Bitcoin Price Chart Dropped 4%, But On-Chain, Holder Demand Is Up 160,000 BTC

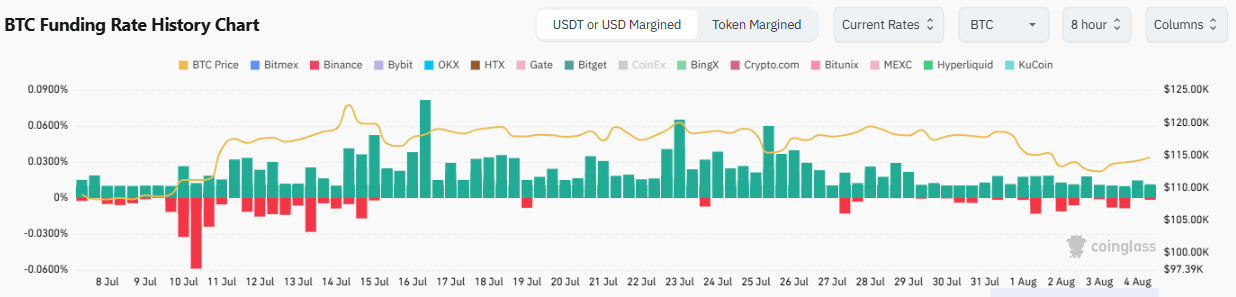

Bitcoin’s price dropped over 4% last week, wiping out half the gains made in early July and briefly dipping below the key support range of $114,672-$115,734. This short-term bearish pressure was amplified by a “death cross” on the 4-hour chart and negative funding rates, signaling caution among traders.

However, a deeper look at on-chain data reveals a completely different story, one of quiet and heavy accumulation by long-term investors.

On-Chain Data Shows Whales Buying The BTC Dip

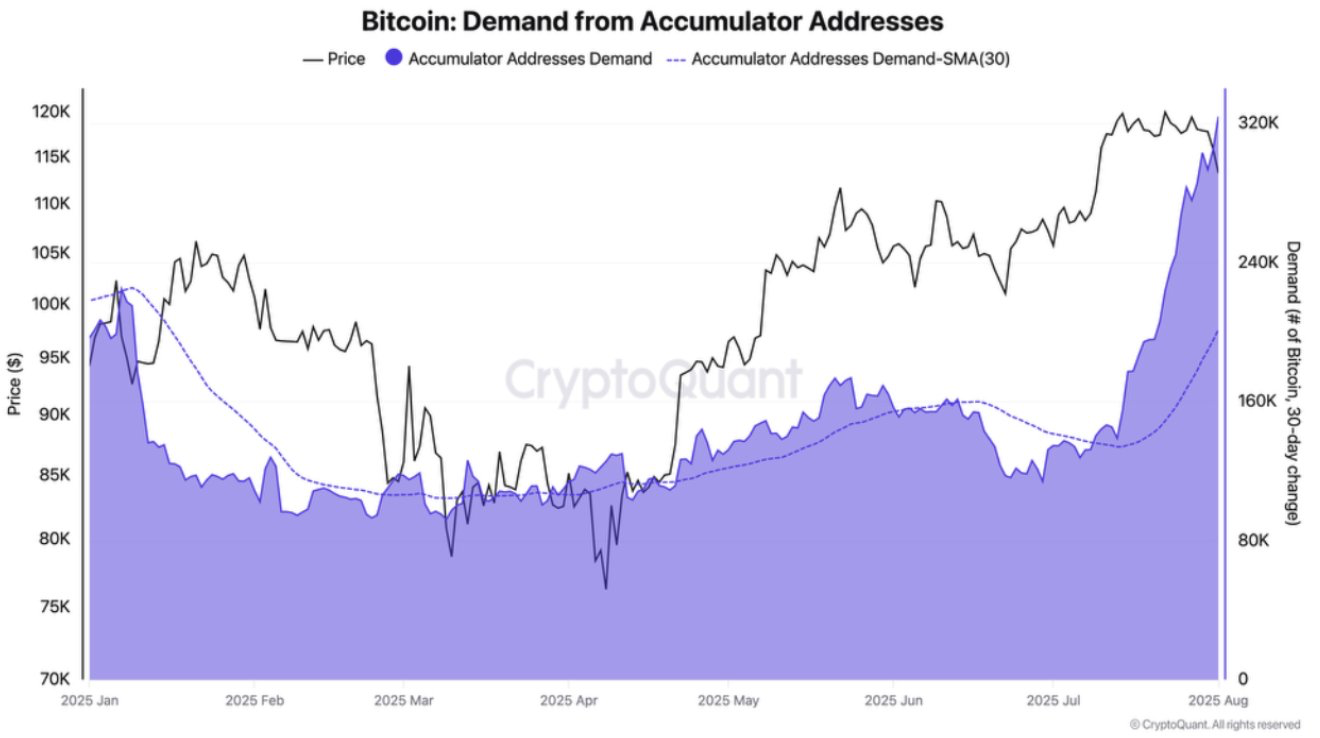

According to an analysis from CryptoQuant, the macro bull market for Bitcoin remains firmly intact. Their data shows that long-term investors have accumulated 160,000 BTC in the past 30 days. To put that in perspective, Bitcoin miners supplied only 13,500 BTC in the same period. This means long-term holder demand is currently outpacing new supply by more than 11-to-1.

A CryptoQuant indicator dubbed Bitcoin Demand from Accumulator Addresses, which tracks addresses that have only acquired BTC without selling any, shows the average BTC accumulated by these addresses has increased by roughly 50,000 BTC in the past 30 days.

Related: Bitcoin (BTC) Price Prediction for August 5

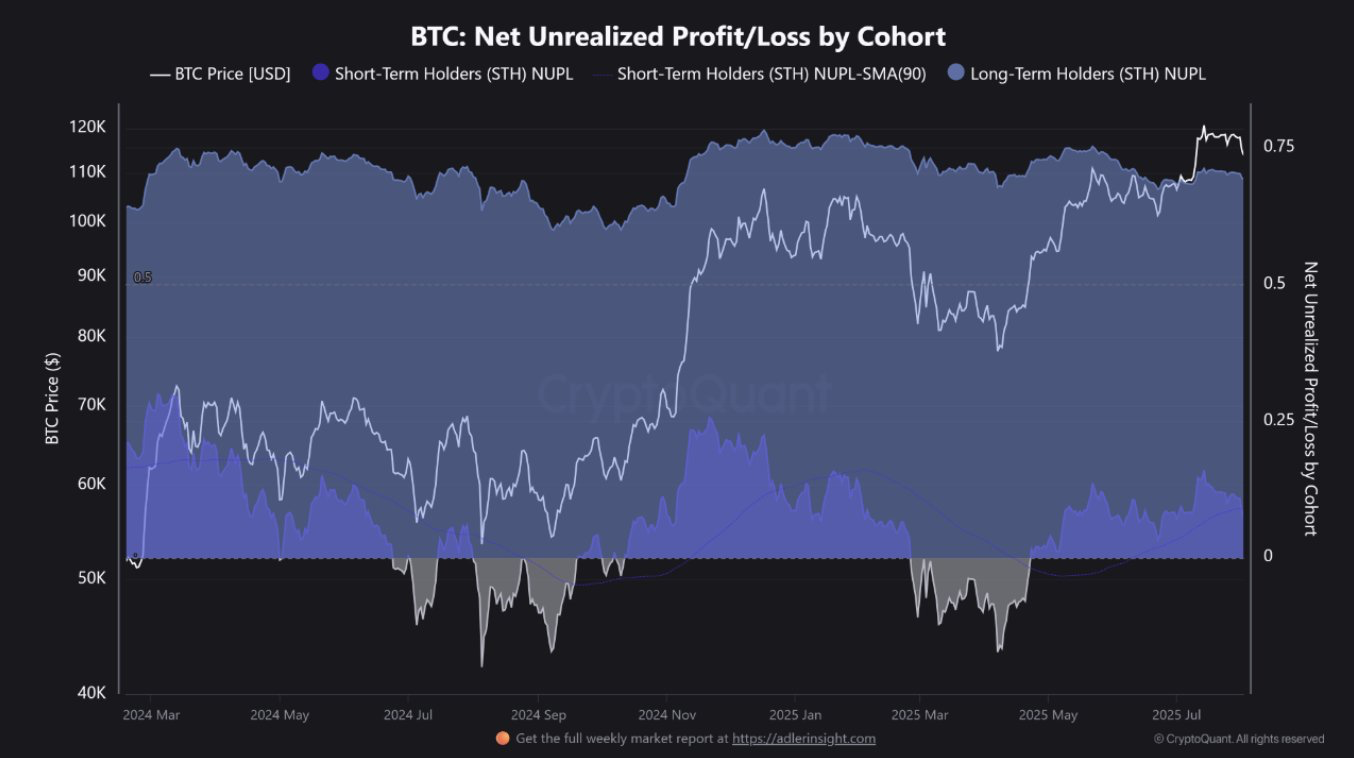

Meanwhile, CryptoQuant’s on-chain analysis revealed that long-term holders remain highly convinced of Bitcoin’s ability to hedge against inflation. On the other hand, short-term holders have been fluctuating near lower profit levels, suggesting partial selling or mid-term pressure.

“The overall trend remains bullish, driven by long-term holder conviction, while short-term holders may cause temporary corrective pressure,” CryptoQuant noted.

Key Midterm Events to Consider

Bitcoin price has experienced short-term bearish sentiment partially influenced by the recent Fed policy decision to hold its interest rate steady. Later this week on Thursday, the Bank of England (BOE) will issue its monetary policy report including its official bank rate, which is anticipated to drop from 4.25% to 4%.

Related: Crypto Market Hits $3.8 Trillion Before Sharp Rejection; What’s Next?

If the BOE cuts its benchmark interest rate later this week, Bitcoin’s bullish sentiment will be rejuvenated. Furthermore, Wall Street analysts have been betting on a Fed rate cut in September amid intense pressure from President Donald Trump.

What the Technicals Say About BTC’s Next Move

From a technical perspective, Bitcoin has been trading within a falling logarithmic trend since its mid-July all-time high of around $122,838. While last week’s drop briefly pushed the price below this trend, it has since rebounded.

Signs of a potential short-term recovery are now appearing. The 4-hour MACD indicator has flashed a buy signal, and the 4-hour Relative Strength Index (RSI) has bounced from oversold levels, suggesting the recent selling pressure may be exhausted for now.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.