The copper-to-gold ratio is widely followed as a macro indicator of economic momentum and investor risk appetite. Historically, it has shown a notable relationship with bitcoin BTC$93,572.43, according to SuperBitcoinBro.

Copper is heavily tied to industrial demand and tends to perform well during periods of economic expansion. Gold, in contrast, is a defensive asset that typically outperforms during periods of greater uncertainty and slower growth.

When the ratio between the two is rising, it signals a risk-on environment, while a falling ratio points to risk aversion.

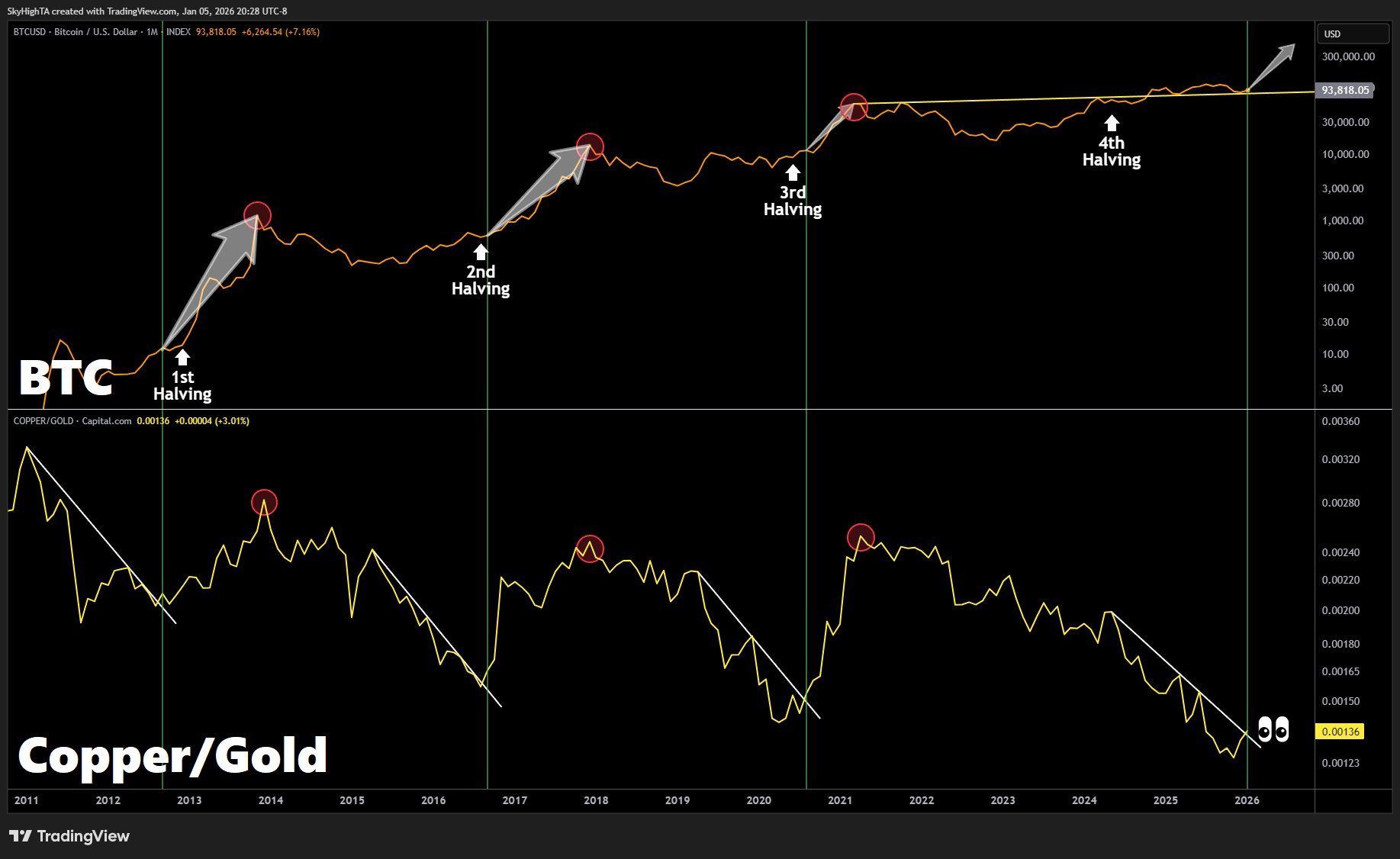

Major peaks in the ratio, seen in 2013, 2017 and 2021, have coincided with cycle highs in bitcoin prices. These periods reflected strong global growth expectations and elevated speculative risk taking across assets.

More importantly for bitcoin, however, has been the behavior of the ratio after prolonged declines. A reversal in the ratio has often preceded significant bitcoin rallies, particularly when they align with bitcoin halving cycles.

Bitcoin halvings, which reduce the payout to miners by 50%, occur roughly every four years and tighten supply. Historically they have acted as a catalyst for longer term bull markets.

During the fourth bitcoin halving, in April 2024, the copper-to-gold ratio was still dropping. That dynamic has since shifted. The ratio now sits near 0.00136 after bottoming in October around 0.00116.

At the same time, copper prices are pushing through $6 per pound at all time highs, while gold trades near $4,455 per ounce, also close to its record. Over the past three months, copper has gained 18% and gold 14%.

If copper’s strength reflects improving growth expectations rather than purely supply constraints, the resulting risk on signal could support a bitcoin rally in 2026.

Leave a Reply

You must be logged in to post a comment.