Bitcoin Price Prediction for Dec 15: Here Are Key BTC Levels to Watch

Bitcoin faces pivotal Fibonacci retracement levels as support and resistance amid bearish MACD signals and dominant long liquidations.

Bitcoin is teetering on the edge of a potential market shift, with its price dipping to $89,675.70 amid a 0.6% 24-hour decline. Yet, further red flags are evident: a 24-hour trading volume of $35.43 billion suggests sustained interest, but performance metrics paint a concerning picture, including a 2.0% weekly drop, 6.8% monthly slide, and an 11.8% annual retreat.

However, the 14-day performance stands out as a modest bright spot amid the broader pullback, showing a +3.7% gain that suggests short-term resilience. Could this 14-day uptick signal a brewing rebound, or a pause before further downside pressure takes hold?

Bitcoin Price Analysis

Diving deeper into Bitcoin’s price action through a technical lens, the weekly chart reveals Fibonacci levels serving as pivotal guides for support and resistance. Drawn from the October peak near $126,030 to a swing low around $74,458, these levels highlight key zones.

Immediate resistance looms at the 61.8% retracement ($94,235), a golden ratio often acting as a formidable barrier in recoveries, followed by the 50% midpoint ($100,344) and 38.2% ($106,453) as potential upside targets if bullish momentum rebuilds.

On the downside, support has materialized around the 78.6% level ($85,537), where price appears to be consolidating after a sharp wick just above $80,000. This potentially signals a deeper floor if breached, with the 100% extension back to $74,458 as the next critical buffer against further declines.

Moreover, technical indicators further underscore caution, with the MACD (Moving Average Convergence Divergence) flashing bearish signals: the MACD line has crossed below the signal line, and the histogram displays expanding red bars, indicating accelerating downward momentum and a potential continuation of the correction.

Bitcoin Liquidation Data

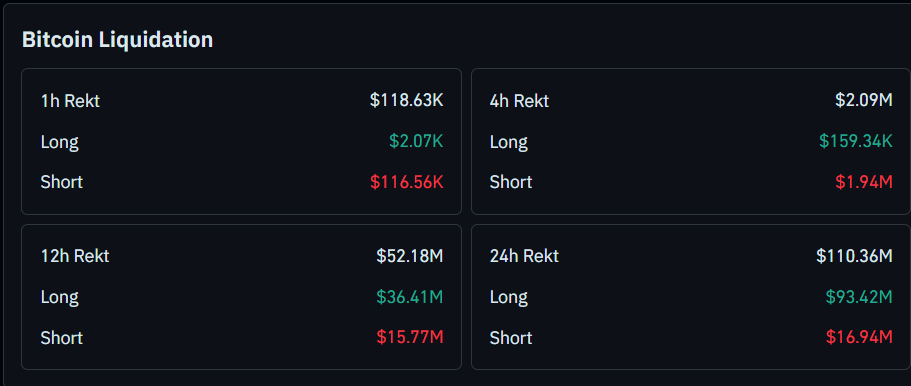

Elsewhere, the Coinglass liquidation dashboard reveals a story of surging pain, particularly skewed toward long positions in the medium term.

Over the past 12 hours, the total rekt (liquidated) value has reached $52.18 million, with longs bearing the brunt at $36.41 million, compared to shorts at $15.77 million, indicating a downward price thrust that caught bullish speculators off guard.

Extending to the 24-hour window, the wreckage amplifies to $110.36 million overall, dominated by $93.42 million in long liquidations against a comparatively modest $16.94 million for shorts. This has possibly contributed to the observed volatility and hinting at bearish dominance in the session.