Disclaimer: The analyst who wrote this article owns shares in Strategy.

Strategy (MSTR), under the leadership of Executive Chairman Michael Saylor, may have just finalized its largest preferred stock issuance to date with an STRC (Stretch) offering joining the STRD, STRF and STRK preferred shares to build out the company’s credit yield curve.

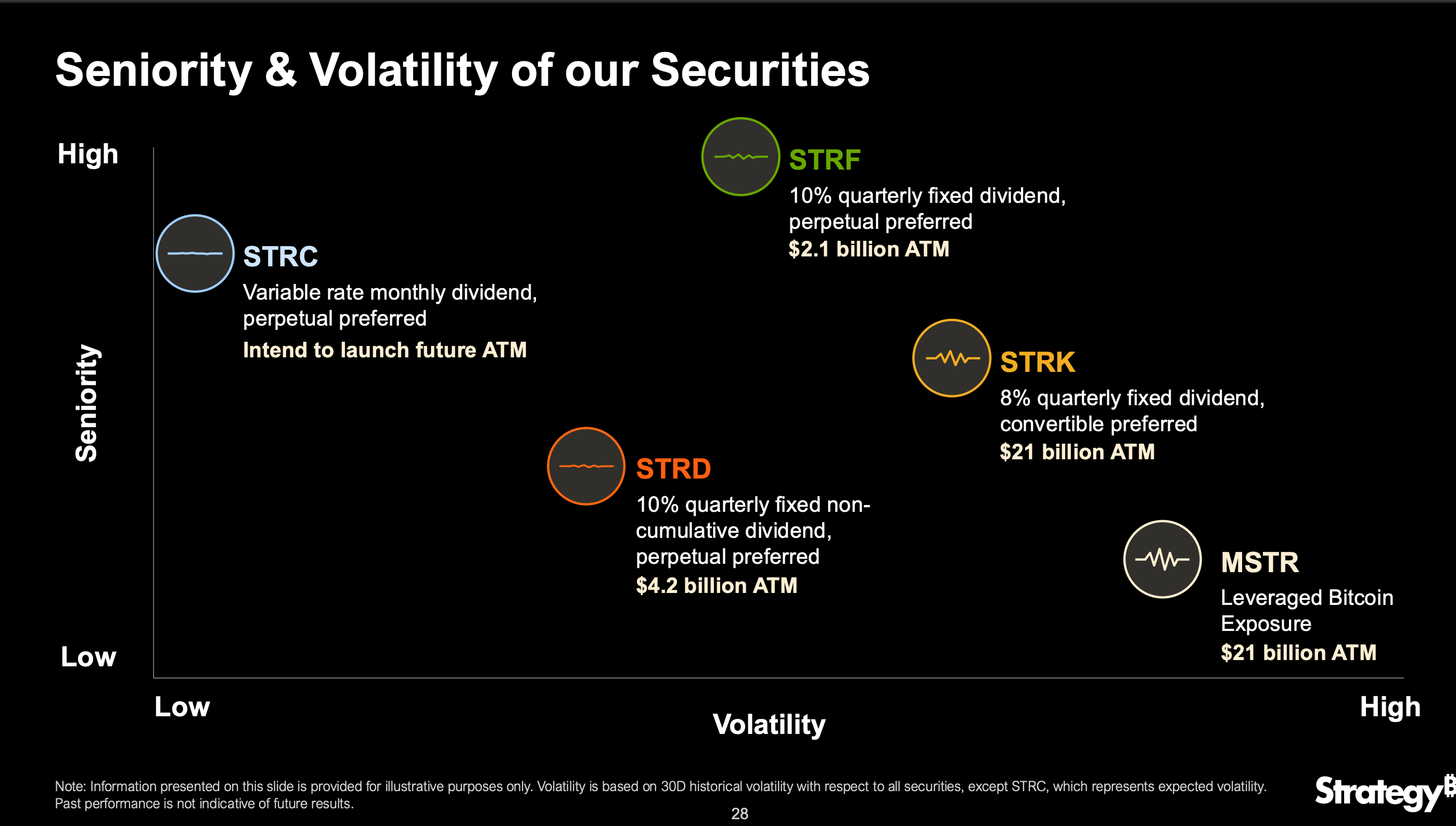

Among these, STRC is ranked high in seniority and low in expected volatility. It adds a new short-duration layer to Strategy’s financing mix and diversifies how the company can raise capital for BTC acquisition.

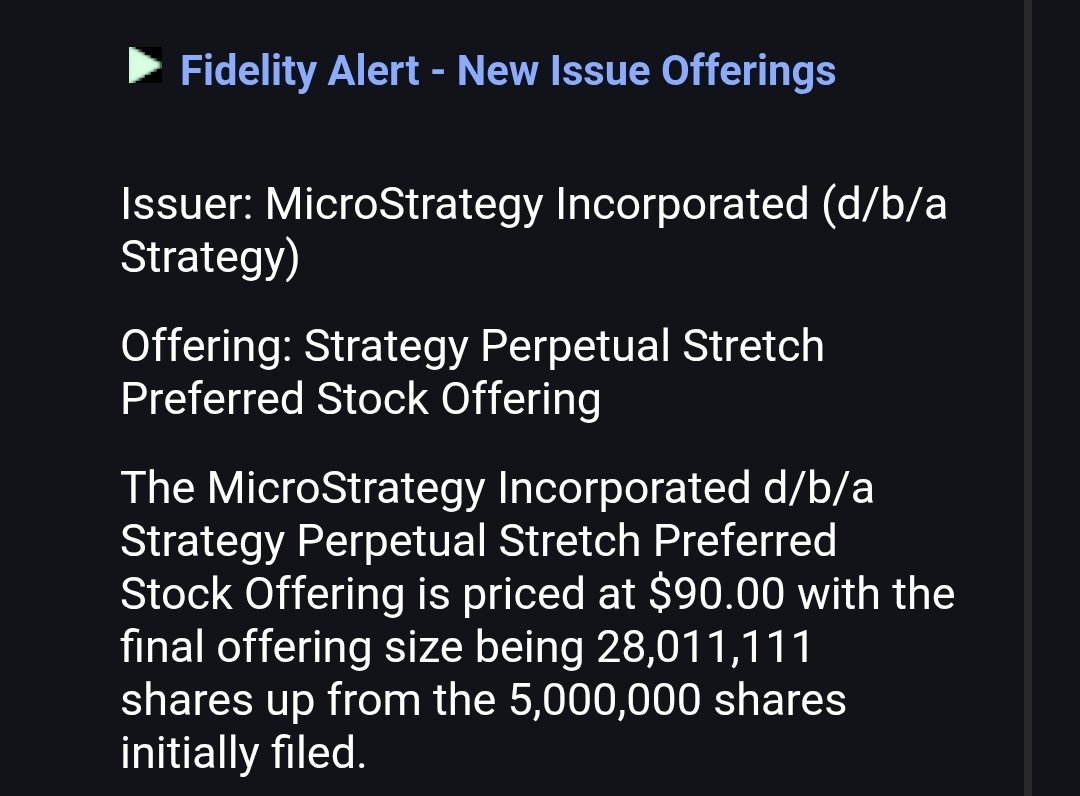

According to a Fidelity alert on X, the deal is 28 million shares priced at $90 each, totaling over $2.52 billion. This represents a dramatic increase from the original $500 million goal announced just days earlier and underscores the company’s continued ambition to aggressively expand its bitcoin

holdings.

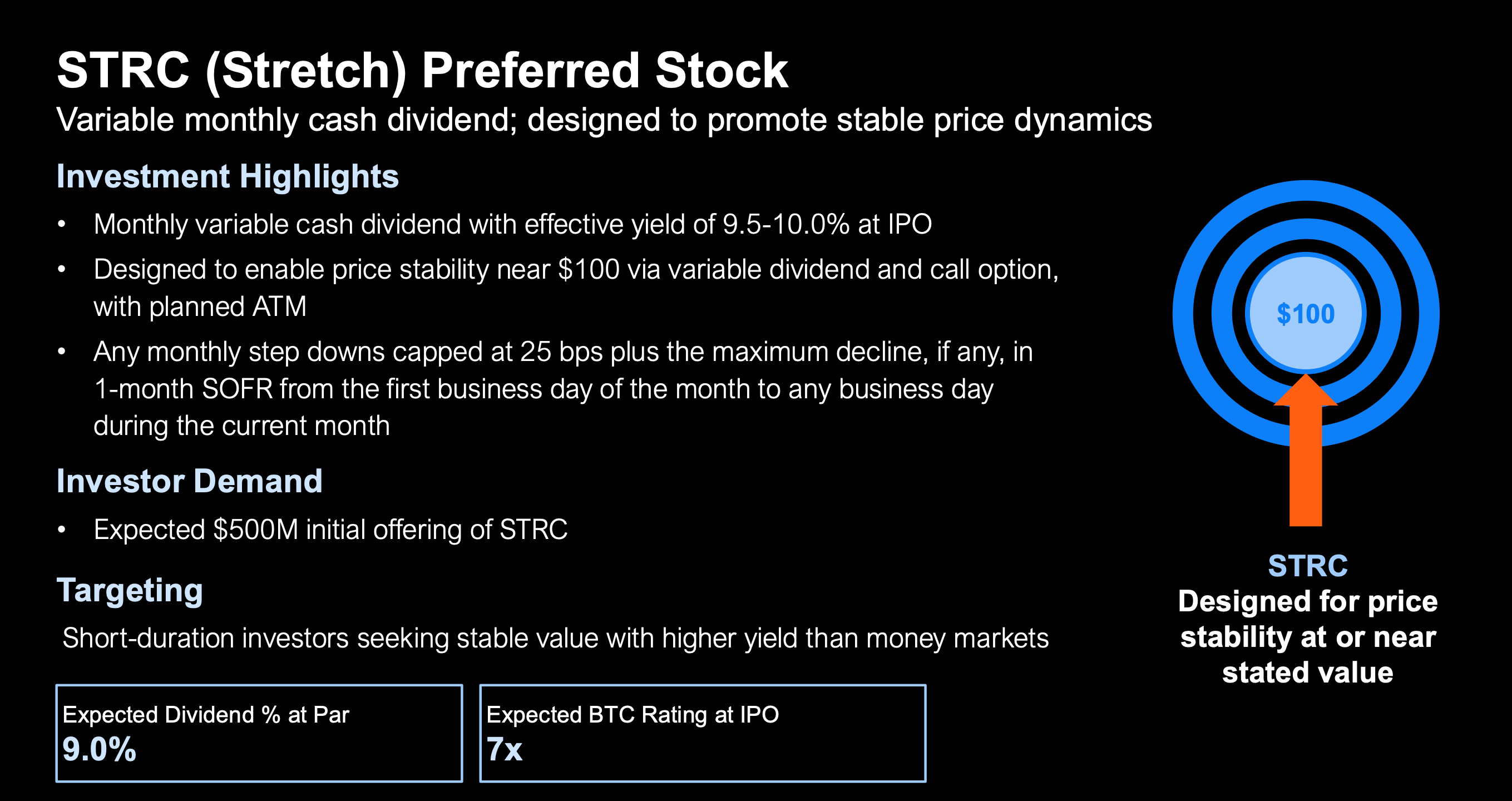

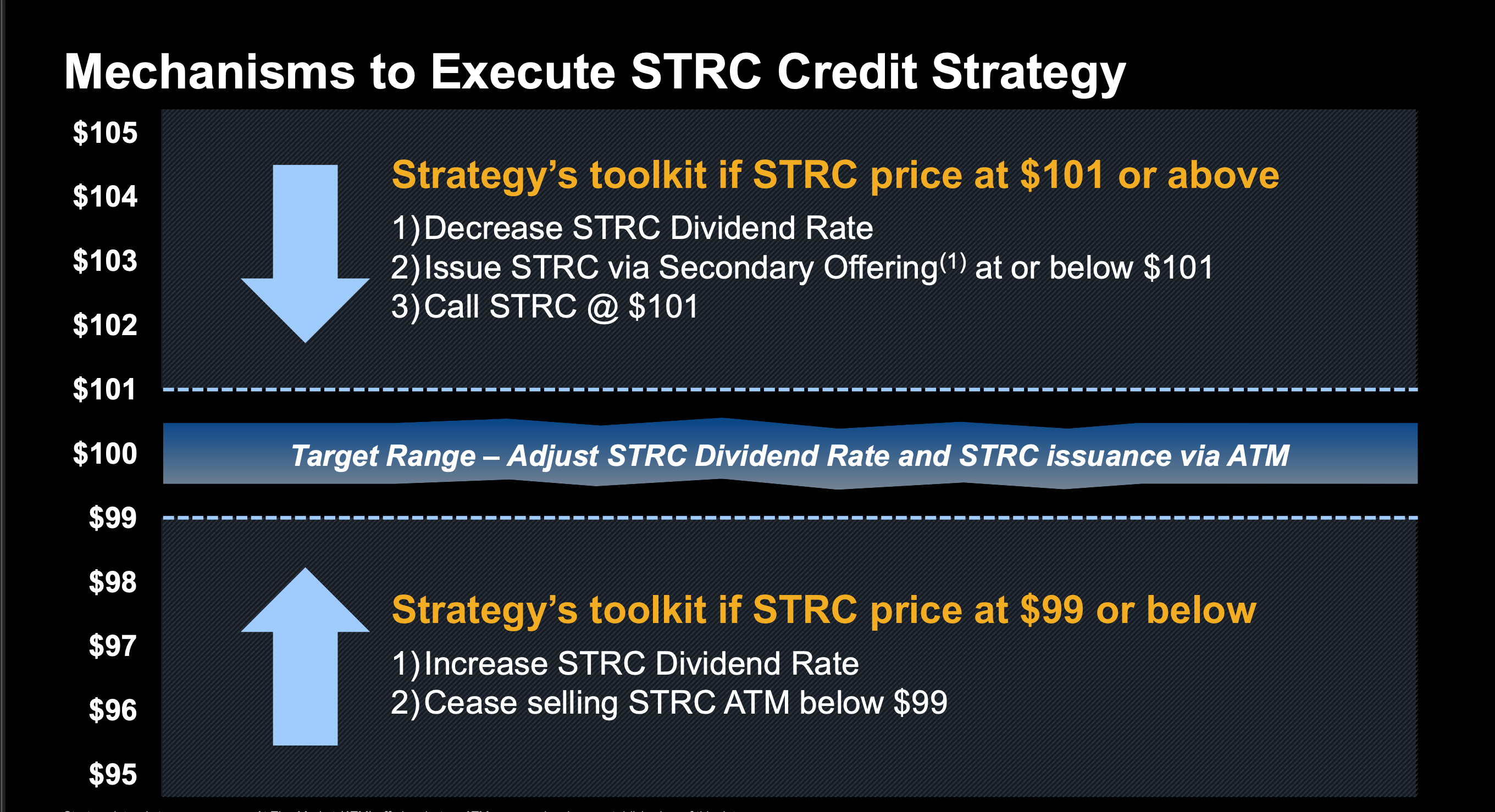

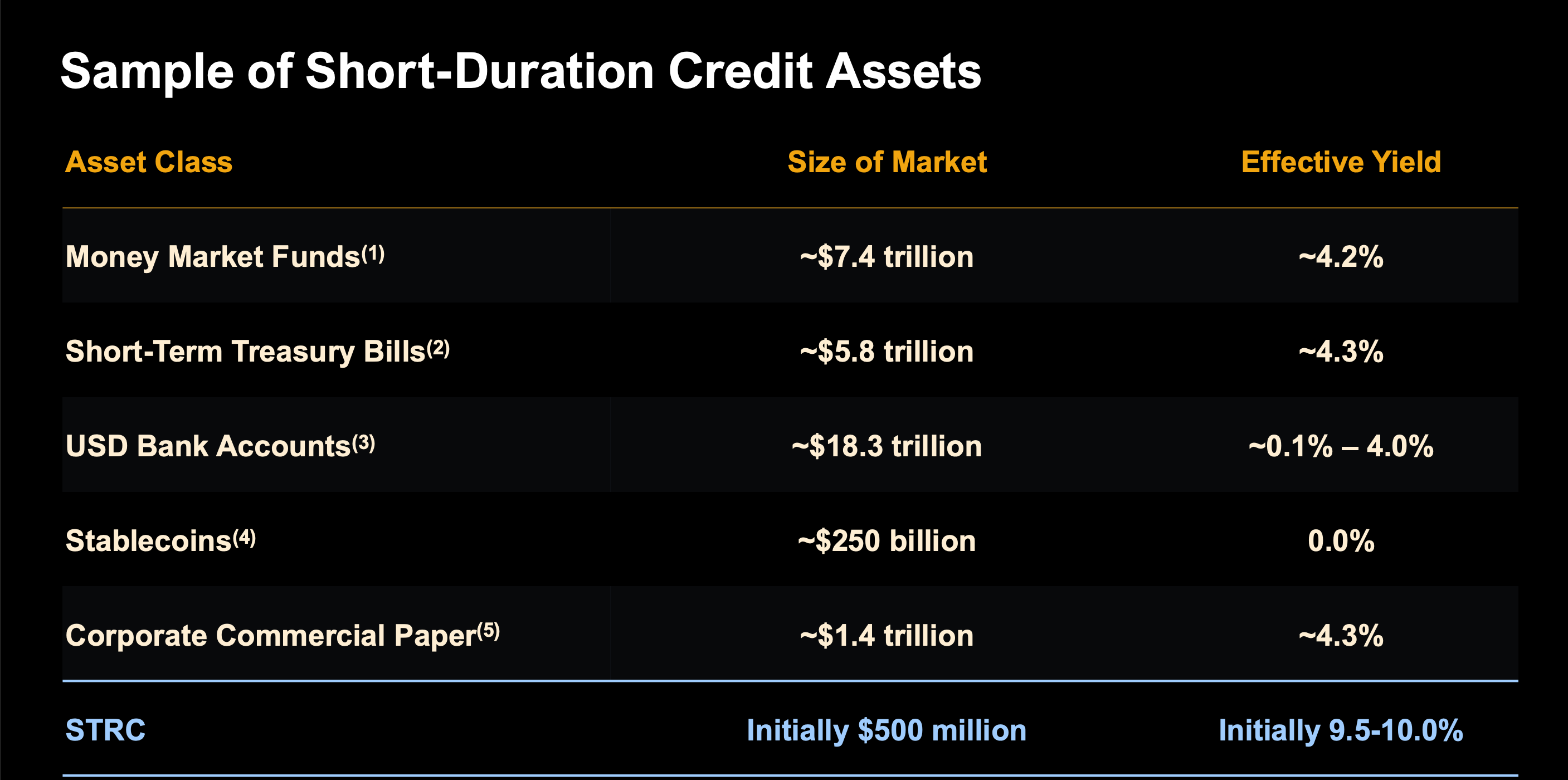

STRC is a senior, perpetual preferred stock offering a variable monthly dividend designed to appeal to yield-seeking investors who want stability near par value. At the time of the offering, STRC carried an effective yield of 9.5%–10.0% paid monthly. It contains mechanisms to maintain a trading range close to $100, including adjustable dividend rates, secondary issuance windows and call options above par.

The toolkit includes raising dividends and halting sales when STRC trades below $99, or issuing new shares and calling the stock if it rises above $101. These levers are designed to create a self-correcting system that promotes market stability while offering attractive returns in the current interest-rate environment.

Any step-downs in the dividend are capped at 25 basis points plus the maximum decline in the one-month secured overnight financing rate (SOFR) over the period.

Compared with conventional short-duration credit options, STRC stands out, offering more than double the 4% available from money market funds and Treasury bills. It is targeting investors looking for higher yield without significant price volatility, positioning it competitively against traditional instruments like commercial paper and bank deposits.