TL;DR

- With US interest rate cut odds in September jumping to almost 80%, markets may start pricing in bullish momentum early – potentially benefiting BTC throughout August.

- Some analysts believe the asset has yet to enter its “thrill” and “euphoria” phases, which can lead to a renewed price rally.

Major Gains This Month?

Bitcoin (BTC) soared to an all-time high of over $123,000 in July but is currently trading well below $120,000. And while some have started doubting the asset’s potential to achieve new gains in the short term, here are three important factors that suggest the ongoing month can be highly beneficial.

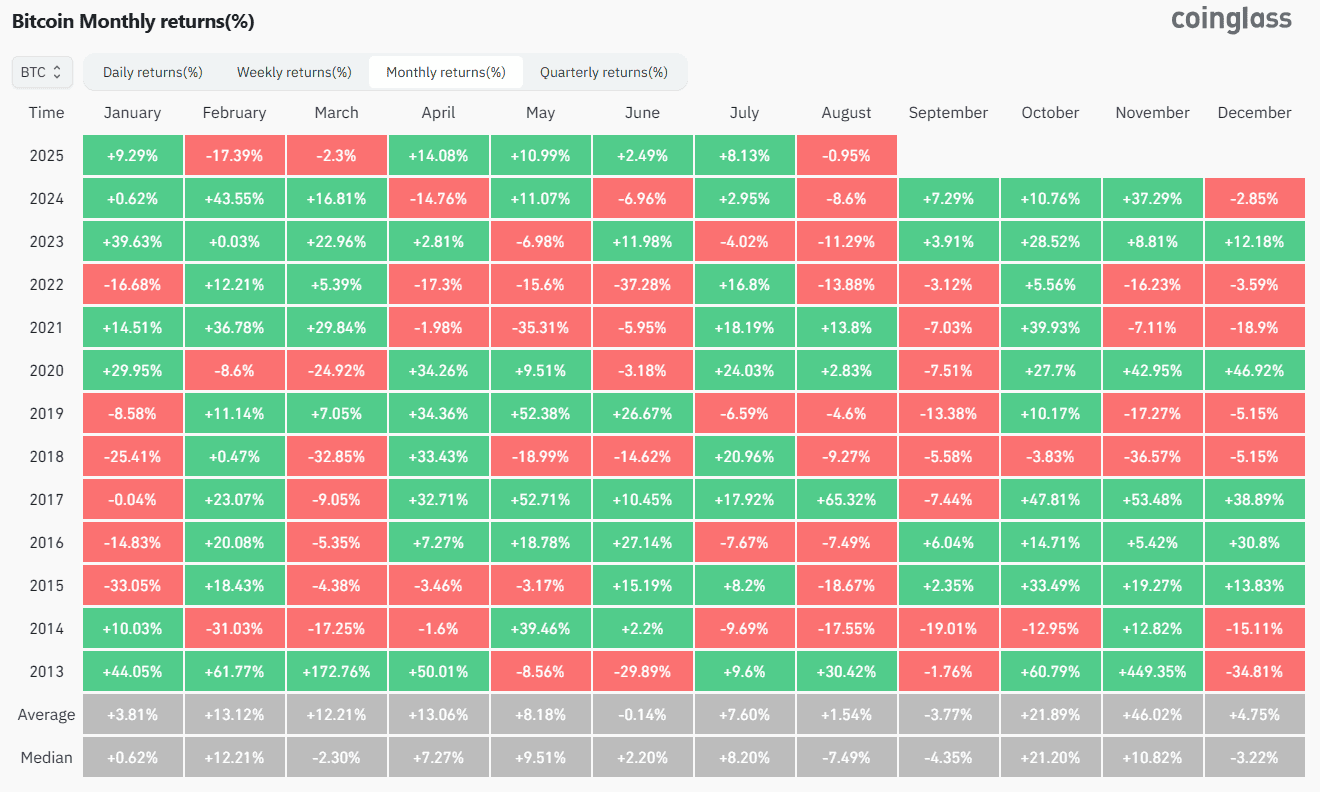

Let’s start with an overlook of BTC’s performance in August during the past 11 years. The primary cryptocurrency has finished the month in the green zone only four times – in 2013, 2017, 2020, and 2021.

Interestingly, it has always managed to close August with some gains after a halving year. The latest halving, which reduced the miners’ rewards for adding new blocks in half, occurred in 2024. We have yet to see whether the current month will follow the historical trend or whether we will witness an exception.

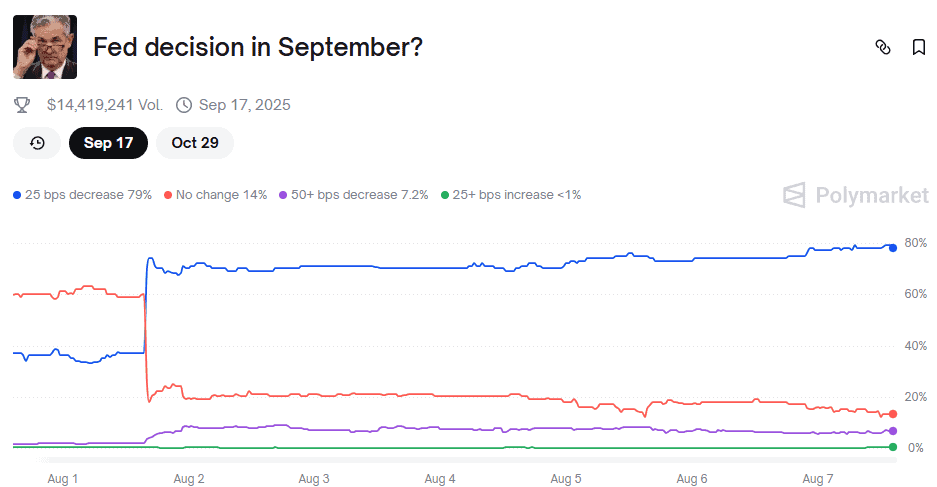

We move on to the potential lowering of interest rates in the United States. The latest jobs data report indicated that the economy is weaker than previously expected, which means the Federal Reserve might be more inclined to drop the benchmark. According to Polymarket, the odds of such a move coming in September have soared from 35% to almost 80%.

Lower rates will make borrowing money cheaper and may encourage investors to take on riskier investments, such as those in cryptocurrencies like BTC. Markets often begin pricing in such events before the actual announcement, with enthusiasm and optimism building early.

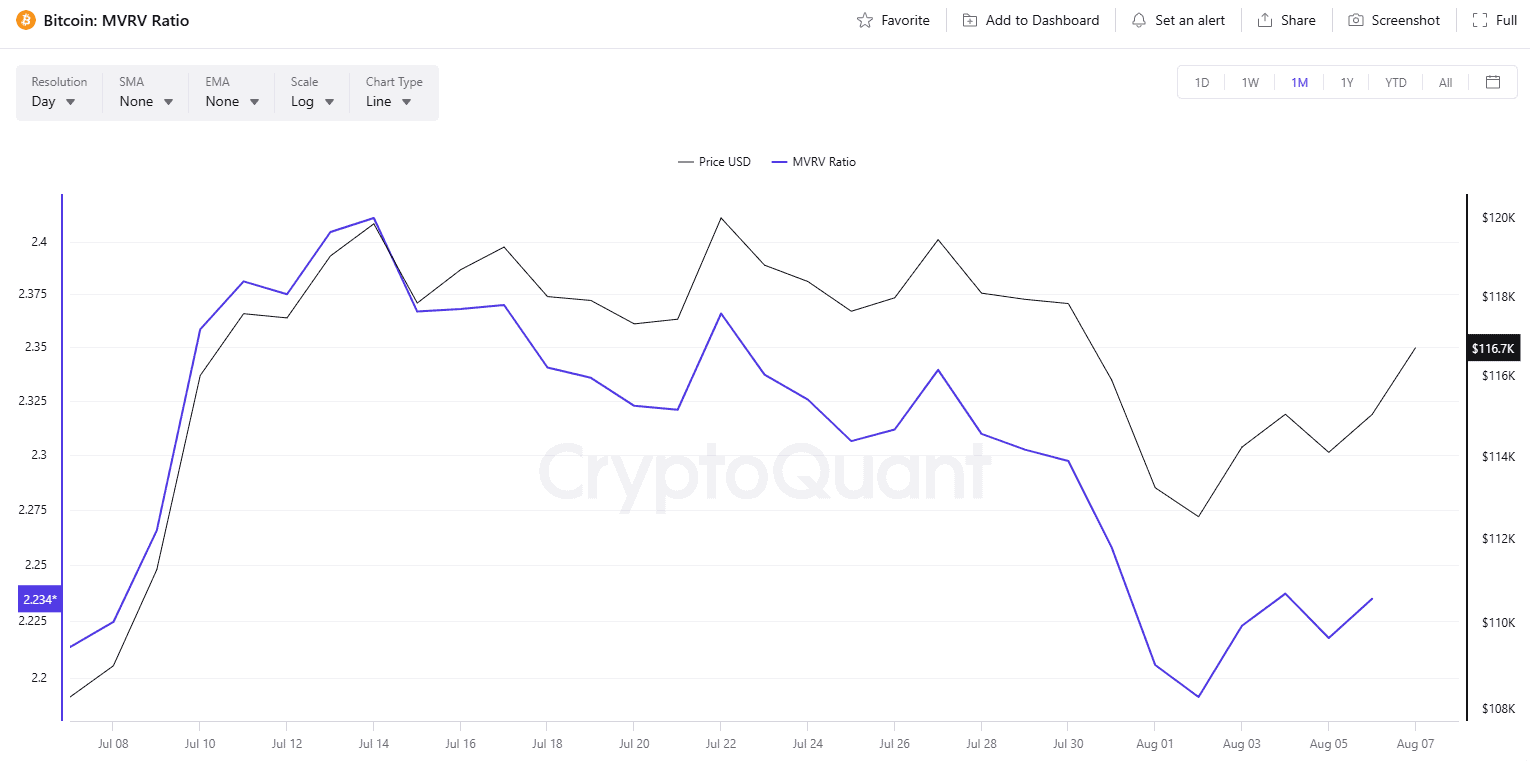

Lastly, we will examine BTC’s MVRV, which compares the asset’s market capitalization to its realized capitalization, helping traders determine whether it is undervalued or overvalued.

Over the past month, the ratio has fluctuated within the healthy range of 2.2 to 2.4, indicating that there is still potential for further appreciation. Based on CryptoQuant’s analysis, levels above 3.7 have historically aligned with cycle tops, while values under 1 have corresponded with market lows.

Waiting for These Phases

Many analysts believe BTC has much more fuel left to reach fresh peaks. X user Mags assumed that the asset is yet to enter the “thrill” and “euphoria” zones, predicting a rally above $200,000. However, this usually marks the end of the bull run and could be followed by a steep correction to approximately $100,000.

#Bitcoin is about to enter Thrill. pic.twitter.com/uz1D2uGnYm

— Mags (@thescalpingpro) August 7, 2025