President Donald Trump Discredits Inflation Fears: Is Crypto Market Ready for Rebound?

-

More than $1 billion was liquidated from the crypto leveraged market today following hotter-than-expected producer cost data.

-

Bitcoin price is likely to rebound to a new ATH after filling the CME gap at around $117.5k.

-

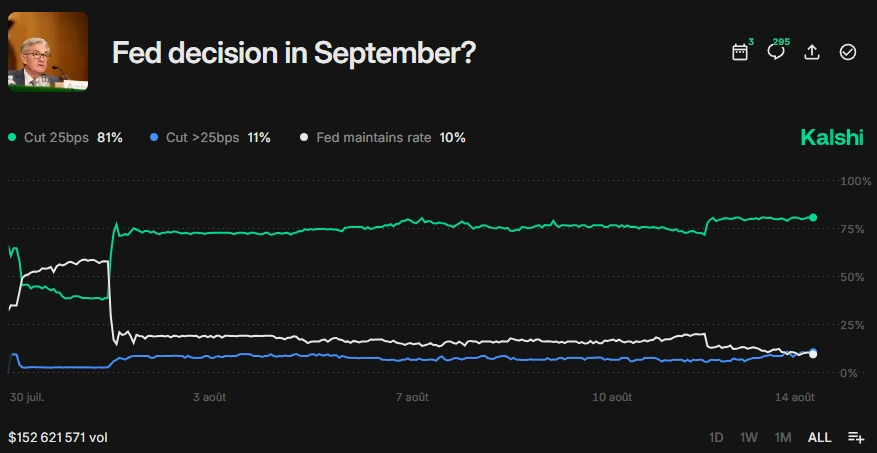

Kalshi traders have made a bet on a Fed rate cut in September despite the hotter-than-expected PPI data.

President Donald Trump has discredited the inflation fears caused by Thursday’s hotter-than-expected Producer Price Index (PPI). Trump told reporters on Thursday that inflation is down to a ‘perfect number’ thus rejuvenating hopes for a Fed rate cut in September.

“Hardly any inflation at all. 401(k) s and the stock are soaring,” President Trump noted.

Crypto Market Reacts to Inflationary Pressures

Notably, Thursday’s PPI data hinted at a possible increase in next month’s Consumer Price Index (CPI). As a result, fears of the Fed holding its benchmark rate at 4.5% surged, thus causing heavy liquidation of long traders.

According to aggregate market data from CoinGlass, more than $1 billion was liquidated from the crypto leveraged market. The long trader accounted for the majority with over $827 million rekt on Thursday.

Nonetheless, odds for a 25 bps rate cut in September, as shown by Kalshi data, surged to 81%. Most importantly, despite the inflationary fears, Kalshi data shows traders now see a higher chance for a 50 bps rate cut, at 11 percent, compared to a no rate cut at 10 percent for the first time.

What’s Next for the Cryptocurrency Bull Market?

The cryptocurrency bull market recently signaled the entrance to its euphoric phase, especially after the Ethereum (ETH) and Bitcoin (BTC) price rebound. The macro bullish sentiment is bolstered by the rising demand from institutional investors implementing crypto treasury strategies.

Additionally, President Trump recently signed an executive order to allow 401(k)s, which have over $8 trillion in assets under management, to diversify into the cryptocurrency market.