BTC loses correlation with M2 money supply after historically tracking liquidity expansion

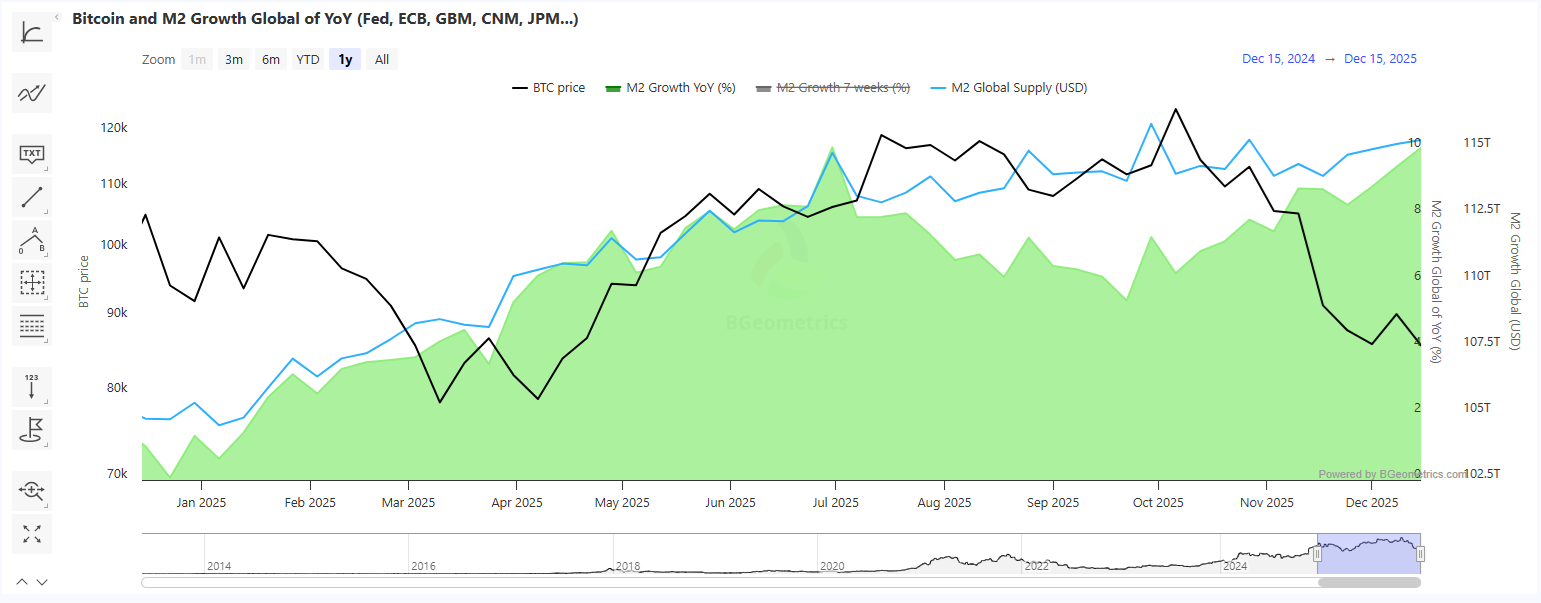

The narrative of BTC being tied to M2 money supply expansion broke down in 2025. A pattern emerged where the growth of BTC lagged behind and decoupled from the growth of the global money supply.

BTC price expansion did not follow the gains of the global M2 money supply. Over the past 12 months, BTC ended up with a small net gain, underperforming traditional assets.

The M2 narrative was part of the setup for crypto, which was expected to have a year-end rally. However, BTC stalled at $126,000 in October, breaking down to a lower range since then.

The BTC rally in 2025 also lagged behind the pace of expansion of M2. Historically, BTC rallies three to six months after monetary expansion, but this time, other factors broke down the trend in Q4.

M2 money supply reaches a new record

In the past 12 months, the global money supply expanded from $104T to over $115T, extending the pace from the past few years. The supply growth exceeded the 2024 expansion.

The growth pace also resembled the post-pandemic conditions of 2020. The US money supply also grew in the past 12 months, rising to $22.5T in October, up from $21.4T in December 2024.

This time around, the expansion of AI and data center stocks, along with the growth of precious metals, meant the additional funds were not chasing crypto assets.

BTC was also more mainstream, and had a longer price history, and trading in 2025 was done with more caution and skepticism. BTC failed to break the expected price levels for the past year, and the crypto market did not break to a new all-time peak.

Can BTC recover its trend?

The M2 money supply narrative has mostly worked for BTC in previous market cycles. This time, the excess money inflows did not chase BTC blindly. Buyers and accumulation were more strategic.

The Chinese money supply expanded even more, by around 8% in the past year, from 311T to 336T yuan. However, the country did not contribute to the growth of BTC directly, and even Asian traders remained cautious.

One of the expectations is that BTC may catch up with the M2 supply. A catchup rally sets an even more bullish target for BTC, with the potential to break above $220K per coin.

At the same time, BTC continues to unwind, with signs of institutional selling and divestment at each local high. BTC has failed to recover above $90,000 for weeks, as each rally is met with selling. The market is expected to take months, while still needing to overcome negative sentiment.