Here’s how much R. Kiyosaki has missed out since ‘selling silver for Bitcoin’

Best-selling finance author Robert Kiyosaki’s decision to rotate out of silver and into Bitcoin (BTC) earlier this year appears to have been a miscalculated move.

Notably, the Rich Dad Poor Dad author announced plans to sell the precious metal, an interesting shift given his long-standing advocacy for silver. Since then, silver has rallied to emerge among the best-performing assets of the year.

In a YouTube video published on January 25, 2025, Kiyosaki said he was trading in his silver holdings to buy more Bitcoin, arguing that while the metal had served him well for much of his investing life, BTC represented a generational monetary shift.

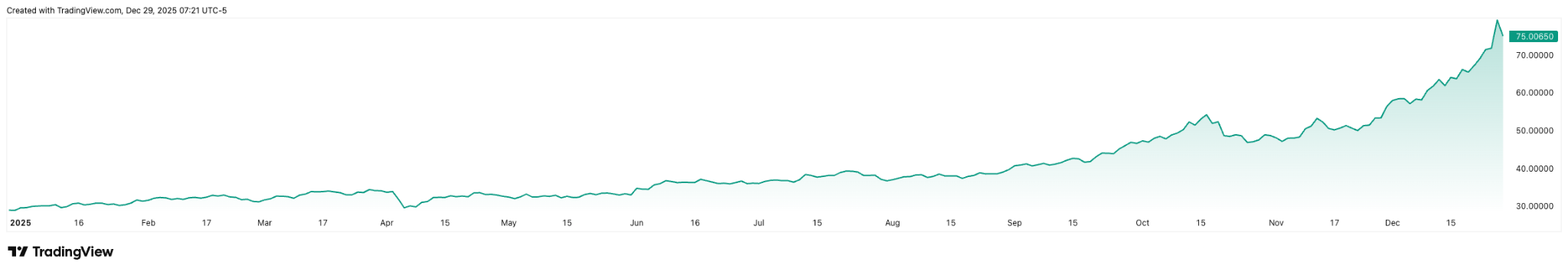

At the time of those comments, silver was trading at roughly $30 an ounce. Since then, silver has delivered a powerful rally, climbing more than 140% from those levels and trading around $74 an ounce as of press time.

Although he did not specify the amount sold, to put the trade into perspective, for every 1,000 ounces sold, near $30, silver’s rise to $74 represents roughly $44,000 in unrealized gains.

Kiyosaki’s silver advocacy

Kiyosaki has consistently promoted silver as accessible “people’s money,” frequently encouraging everyday investors to accumulate the metal as protection against inflation, currency debasement, and rising government debt.

He has often highlighted silver’s affordability relative to gold and pointed to its essential industrial role as a key driver of long-term value, making his decision to scale back silver exposure notable even by his own standards.

Kiyosaki’s shift was not framed as a rejection of silver itself, but rather as an expression of growing urgency around Bitcoin.

The investor has repeatedly argued that unprecedented levels of government borrowing and money creation favor assets outside the traditional financial system, and he sees Bitcoin as the clearest beneficiary of that trend, especially for younger generations.

At the time of the sale, Bitcoin was rallying significantly, buoyed by the anticipation of a pro-cryptocurrency-friendly Donald Trump administration.

Beyond silver and Bitcoin, the financial educator has also advocated investment in gold, noting that the assets are ideal for wealth preservation while warning of an upcoming economic crash.

To this end, he expects silver to rally sharply over the next 12 months, projecting a price of $200 by the end of 2026.

Featured image via Cavaleria Com YouTube