Bitcoin Price Prediction: Will $BTC Hold Above $107K or Break Down?

Bitcoin ($BTC) is trading around $107,917, just below the critical $109,000 resistance level. After a solid rally that started near $96,000, the Bitcoin price Dollar climbed steadily following an ascending trendline. However, recent candles show hesitation near the $109K barrier.

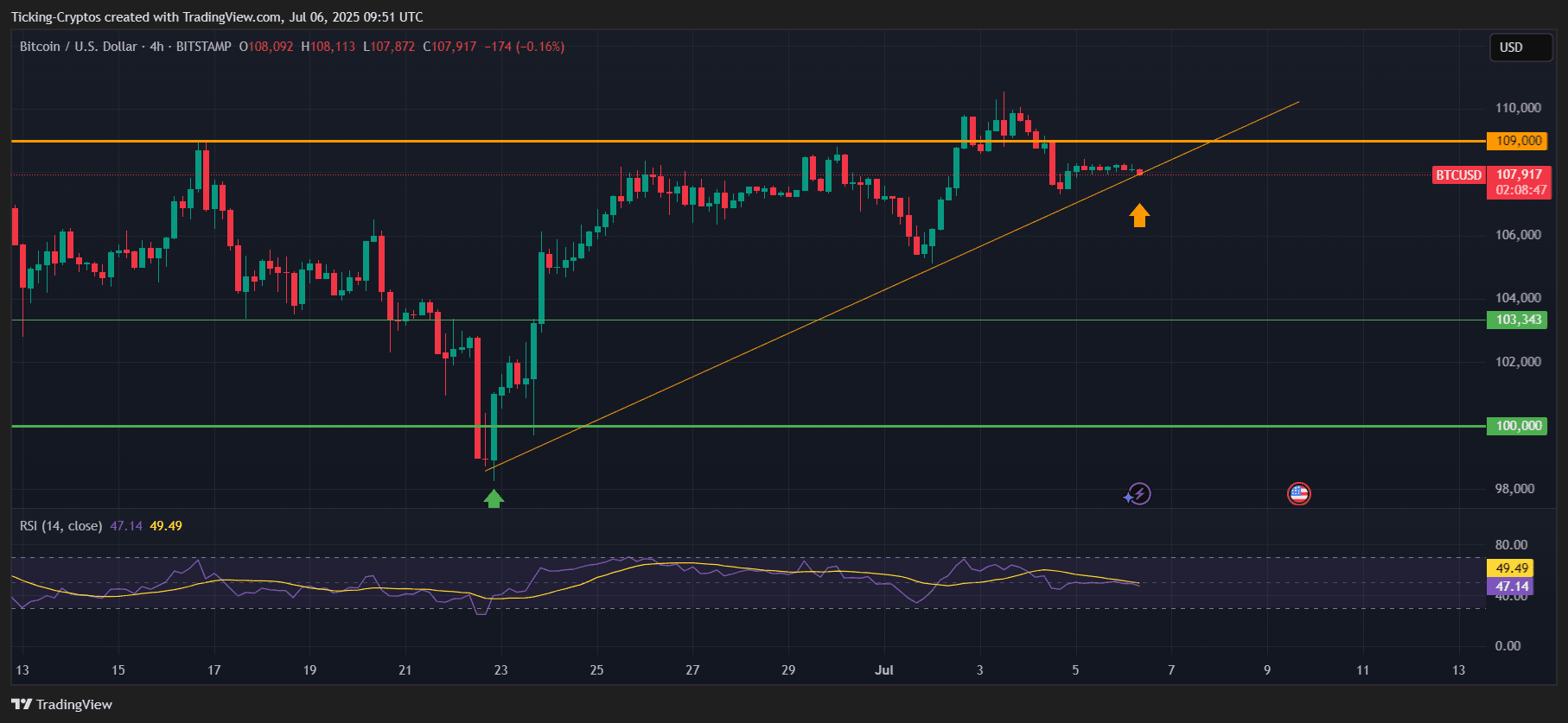

BTC/USD 4-hours chart – TradingView

While many retail traders panicked due to a large 80,000 BTC wallet transfer, smart money spotted an opportunity. A whale bought 567 BTC worth $61.1 million yesterday, reinforcing confidence in Bitcoin’s mid-term outlook. This is a classic dip-buying move from experienced players—while fear dominates the headlines

The 4-hour chart shows Bitcoin consolidating along a rising support line (orange), maintaining higher lows. Despite a rejection at $109,000, BTC is holding the line—literally.

Key levels to watch:

- Support: $107,000 (trendline), $103,343, and psychological $100,000

- Resistance: $109,000 and any breakout above could open the path to $112,000+

The RSI is neutral at 47.14, below the 50 midline and showing mild bearish divergence, which suggests short-term caution. If the ascending trendline holds, a breakout above $109K becomes increasingly likely. If it fails, $103K or even $100K could be retested quickly.

Bitcoin Price Prediction: What’s Next for BTC?

In the short term, Bitcoin price Dollar is caught between consolidation and breakout. If buyers defend the trendline and RSI begins to rise back above 50, we could see a retest and breakout above $109,000. That would shift momentum bullish again, targeting $112,000–$115,000 by mid-July.

However, if the ascending support breaks with strong volume, the $103,343 level becomes a magnet, and the market could slide further to the $100,000 psychological zone—a classic support flip area.

For now, the market is watching two things:

- Whether whales continue buying dips, like the recent 567 BTC buy.

- If retail panic selling increases after the 80K BTC wallet scare.

As of now, smart money is still in accumulation mode—don’t ignore that signal.

How to Buy Bitcoin? Use OKX – Europe’s Top Exchange

Looking to buy Bitcoin while it’s consolidating?

OKX is a top platform to trade $BTC in Europe with low fees, deep liquidity, and a user-friendly interface.

Limited-Time Offer:

Join OKX before September 14, 2025, and claim your free McLaren F1 Team cap and a chance to win a VIP experience in Zandvoort (Aug 29–31).

👉 Click here to join now