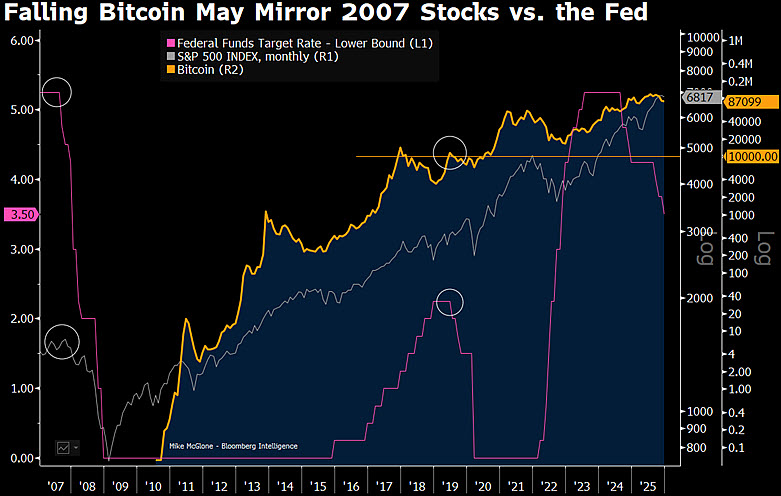

Don't Be Surprised If Bitcoin Resets to $10,000: Top Bloomberg Expert Reveals 2007 Parallel

Mike McGlone, a Bloomberg Intelligence strategist, continues to insist that Bitcoin could go back up to $10,000, and his reasoning has nothing to do with belief, messaging or loyalty to the asset. At the end of the day, it is all about who has already bought, when that money came in and who is left to buy at current levels, according to McGlone.

Bitcoin traded near $10,000 in 2020. That was when Michael Saylor and a small group of companies began buying in bulk. Their purchases mattered because they absorbed supply and pushed the price higher. As Bitcoin rose, more buyers joined later, lifting price further without needing new demand.

The next boost came from spot Bitcoin ETFs. They opened Wall Street access and allowed large amounts of money to enter directly. That wave did its job. It added demand and supported higher prices. But that money is already in the market.

That is where the situation changes, argues McGlone. The same buyers already hold Bitcoin. ETF inflows slowed after launch. Companies did not keep adding Bitcoin to their balance sheets. Early holders still control a large share of the supply and sit on big unrealized gains, which creates selling pressure when price weakens.

Disruption

At the same time, investors have many more options than before. CoinMarketCap now lists about 28 million cryptocurrencies, compared with a whopping one in 2009. Capital no longer flows into Bitcoin automatically. It spreads across thousands of competing assets.

McGlone compares this setup to stocks before 2007. Prices stayed high for a while even as conditions tightened, then fell once buyers stopped replacing sellers. Michael Saylor does not change this setup. His company already holds about 671,268 BTC at an average cost near $74,978. That capital is already committed. It does not represent new buying power that can support price in a downturn.

In this structure, $10,000 is the reset level for McGlone.