This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Are we back?

BTC is at a new all-time high of $121k, ETH is back above $3k, and Aave just crossed $50 billion in TVL.

But probably most significant of all is the return of initial coin offerings (ICO). This past Saturday saw Pump’s ICO raising $500 million at a $4 billion FDV.

I say “Saturday,” but it was all over in 12 minutes. 125 billion PUMP tokens (12.5% of total token supply) were all sold for $0.004 apiece.

As of this morning, PUMP is trading at 0.017, so that’s a 325% profit if you snagged it in the ICO.

Who were the buyers?

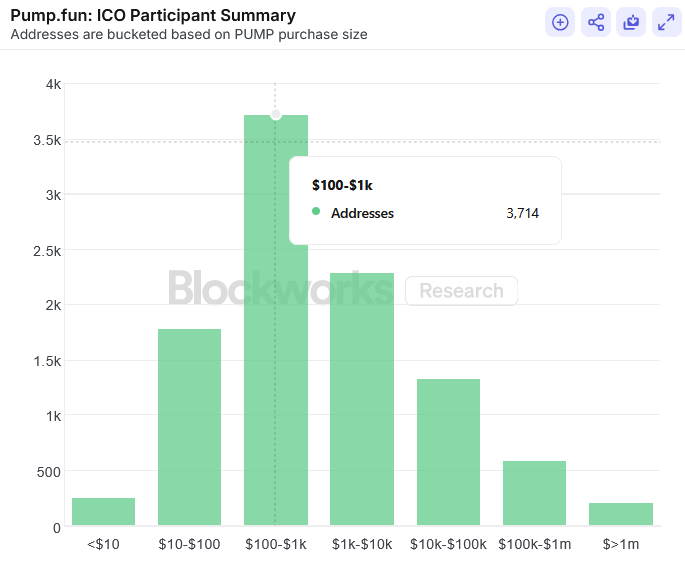

10,145 unique addresses aped in at a remarkably equitable median price of $537.

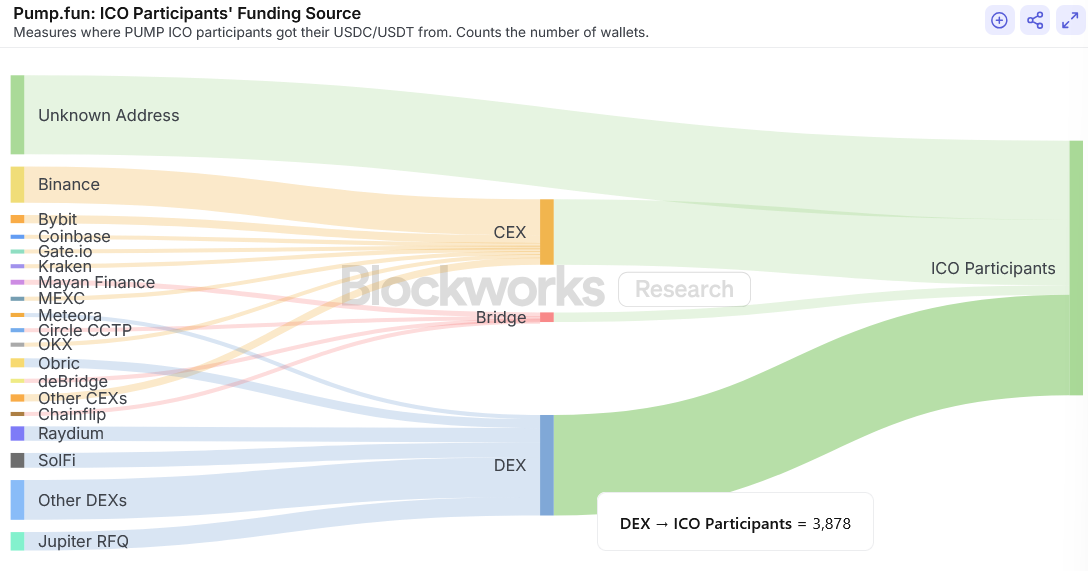

Interestingly, more users came from DEXs than CEXs. About 3,878 Pump investors came from Solana DEXs including Raydium, SolFi and Jupiter — compared to 2,525 investors from CEXs.

A number of Bybit users failed to receive their PUMP allocations due to an “unexpected API delay,” so they’ll be getting refunds and a sad $20 spot fee coupon instead.

The key takeaway here, I think, is: Onchain infrastructure has never been more streamlined and effective.

Pump’s strategy

Pump’s $500 million ICO is big, but not that big. Let’s put that into context.

EOS’ (today called Vaulta) ICO in 2017-18 still holds the record for the largest-ever ICO, at a whopping $4.1 billion.

Telegram’s 2018 ICO also raised $1.7 billion in two phases. The GRAM tokens sold were eventually refunded due to regulatory troubles, and the app’s backers later created TON.

Compared to Ethereum, however, Pump’s ICO is big. Ethereum raised ~$18 million in bitcoin across 42 days in 2014.

These are obviously not apples-to-apples comparisons given the differences in time period, market maturation, product type, etc.

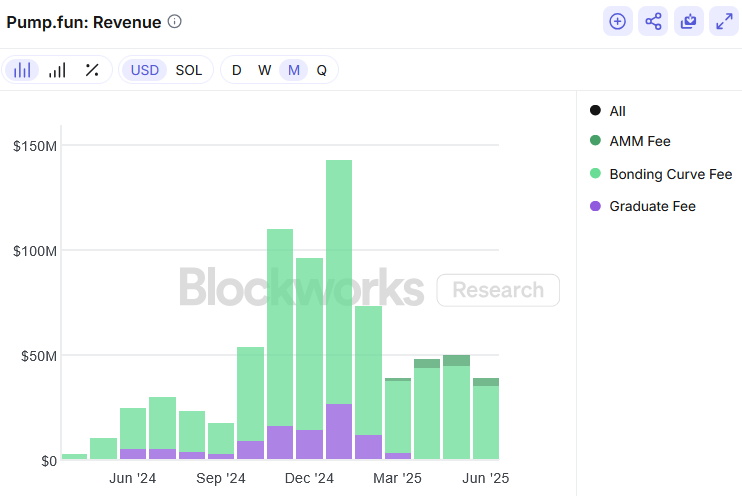

But the biggest difference of all is that unlike the industry’s past ICOs, Pump is not a mere proof-of-concept — the memecoin launchpad is a cash cow.

Pump has made $786 million in cumulative revenues since its inception in January 2024. That’s a staggering $377 million in annualized revenues for the two-year-old company.

Furthermore, Pump is allegedly planning to share 25% of revenues with token holders, my colleagues Katherine and Jack reported last week.

“There’s a reasonably high probability that the PUMP token will have some value accrual mechanism,” Blockworks Research’s Ryan Connor told me.

Pump wants to go after the social media market. In the team’s own words: “our plan is to Kill Facebook, TikTok, and Twitch. On Solana.”