Bitcoin Price Analysis: BTC Targets $90K Again – Breakout Incoming or Another Rejection?

Bitcoin continues to grind sideways below the $90K level, showing signs of compression after weeks of chop. While there has been no significant bullish breakout yet, the price is pressing against key local resistances. Buyers are trying to reclaim control, but the lack of follow-through makes this a pivotal area to watch.

Bitcoin Price Analysis: The Daily Chart

On the daily chart, BTC remains trapped within a descending channel, testing the upper boundary once again near the critical $90K level. The 100-day and 200-day moving averages located above $95K act as major dynamic resistance levels, and buyers have yet to reclaim them.

Despite recent bounce attempts, momentum has been fading. RSI is climbing but is still around the neutral territory, indicating that there is room for a move higher. If buyers fail to break above the $90K zone and the higher boundary of the channel, another visit to the $80K support zone remains likely. Until that breakout happens, this is still a bearish market structure.

BTC/USDT 4-Hour Chart

On the 4-hour timeframe, the asset has been consolidating in a short-term channel. Multiple rejections from the $90K level, located at the middle of the channel, have formed a mid-range ceiling. Meanwhile, higher lows forming gradually below this zone show that buyers are slowly stepping in.

The RSI is also pushing higher, showing bullish momentum building while still not being overbought. If a clean breakout above $90K occurs with strength, it opens up the way for a move toward the primary resistance zone at $95K. On the other hand, failure at the $90K zone could mean another sweep back toward $86K and even a breakdown of the channel that could pave the way for a deeper drop toward the $80K area.

On-Chain Analysis

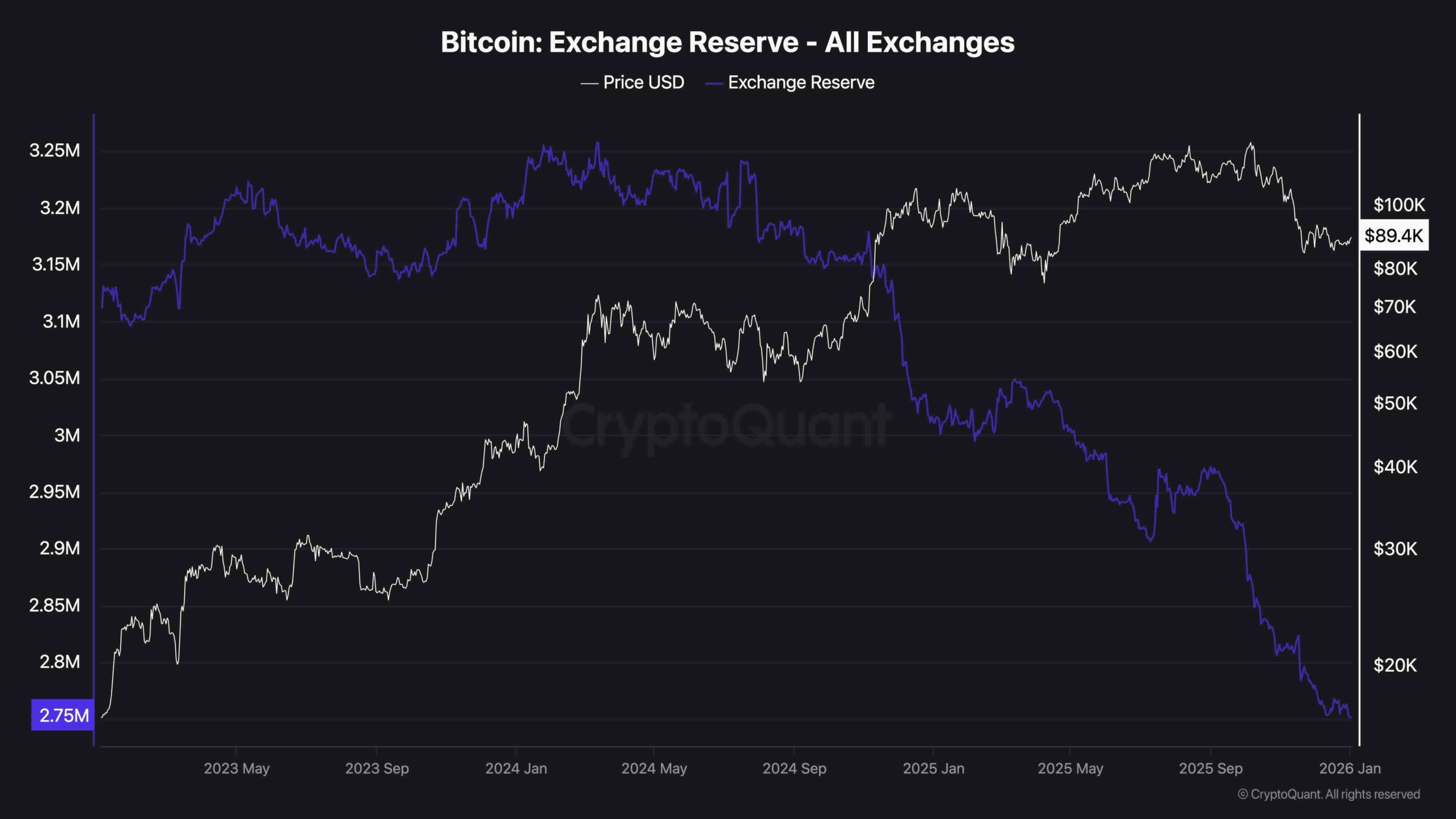

The BTC exchange reserve metric continues to drop sharply, hitting 2.75M BTC, a significant multi-year low. This trend reflects ongoing accumulation and reduced sell pressure on centralized exchanges.

While the price action has remained stagnant, this underlying metric supports the long-term bullish thesis. However, the disconnect between low reserves and weak price action highlights the broader uncertainty and hesitation among market participants heading into the first quarter of 2026. Therefore, more sideways or even corrections might be required before the market can begin rallying again.

Leave a Reply

You must be logged in to post a comment.