Bitcoin Price Fall – Leverage-Driven Decline, Won’t Last Long

Bitcoin has experienced notable volatility recently, with the crypto king falling to $112,500 twice this month. While this price movement may appear concerning, it’s important to understand the dynamics behind the decline.

This drop is largely driven by leveraged positions and is unlikely to last long, given the broader market conditions.

Bitcoin Investors Are Not Behind The Decline

Futures market activity heavily influences the market sentiment around Bitcoin, while on-chain profit and loss-taking have remained relatively muted during the recent ATH (all-time high) formation and subsequent correction.

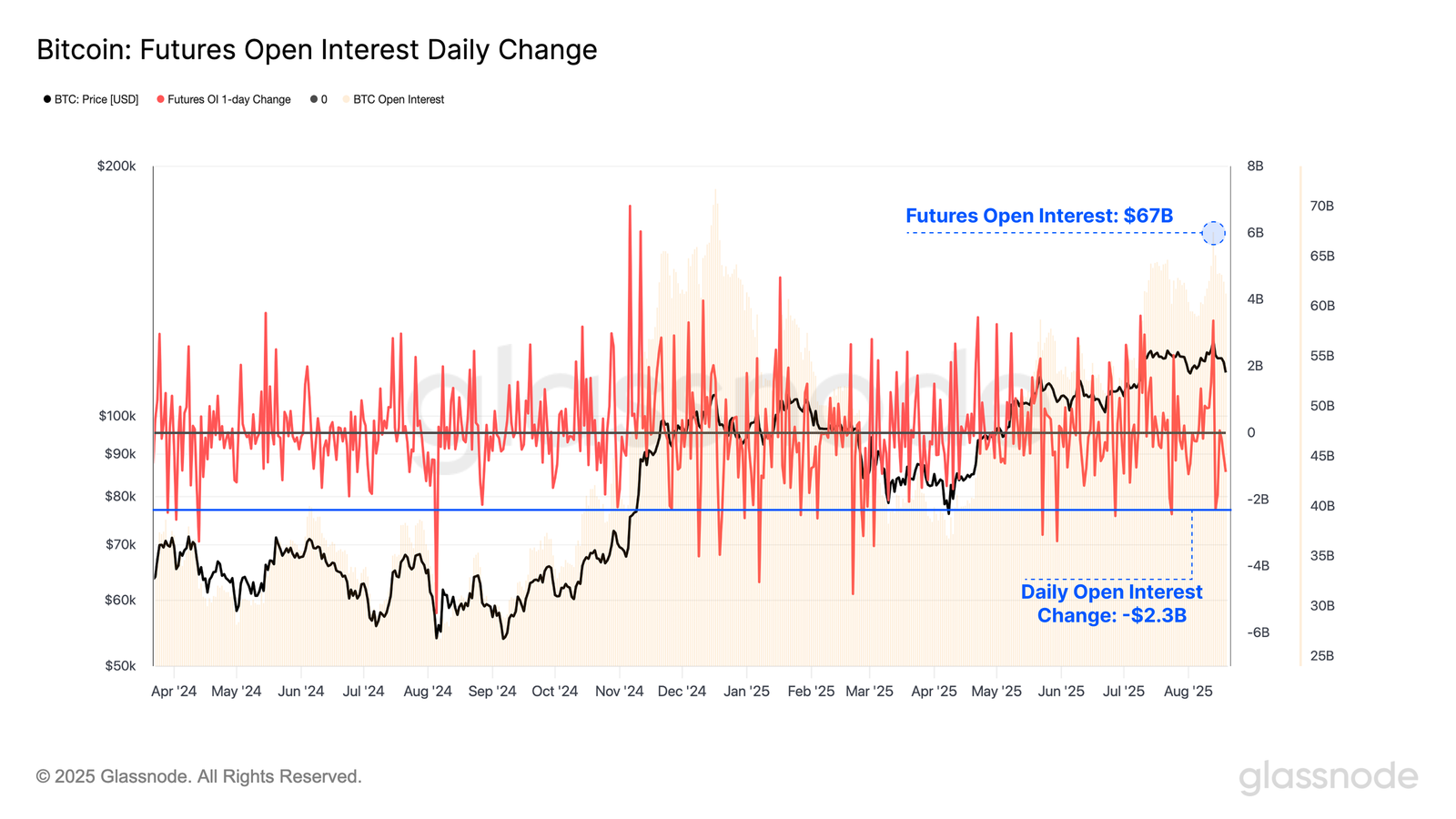

Open interest in Bitcoin futures contracts remains high at $67 billion, indicating a high level of leverage in the market. Leverage, while a powerful tool for profit, can exacerbate price swings, as we’ve seen in recent market movements.

Notably, during the recent sell-off, over $2.3 billion in open interest was wiped out. This represents one of the largest nominal declines, with only 23 trading days recording a larger drop. Such a significant unwind highlights the speculative nature of the market, where even modest price movements can trigger the contraction of leveraged positions.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

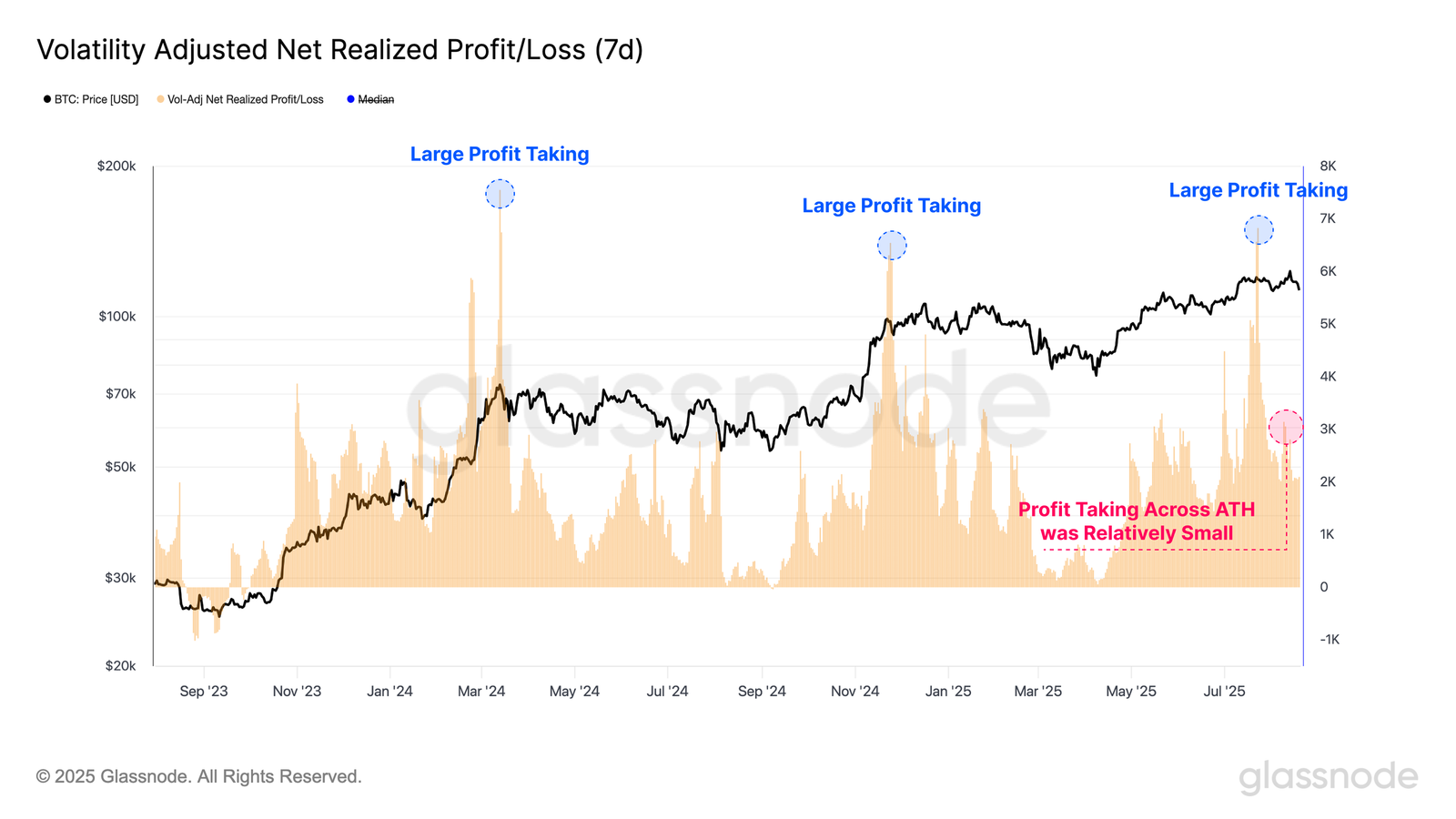

This is further backed by the fact that, in recent weeks, the Volatility-Adjusted Net Realized Profit/Loss metric indicates softened profit-taking activity. In previous breakout scenarios, such as during the $70,000 and $100,000 price levels in 2024, substantial profit-taking volumes signaled strong investor activity.

At those points, the market absorbed the selling pressure from existing BTC holders. However, the latest all-time high attempt at $122,000 this July saw lower profit-taking volumes, suggesting a change in market behavior.

One interpretation of this dynamic is that the market struggled to sustain upward momentum, despite a softer sell-off from current holders. This lack of strong profit-taking may point to weaker demand to absorb supply, which could explain the current market consolidation and limited movement despite reaching new price levels.

BTC Price Bounces Back

Bitcoin’s price is currently at $114,200, after bouncing off the support level of $112,526 for the second time this year. This recovery is expected to continue, as the decline results primarily from leverage-related sell-offs. A bounce back is likely, given the relative strength of Bitcoin’s support at $112,526.

If Bitcoin successfully breaches and flips the $115,000 mark into support, the cryptocurrency could rise toward $117,261. Maintaining this support level is key for a continuation of the bullish trend, potentially paving the way for a move toward $120,000.

However, if Bitcoin fails to breach $115,000 or if investors move towards further selling, the price may drop below $112,526. Such a move could take Bitcoin down to $110,000 or lower. This would invalidate the current bullish thesis and signaling a potential longer-term bearish phase for the cryptocurrency.

The post Bitcoin Price Fall – Leverage-Driven Decline, Won’t Last Long appeared first on BeInCrypto.