Bitcoin Whales Return as $88,500 Close Sets Next Price Trigger

Bitcoin whale wallets showed a sharp 30 day balance jump near early January, while price stayed relatively steady on the same view. At the same time, analyst Friedrich said a weekly close above $88,500 could confirm the range break after weeks of consolidation above $80,000.

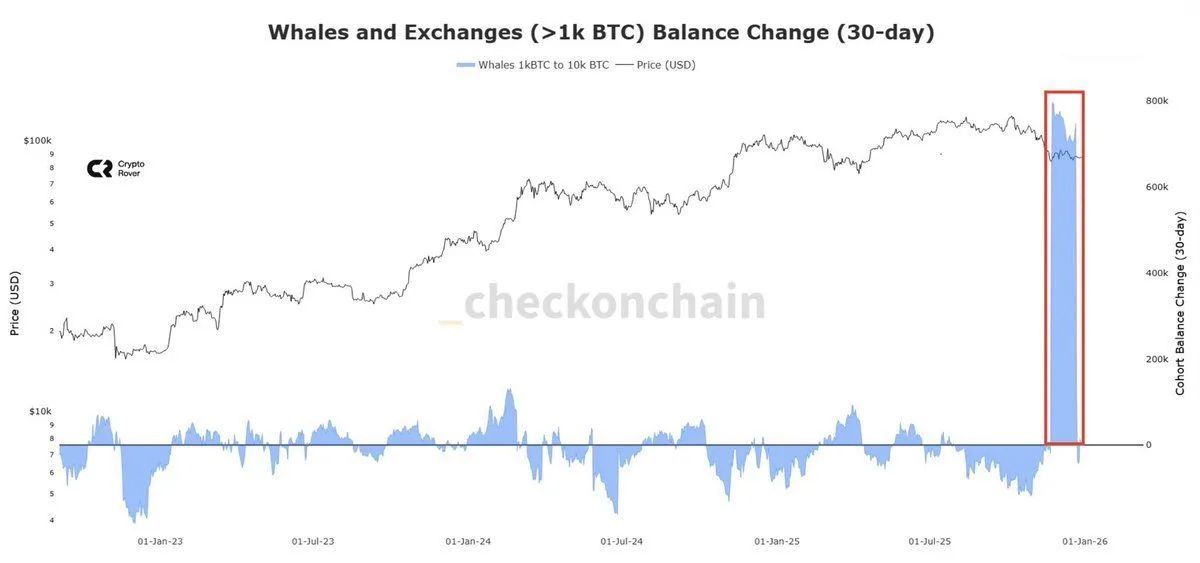

Whale cohort balance flips positive on 30 day view

Onchain data shared by Crypto Rover showed a sharp shift in Bitcoin whale balances over the past 30 days, with the 1,000 BTC to 10,000 BTC cohort turning strongly positive near early January.

Whales and Exchanges over 1k BTC Balance Change 30 day. Source: Crypto Rover/X

The chart, titled “Whales and Exchanges (>1k BTC) Balance Change (30 day),” plots a blue area for the cohort’s 30 day balance change alongside a gray Bitcoin price line. In the highlighted section at the far right, the blue area jumps from near zero to one of the highest readings on the full timeline.

Because the metric tracks net balance changes, a move above zero typically signals that wallets in that size band increased holdings over the period. Meanwhile, the price line near the same window looks more muted than the balance spike, so the accumulation signal stands out more than the price move in the snapshot.

The post did not include a breakdown by entity type or venue, so the chart alone cannot show whether the shift came from new purchases, internal transfers, or reclassification of wallets. Still, it captures a clear change in direction for large holder balances compared with the prior weeks shown on the same view.

Analyst flags $88,500 weekly close as Bitcoin trigger after 8 week range

Market commentator Friedrich said Bitcoin remained in a bullish setup as long as it held above the mid $70,000s, while he pointed to an $88,500 weekly close as a key confirmation level.

Bitcoin Tether Perpetual Futures 1D. Source: FriedrichBtc/X

In a post on X, he said Bitcoin had not traded below $76,600 during the recent pullback. He added that a break under that level could open a deeper drop, while he argued that eight weeks of consolidation above $80,000 increased the odds of a larger move once price left the range.

A TradingView chart he shared showed BTC/USDT perpetual futures near $90,555 on the daily timeframe. The chart marked a downside risk zone that extended into the high $80,000s, with a lower boundary around $86,808.

The same chart also plotted upside steps at roughly $97,636, $104,349, and $110,709, then a higher target zone near $126,025. Friedrich said a weekly close above $88,500 would support a push higher into the remaining part of January, while he cited bearish market expectations as part of his thesis.

Leave a Reply

You must be logged in to post a comment.