Here’s Why Bitcoin Price Has Only One Way to Go, and That’s Upward

Bitcoin price could keep rising as institutional interest hits new highs in 2025, with demand continuing to outpace the amount of new BTC entering circulation.

Andre Dragosch, Head of Research for Bitwise Europe, shared fresh data showing how this growing imbalance could lead to long-term price growth. The chart he released highlights just how much institutions have stepped up their buying, especially in the wake of Bitcoin’s 2024 halving.

Institutional Demand for Bitcoin Growing

Notably, back in 2020, institutions bought 446,350 BTC, just slightly under the 453,318 BTC that miners produced. However, in the years that followed, demand slowed. Between 2021 and 2023, annual institutional purchases dropped well below supply. For instance, in 2022, institutions added only 86,529 BTC to their holdings, while the network produced 332,425 BTC.

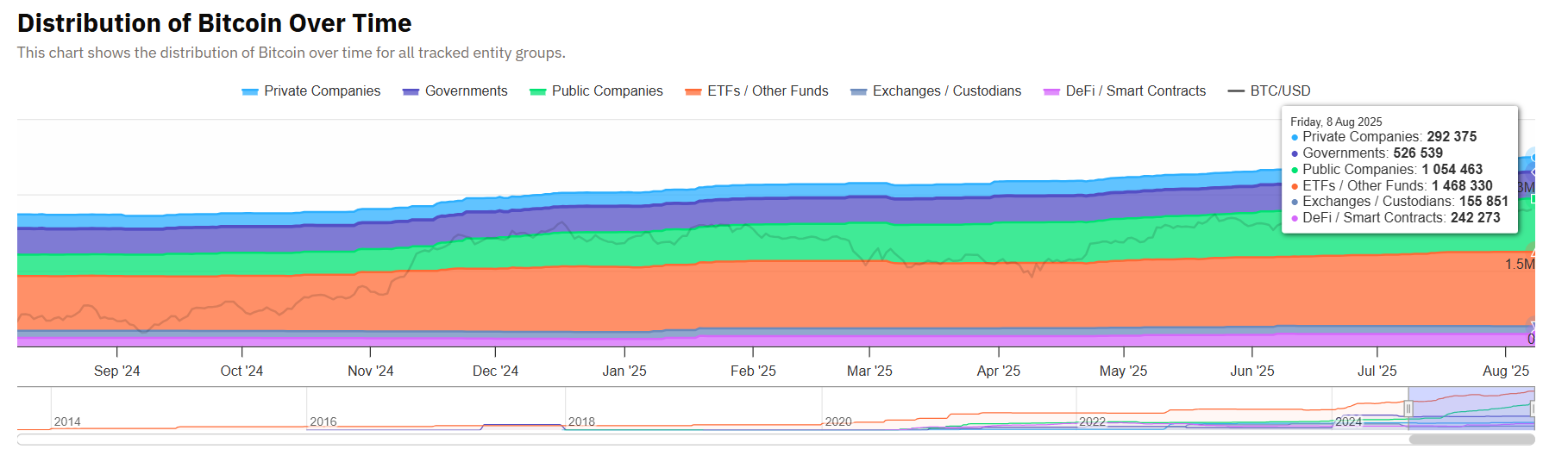

Data from Bitcoin Treasuries confirms this growing accumulation trend. By the end of 2024, private companies, public firms, and ETFs held a combined 2,252,936 BTC. Specifically, private companies owned 271,735 BTC, public companies held 694,147 BTC, and ETFs and other fund products controlled 1,287,054 BTC.

Today, just eight months into 2025, these holdings have grown significantly. Notably, private companies now hold 292,375 BTC, an increase of 20,650 BTC. Public companies have added 360,316 BTC, bringing their total to 1,054,463 BTC. ETFs and similar funds now hold 1,468,330 BTC, after buying another 181,276 BTC this year.

More Companies Adopting Bitcoin Treasuries

This massive demand spike comes as more companies step into Bitcoin for the first time. Several major names made their initial purchases in 2025. GameStop bought $500 million worth of Bitcoin in May. In June, Belgravia Hartford, a publicly traded investment firm, added Bitcoin to its reserves.

Other firms moved earlier in the year. Rumble made its debut Bitcoin purchase in January, and the company’s CEO said they plan to keep adding. In July alone, the market saw a flurry of new entrants. UK-based Abraxas Capital picked up over $250 million worth in a single week. Nasdaq-listed electric vehicle maker Volcon Inc. entered the scene with $500 million.

Meanwhile, Trump Media, the parent company of Truth Social, announced plans in May to raise $2.5 billion to build a Bitcoin treasury. Also, Bitcoin-native company Twenty One went public with over 43,500 BTC, including 5,800 acquired from Tether.

With this kind of momentum, some experts believe Bitcoin price could hit staggering levels in the coming decade. Andre Dragosch suggested that by year-end 2035, Bitcoin could climb to $1.3 million, $7.2 million, or $13.7 million, using different valuation models.