A spike in upside liquidity suggests that Bitcoin (BTC) may be positioning for another short squeeze.

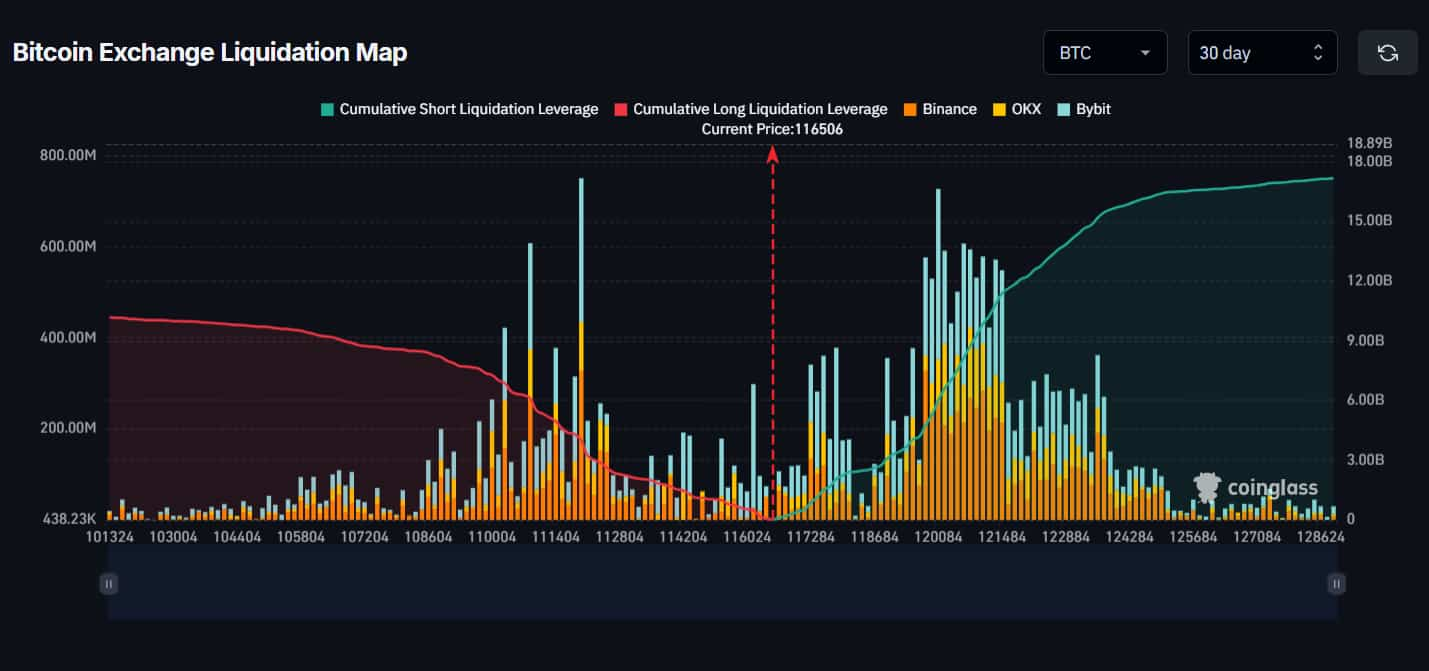

Trading above $116,506 at the time of writing, Bitcoin faces nearly $18 billion in leveraged short positions, with the heatmap showing a liquidation zone near $120,000, according to CoinGlass data gathered on August 7.

The chart below pinpoints the regions with the highest density of leveraged short positions and highlights the zones most prone to liquidation. More precisely, the steepening green curve on the right visualizes where short sellers face the greatest risk of being wiped out.

The data shows a sharp uptick in the curve just above the $119,000 level, after which a dense concentration of leveraged short positions clearly appears. What that means is that if Bitcoin begins to push toward that zone, we might see a chain reaction trapping late short sellers and potentially driving the price even higher.

In simpler terms, the chart highlights just how much capital is currently betting against Bitcoin rising past the critical level. If the asset does climb, those short positions will start incurring losses, so exchanges will begin forcibly liquidating.

In turn, forced liquidations are likely to trigger buy orders because traders must purchase Bitcoin to cover their positions. This surge in buying pressure can again drive the price up, triggering even more liquidations.

Bitcoin price movements

On Thursday, August 7, Bitcoin rose 2.15% over the past 24 hours, bouncing back from a week-long decline of 1.35%. The rally was largely driven by a new executive order signed by President Donald Trump, which allowed cryptocurrencies to be included in 401(k) retirement plans.

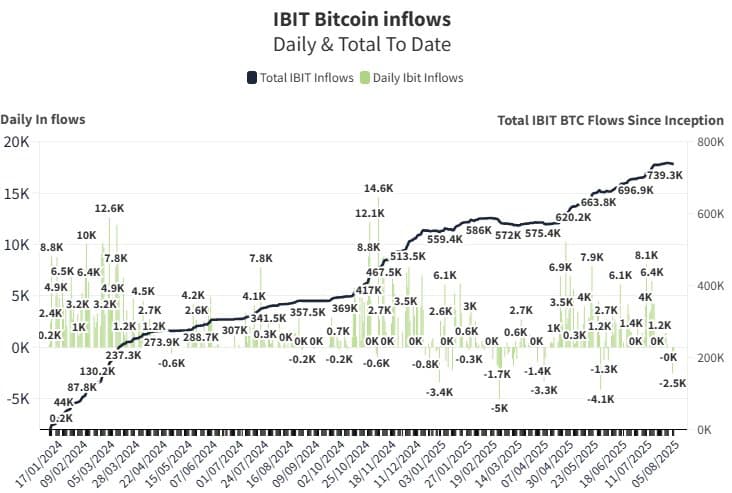

Spot Bitcoin ETFs in the U.S. saw some new inflows on the same day, with BlackRock recording a net gain of $41.9 million after several days of consecutive outflows.

With regulatory winds turning favorable and institutional demand quickening up once again, Bitcoin might very well see some gains in the near future. However, the question remains whether the rally has enough momentum to crack key resistance levels necessary to trigger the liquidations discussed above.

Featured image via Shutterstock