Silver’s wild 6% price spike and 10% plunge mirrors crypto volatility

The price of silver continues to notch new highs amid a precious metals market boom, with the asset trading in a very crypto-like fashion over the weekend with sharp volatility.

Silver hit a new all-time high (ATH) of almost $84 on Sunday, U.S. time, with demand for gold also driving the price up to new heights of around $4,530. Meanwhile, the crypto market continues to stutter.

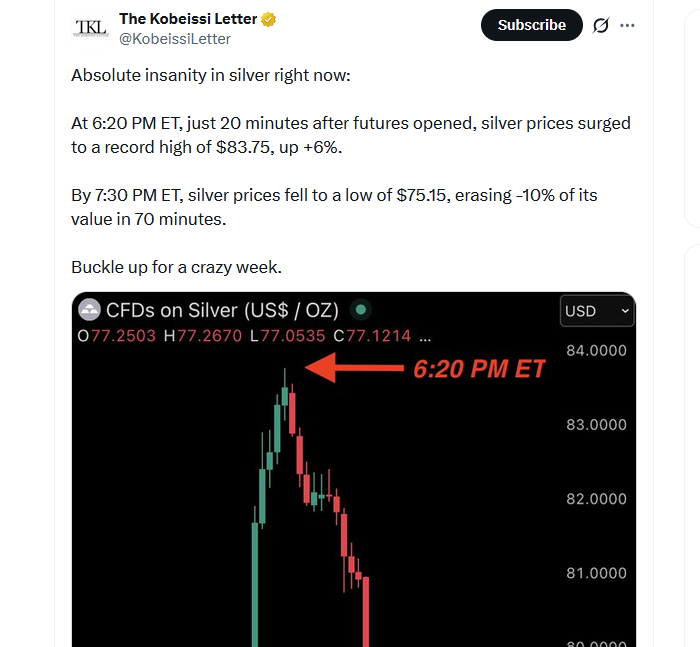

As highlighted in a Sunday post by markets publication The Kobeissi Letter, silver saw extreme volatility over the weekend spiking 6% and then dumping 10% in the span of an hour.

“Absolute insanity in silver right now: At 6:20 PM ET, just 20 minutes after futures opened, silver prices surged to a record high of $83.75, up +6%.By 7:30 PM ET, silver prices fell to a low of $75.15, erasing -10% of its value in 70 minutes,” The Kobeissi Letter stated.

Silver fluctuating like BTC

While precious metals like silver and gold are generally thought to have more stable prices, silver is the more volatile of the two.

With a new US Federal Reserve chair set to take over from Jerome Powell in 2026, there are expectations of major interest rate cuts under a less hawkish and more President Trump-aligned chair.

Lower rates indicate lower returns from investments in bonds, with investors then more likely to pile into commodities such as gold and silver.

Related: Bitcoin doesn’t need gold and silver ‘to slow down,’ say analysts

Alongside this, demand for silver is also bolstered by its industrial use to make a wide range of products and is part of the “debasement trade” which refers to faltering long term confidence in the US dollar due to monetary inflation.

Bitcoin yet to rally

While silver and gold are pumping partly on the back of anticipated rate cuts, Bitcoin (BTC) and the crypto market have been flat in December, with BTC down 0.5% over the past 30 days to sit at $90,160 at the time of writing, as per CoinGecko data.

It has been a tough year overall and despite surging to an ATH of $120,000 in early October, BTC now needs a 6.5% pump to close out the year in the green.

Magazine: Big questions: Would Bitcoin survive a 10-year power outage?