Bitcoin Price Analysis: BTC at Risk of Pullback as New ATH Hopes Diminish

Bitcoin has slightly lost its bullish steam upon nearing the $111K all-time high, with strong selling pressure emerging at this key level.

The price continues to struggle in reclaiming this threshold, signaling a likely period of consolidation or corrective movement in the days ahead.

Technical Analysis

By ShayanMarkets

The Daily Chart

Bitcoin’s bullish rally toward its all-time high of $111K has shown signs of exhaustion, with the price losing momentum near this key resistance. The inability to reclaim the previous high around $110K suggests the potential formation of a double-top pattern, a classic bearish reversal signal.

Currently, BTC is consolidating within a critical price range, bounded by the $111K ATH and a fair value gap between $103K and $104K. Given the visible weakness in bullish momentum, a short-term rejection and further consolidation within this zone are likely. That said, the FVG may act as a significant demand zone, potentially halting any deeper corrections and providing the base for another upward attempt toward the $111K mark.

The 4-Hour Chart

On the 4-hour timeframe, BTC failed to print a new higher high above $110K, encountering notable rejection at this resistance. This price action confirms the presence of heightened selling pressure and distribution behavior near the ATH zone, reinforcing $111K as a key barrier.

Bitcoin now trades between two prominent liquidity zones: one just below $105K and the other above $110K. These liquidity pools are attractive targets for institutional players and could drive price volatility in the short term. As such, a range-bound movement is expected between these levels until a decisive breakout occurs, likely triggered by a liquidity sweep in either direction.

Sentiment Analysis

By ShayanMarkets

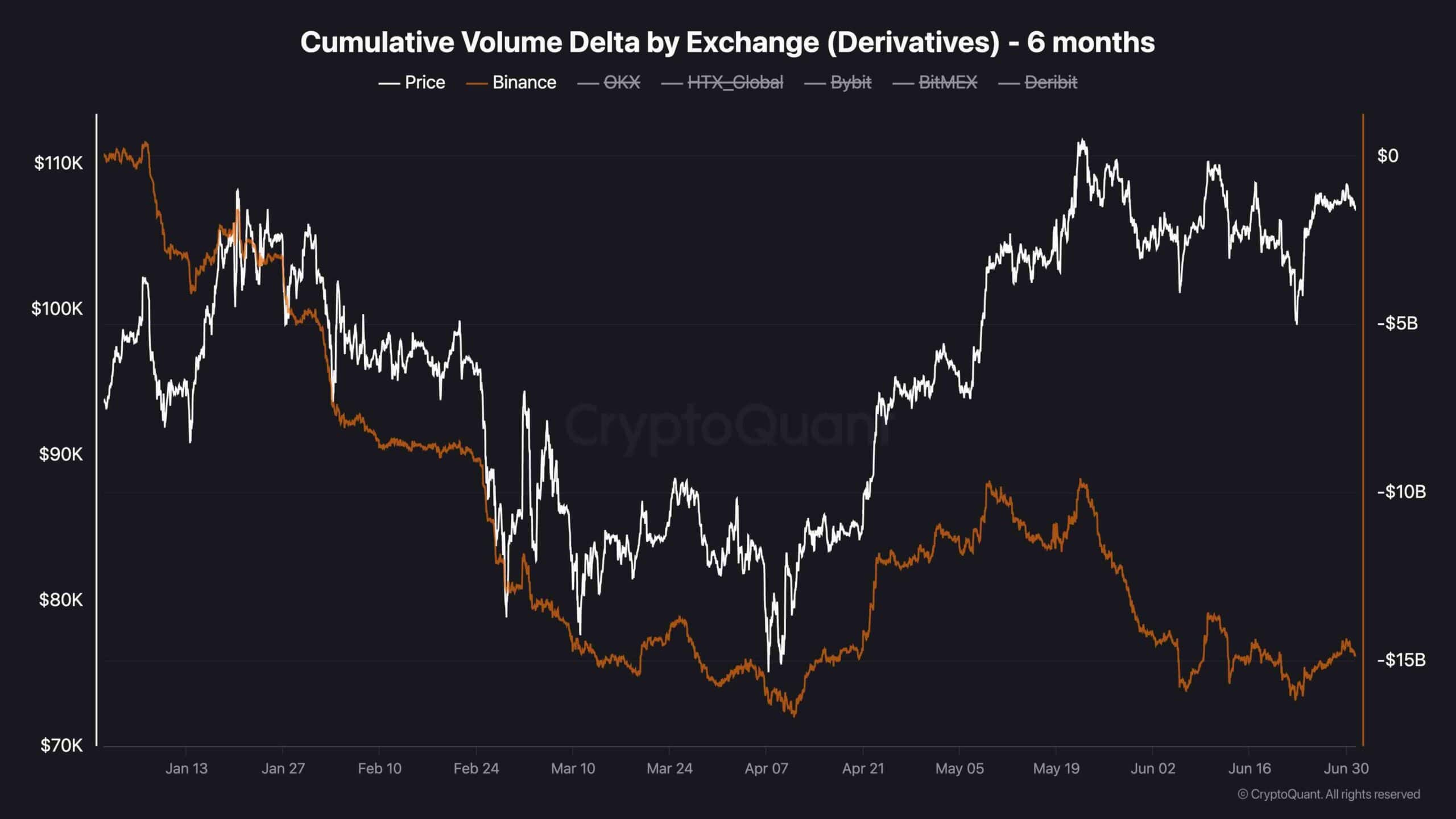

Over the past 45 days, taker users on Binance Derivatives have persistently engaged in sell-side activity. Despite this, Bitcoin has remained range-bound between $100K and $110K, while the Cumulative Volume Delta (CVD) has shown a consistent negative trend throughout the period.

The CVD, which measures the net flow of buy and sell volume in real time, highlights a clear dominance of aggressive selling pressure. However, the price’s ability to hold steady, without further decline, points to a potential absorption phase, likely directed by institutional investors or large-scale players quietly accumulating.

This ongoing divergence between persistent sell-side flow and stable price action suggests that Bitcoin may be forming a strong base. If the current structure holds, with continued absorption within the range, the likelihood of a bullish breakout increases, potentially setting the stage for a renewed uptrend.