Bitcoin's apparent demand shrinks, signals new bear market: Analysts

Bitcoin (BTC) demand growth has slowed significantly since October 2025, signaling that Bitcoin has entered into another bear market cycle, according to analysts at crypto market analysis platform CryptoQuant.

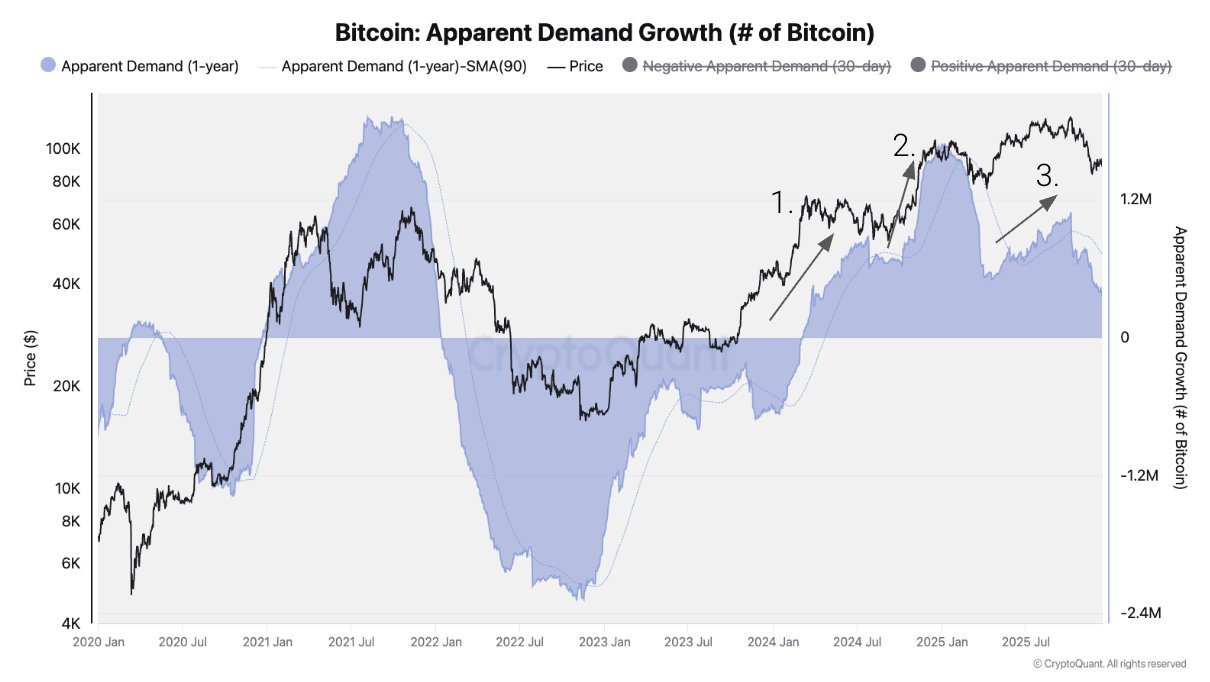

Investor demand for BTC came in three waves during the current market cycle, with the first wave landing in January 2024, CryptoQuant analysts said.

The first wave followed the launch of Bitcoin exchange-traded funds (ETFs) in the US, the second wave followed the results of the 2024 US presidential election, and the third was a BTC treasury company bubble. According to CryptoQuant:

“Demand growth has fallen below trend since early October 2025. This indicates that the bulk of this cycle’s incremental demand has already been realized, removing a key pillar of price support.”

Institutional demand has also contracted, with the total amount of Bitcoin held in ETFs declining by about 24,000 BTC in Q4 2025, a “sharp contrast” to the accumulation behavior seen in Q4 2024, CryptoQuant said.

Funding rates, the fees paid by perpetual futures traders to maintain their positions, have also declined to their lowest levels since December 2023, another signal that BTC has entered a bear market.

The final reason given by the analysts for the bearish outlook was Bitcoin’s price structure breaking down below the 365-day moving average, which is a critical and dynamic support level for any asset.

Related: Bitcoin rallies thwarted by fading Fed rate cut odds, softening US macro

While some analysts remain hopeful for a better 2026, fear grips the market

Some analysts continue to forecast higher BTC prices in 2026, driven by increased demand and lower interest rates. Falling interest rates are positive catalysts for crypto prices and other risk assets.

However, overall crypto market sentiment remains firmly in “fear” territory, according to CoinMarketCap’s Crypto Fear and Greed Index.

Only 22.1% of investors expect the Federal Open Market Committee (FOMC) to lower interest rates at its next meeting in January, according to the Chicago Mercantile Exchange (CME) Group’s FedWatch tool.

US President Donald Trump attempted to pressure Federal Reserve Chairman Jerome Powell to lower interest rates in 2025 by threatening to fire Powell.

Powell’s term is set to expire in May 2026, and Trump is reviewing potential replacements who are expected to cut rates.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Magazine: 6 reasons Jack Dorsey is definitely Satoshi… and 5 reasons he’s not