What Is Cathie Wood’s Ark Invest Buying and Selling Amid This Market Correction?

The privately held company has made adjustments to the ETFs it manages, both reducing and adding to specific positions.

Falling Prices

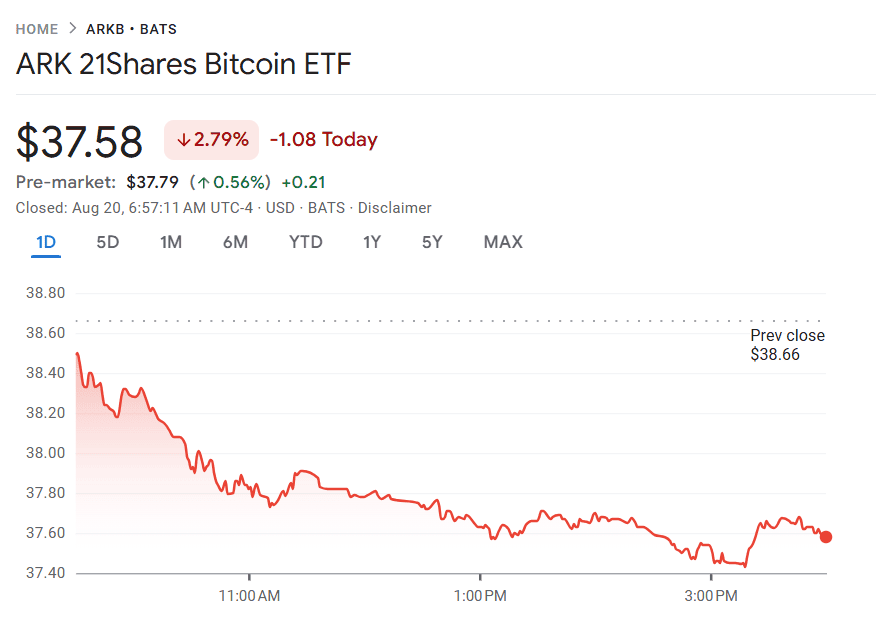

Ark Invest, the investment management firm with more than $6 billion in assets under management (AUM), reduced the size of its ARKB (ARK 21Shares Bitcoin ETF) by 559.85 BTC, or approximately $64.4 million, as reported by the market watcher page Whale Insider yesterday.

The crypto community responded with mixed feelings about the sale, with some indicating that it was a regular rebalancing of the fund. In contrast, others outright questioned it or even mocked it.

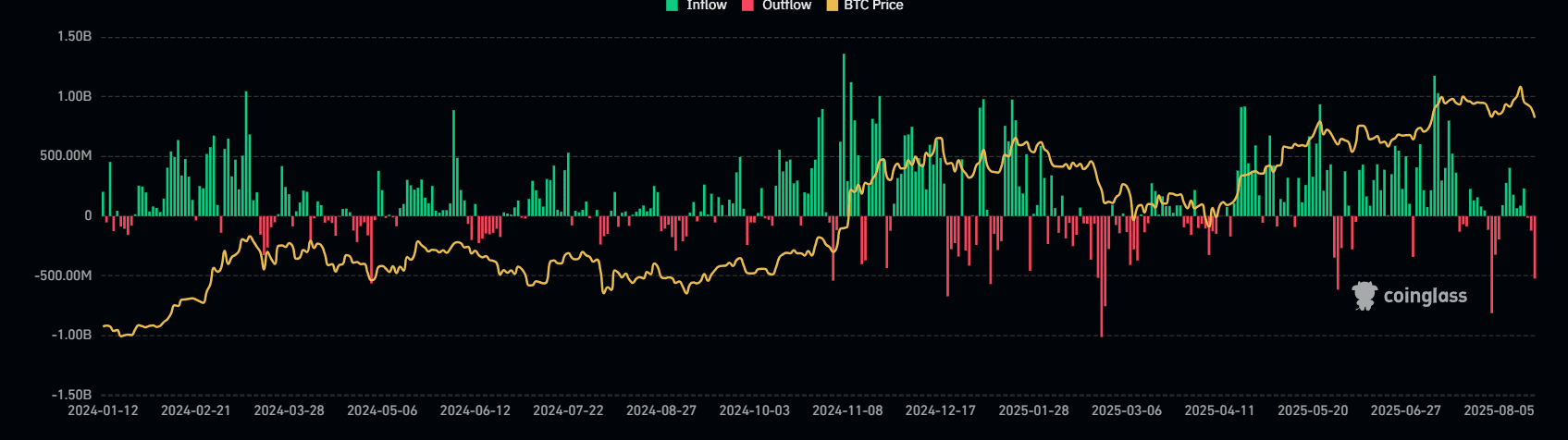

Data collected at print time from CoinGlass also indicates a wave of sell-offs across exchange-traded funds, coinciding with the recent price slump for the leading cryptocurrency, which was preceded by a new all-time high of over $124,000.

The ARKB stock seems to have reacted negatively to the sale, with the most recent data indicating a 2.79% daily decline, as reported by Google Finance.

Buying Opportunity

The company has not only been selling, though, because today, the ARKK (ARK Innovation ETF) scooped up 356,346 shares of Bullish, with an estimated cost of $21.2 million, and 150,908 shares of Robinhood Markets shares, worth about $16.2M.

This is a continuation of last week’s purchase of 2.53 million Bullish shares, worth roughly $172 million, following the exchange’s debut on the NYSE, and several buying sessions of Robinhood stock, with the last two being $14 million and $9 million, respectively.

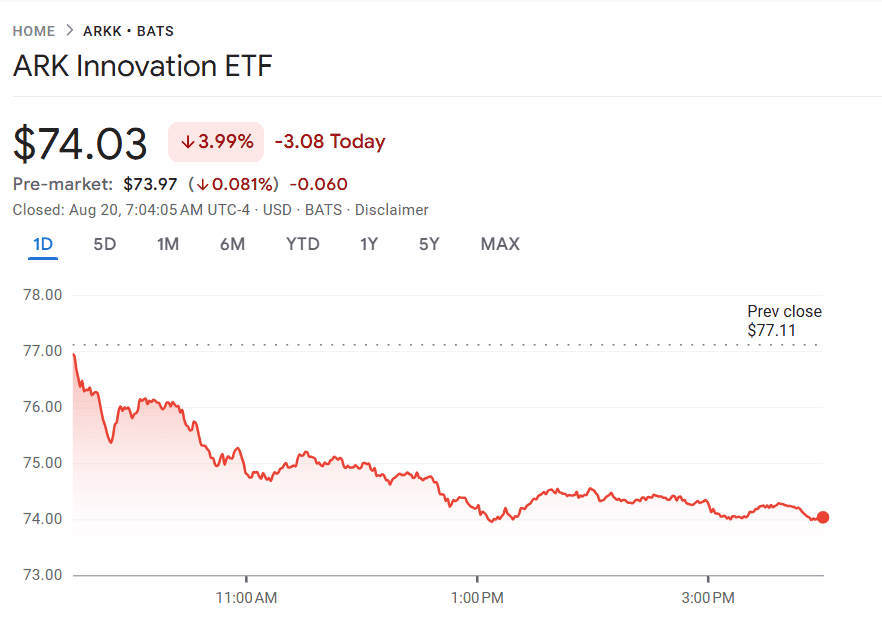

This fund’s stock is also plummeting, not reacting to the stocking up, posting a slightly more significant 3.99% daily drop, which is in line with the currently shaky markets, with investors and institutions preparing for the upcoming Fed speech at the Jackson Hole symposium, which will likely set the tone for the markets for the coming weeks and months.