Galaxy Digital Warns Crypto Treasury Firms Create ‘Structurally Fragile’ Market

Galaxy Digital, the crypto-focused financial services firm founded by Bitcoin bull Michael Novogratz, is cautioning that the fast rise of public companies buying crypto for their balance sheets could potentially make the market “structurally fragile.”

In a July 31 research report, the New York-headquartered crypto firm said the rise of Digital Asset Treasury Companies — or DATCOs — is tied to a single trade: raising equity and using the proceeds to purchase Bitcoin or other cryptocurrencies.

“When hundreds of firms adopt the same one-directional trade (raise equity, buy crypto, repeat), it can become structurally fragile. A downturn in any of these three variables (investor sentiment, crypto prices, and capital markets liquidity) can start to unravel the rest,” the report warns.

As of press time, DATCOs hold more than $100 billion in cryptocurrencies, per data compiled by Galaxy Digital.

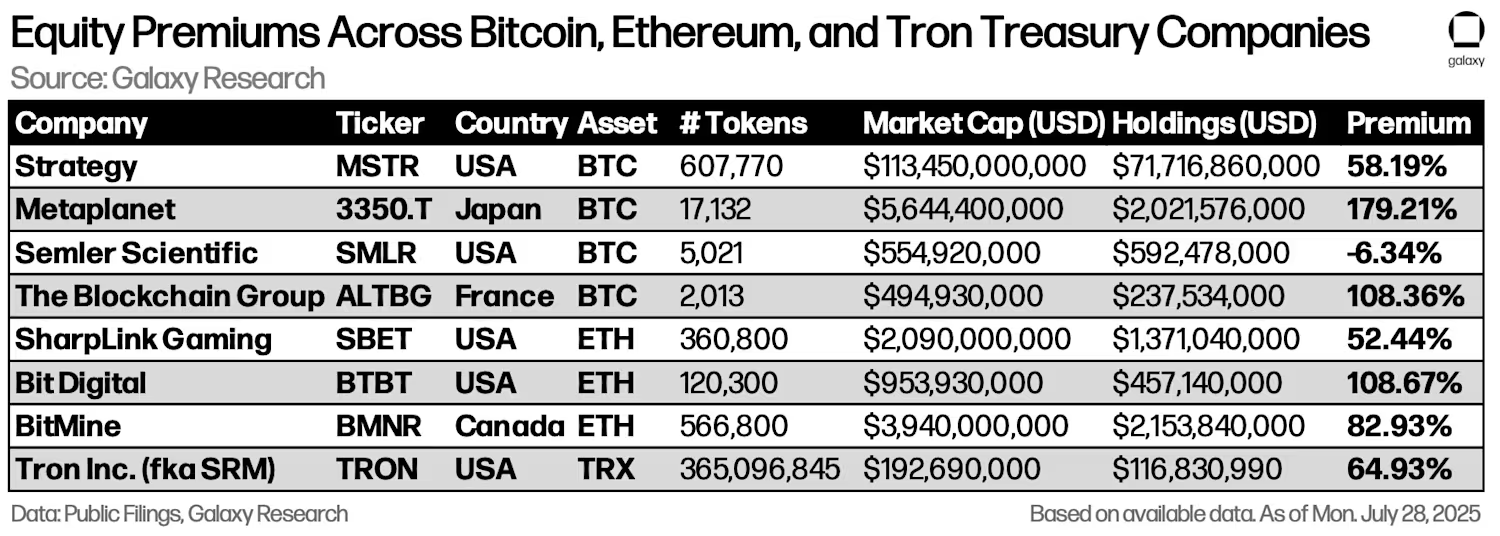

Michael Saylor’s Strategy leads the group with more than 607,700 BTC, valued at approximately $70 billion at current market prices, followed by Metaplanet in Japan and Semler Scientific in the U.S.

Although BTC makes up the bulk of holdings at about $93 billion, companies are also adding ETH, SOL, BNB, and other tokens to their treasuries. For example, as of Aug. 1, Tom Lee’s BitMine is the largest ETH holder, with more than 625,000 ETH worth about $2.3 billion, per data from Strategic ETH Reserve.

Risk of Cascading Failures

Galaxy Digital says today’s DATCO boom is comparable to the investment trust boom of the 1920s, when premiums to asset value fueled rapid growth until sentiment turned.

An unwind, the investment firm said, could “conceivably dull the public equity markets’ appetite for digital asset exposure of any kind, slowing inflows into crypto ETFs, which, all else equal, would weigh on the underlying cryptocurrencies’ prices.”

“These cascading failures were an accelerant of the 1929 crash and subsequent Great Depression. DATCOs may be more transparent and better regulated than 1920s trusts, but the mechanics of mNAV-driven capital formation are eerily similar,” the report reads.

Galaxy Digital notes that the risks remain “largely theoretical” for now, since apart from Strategy, DATCOs only hold about $32 billion in crypto, or less than 1% of the market.

Warning Signs

Galaxy Digital is not the only prominent firm sounding the alarm. Animoca Brands, the blockchain gaming and investment company, previously emphasized risks tied to the growing practice of companies announcing altcoin treasury strategies.

The firm cautioned that such strategies expose companies to heightened volatility, liquidity issues, and the possibility of forced asset sales if debt structures come under stress. It also pointed to the risk of activist investors pressuring management to sell assets at unfavorable prices if shares trade persistently below net asset value.

Breed VC, an early-stage crypto venture capital firm, issued a similar warning, arguing that many Bitcoin treasury companies that rely heavily on debt “pose a greater systemic threat.”

It said the pure-play firms most at risk are those heavily reliant on a premium known as the multiple of net asset value, or MNAV. “The existential threat is an extended bear market that erodes the MNAV premium just as sizable debt maturities come due,” Breed said.

The report warned of a potential “death spiral,” where dropping BTC prices and rising debt could push companies into distressed sales. In such a scenario, only a few strong players would survive, with bigger firms like Strategy likely picking up weaker rivals for pennies on the dollar.