Metaplanet stock crashes as Bitcoin treasury companies lose their lustre

Metaplanet stock price has crashed and entered a bear market as demand for Bitcoin treasury companies waned and investors began booking profits.

- Metaplanet share price has plunged by 55% from the year-to-date high.

- The stock has dropped as Bitcoin treasury companies dive.

- Technical analysis points to more downside in the near term.

Metaplanet shares have plunged to ¥910 ($6.18), the lowest level seen since May 23 and 55% below this year’s peak. This decline has pushed the company’s market capitalization from ¥1.14 trillion to ¥638 billion.

Why the Metaplanet stock price has crashed

There are several reasons why Metaplanet’s share price has dropped over the past few months, even as Bitcoin (BTC) remains a few points below its all-time high.

First, there are signs that demand for Bitcoin treasury stocks is weakening. For example, Strategy, the largest Bitcoin accumulator, has dropped by 30% from its all-time high. Other similar companies like MARA Holdings and Trump Media have also declined by double digits.

Second, Metaplanet shares have fallen due to profit-taking by some investors. At its peak in June, the stock was up more than 15,000% from its lowest level in 2024.

It’s common for stocks to pull back after a massive rally. From a technical analysis perspective, the stock has likely entered the distribution or markdown phase of the Wyckoff Theory.

Third, there are ongoing concerns about Metaplanet’s valuation. Despite a 55% drop from its all-time high, its net asset value (NAV) multiple stands at 2, higher than other Bitcoin treasury companies. Strategy has a NAV multiple of 1.47, while MARA is at 1.

Additionally, concerns over continued dilution remain. In a statement last week, the company announced plans to raise an additional $3.7 billion to buy more Bitcoin. This move would increase dilution, as its outstanding shares have surged from 114 million in January last year to 460 million.

Metaplanet share price technical analysis

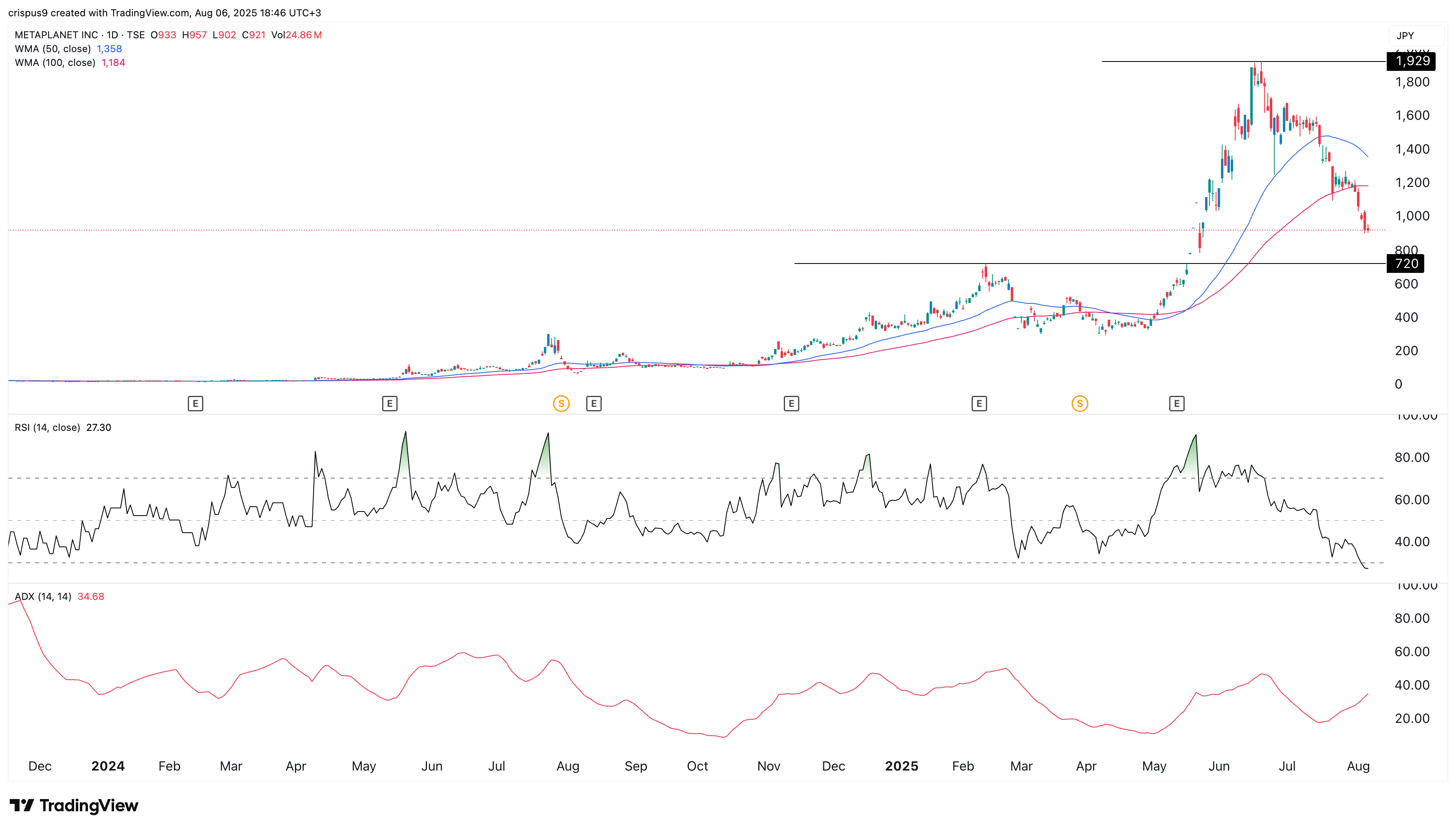

The daily chart shows that Metaplanet’s stock price has remained in a strong bearish trend over the past few months, falling from a high of ¥1,929 in June to ¥920.

It has dropped below the 50-day and 100-day Weighted Moving Averages. Meanwhile, the Relative Strength Index has fallen to 27, and the Average Directional Index has risen to 35. These momentum indicators suggest that the bearish trend is strengthening.

Therefore, the path of the least resistance for the Metaplanet share price is downwards, with the next target being at ¥720, its highest point in February.