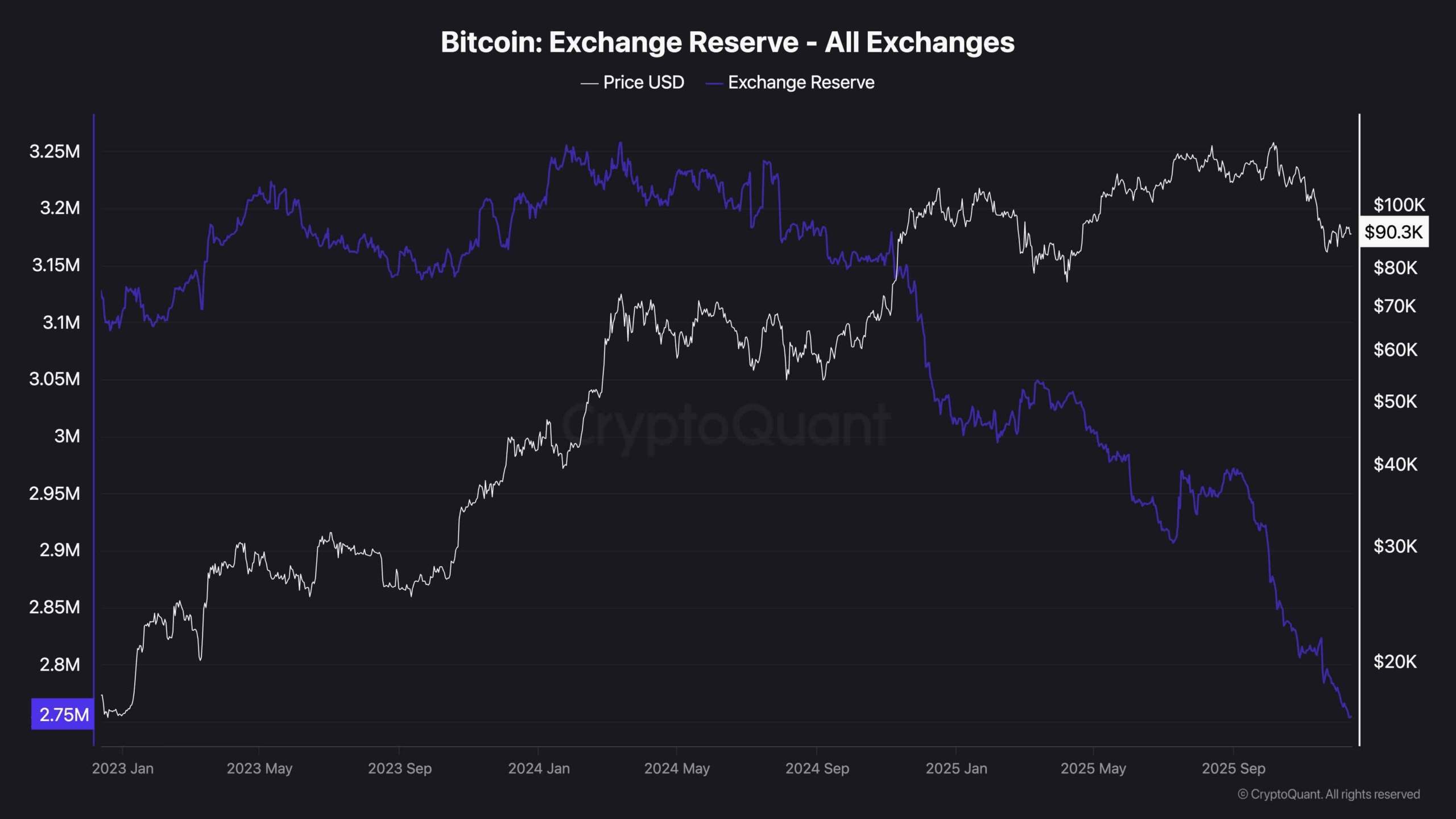

Bitcoin Exchange Reserve

Exchange reserve data paints a more interesting picture. BTC reserves on exchanges continue to fall sharply, now hitting multi-year lows around 2.75M BTC. This typically suggests long-term holders are not interested in selling, and supply is drying up.

However, this hasn’t translated into price strength yet. The divergence between falling reserves and sideways price action shows one thing: demand is still not strong enough to push prices higher, despite low exchange supply.

This could be because institutional flows and retail interest remain weak at current levels, or because capital is sitting on the sidelines waiting for macro clarity. Until spot demand kicks in, the falling reserves alone won’t be enough to ignite a sustainable rally.