Bitcoin notches recovery to $115k as long-term demand remains

Bitcoin and other leading cryptocurrencies are showing signs of recovery following a sharp dip last week, primarily driven by macroeconomic factors.

Over the past week, Bitcoin’s price dropped 4%, hitting a multi-week low of $112,000, which prompted Arthur Hayes, co-founder of BitMEX, to warn that ongoing macroeconomic pressures could push BTC back toward the $100,000 range.

However, Maksym Sakharov, co-founder and CEO of WeFi, told CryptoSlate that the correction was a natural consequence of an overheated market.

According to Sakharov, Bitcoin’s impressive bull run over the past month, followed by a new all-time high, made the price dip almost as expected. The market, he added, was simply taking a breather before continuing its upward momentum.

Already, the market is showing signs of strength again, with Bitcoin and other major assets, including Ethereum, Solana, and BNB, all beginning to recover and show gradual rebounds.

XRP, in particular, stood out among the top 10 digital assets, climbing more than 5% in the last 24 hours to cross the $3 mark after briefly trading below it over the weekend.

On-chain data shows continued demand

Despite the recent dip, market analysts remain optimistic about Bitcoin’s long-term future.

Abramchart, a contributor at CryptoQuant, emphasized that Bitcoin’s bull run is far from over, as long-term holders (LTHs) continue to display confidence in the top crypto.

According to the analyst, the Net Unrealized Profit/Loss (NUPL) indicator has stayed above 0.5, signaling that Bitcoin is still profitable for many investors.

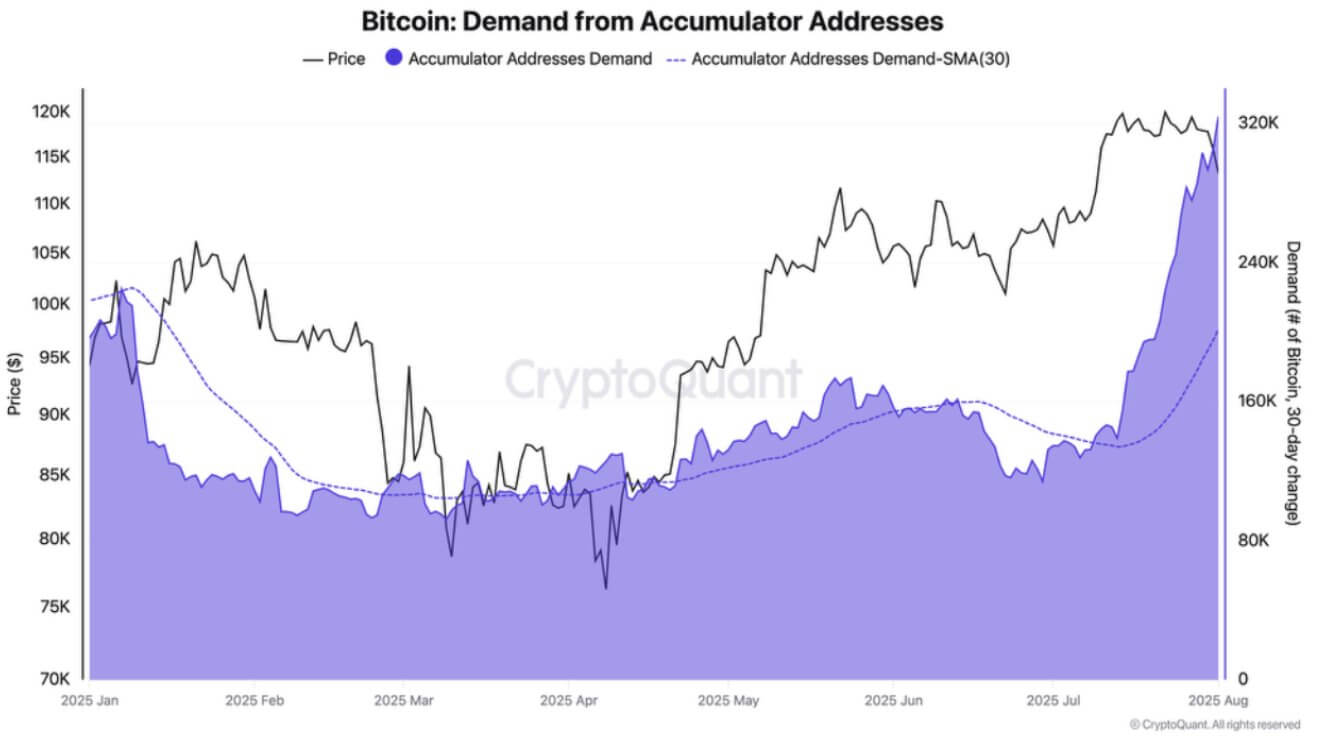

Supporting this view, Darkfost, another analyst, noted that demand for Bitcoin remains strong.

He pointed out that addresses accumulating Bitcoin without selling are increasing, with an average of 50,000 BTC accumulated by these addresses over the past month. This sustained buying behavior supports the notion that demand for the asset remains robust.

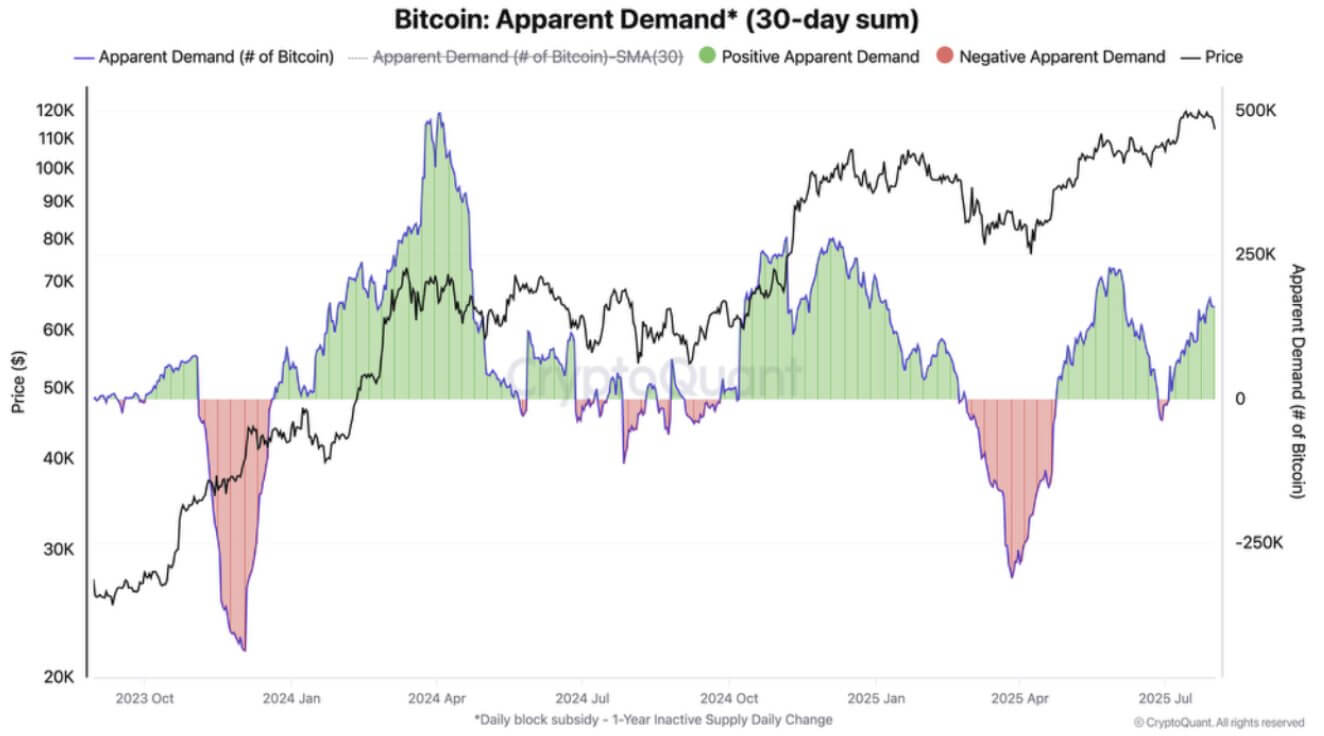

Moreover, a chart tracking “apparent demand,” which compares new Bitcoin issuance against the volume of coins inactive for over a year, shows a positive trend.

Over the past 30 days, around 160,000 BTC have been absorbed by long-term holders, further confirming market resilience.

WeFi’s Sakharov concluded that these patterns suggest Bitcoin’s recent correction is merely part of the broader cycle. He remains confident that the asset is on track to reach new highs, driven by structural demand and long-term investor conviction.