This is a segment from the 0xResearch newsletter. To read full editions, subscribe.

Blockchains inflate their tokens to pay their validators as rewards.

I guess this is ironic, given how much contempt the industry has for inflationary fiat.

But there’s a crucial difference:

Tokens exist in a vastly competitive marketplace; fiat doesn’t.

If a token has too much inflation, holders simply swap to a less dilutive option. Fiat users don’t get that choice.

That is what the economist Ludwig von Mises argued in his magnum opus Human Action: “Free banking keeps credit expansion within narrow limits.”

But of course, token issuers don’t need to read a thousand-page treatise on economics to know that their tokens don’t enjoy the same privilege of fiat’s political monopoly.

Of late, a slew of L1s are looking to reduce their inflationary token schedules in a bid to stave off sell-side pressure on their tokens.

Two weeks ago, NEAR L1 proposed to halve its 5% annual inflation rate (60m NEAR) to 2.5%.

The proposal by HOT DAO cites the lack of fee burns (0.1% in reality vs. an expected 2-3%) as one of the main causes, claiming “high inflation without high usage is unsustainable.”

Just two days prior to NEAR’s proposal, Celestia co-founder John Adler also proposed an ambitious overhaul of the network’s consensus from proof-of-stake to “proof-of-governance.”

It’s a long and highly technical proposal, but here’s the rough idea:

Rather than having Celestia validators take a commission on delegated stake from TIA liquid stakers, the plan is to phase out liquid staking entirely, handpick validators via off-chain governance, then pay them a flat rate.

If passed, TIA issuance will plunge 20x, from 5% to 0.25%.

Earlier this year in March, Solana too attempted to cut SOL inflation by revising its fixed inflation curve as part of the widely publicized SIMD-228 proposal.

The proposal was unsuccessful. Had it passed, SOL inflation would’ve reduced from its existing ~4.4% to an ~1% per annum.

My colleague Carlos over at Blockworks Research reminded me that Galaxy has an alternative proposal (SIMD-279) to reduce SOL inflation, but it doesn’t seem to have picked up much traction.

Tron, on the other hand, successfully halved its block rewards to validators. As part of Committee Proposal 102 passed in mid-June, block and voting rewards were reduced, thereby increasing its deflationary rate to ~1.29%.

How about Ethereum?

No major changes to its monetary policy in its upcoming Fusaka or Glamsterdam hard forks, it seems.

But of course, Ethereum already got the job done in 2022 as part of the Merge upgrade. ETH inflation was slashed by about ~90% — the equivalent of three Bitcoin halvings — when Ethereum moved to proof-of-stake consensus.

As far as I can tell, neither BNB Chain nor Avalanche are doing anything on the front of cutting network inflation.

What these chains are counting on, however, is reducing total supply via token burning.

(L1 blockchains typically have some kind of mechanism that permanently removes tokens from the supply the more its chain is used.)

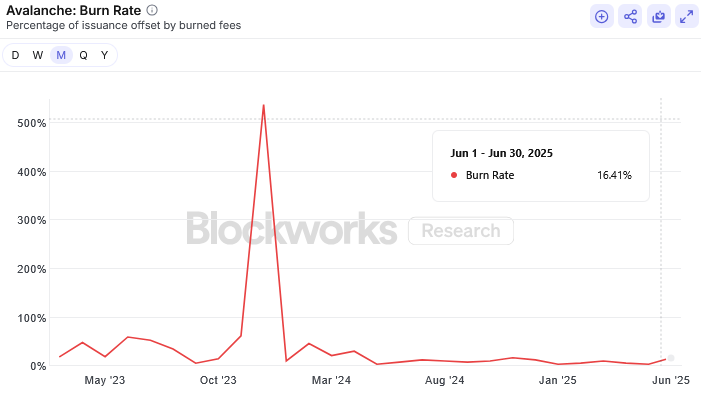

In Avalanche’s case, 100% of C-Chain fees are burned — about 16.4% of AVAX issuance is offset by a burn in the last month.

For BNB Chain, the chain conducts a quarterly burn of BNB through a series of different burn mechanisms. In the last burn event, ~1.6 million BNB ($916 million) was burned. Another 1.6 million BNB is slated to be burned in the next quarter, according to Bnbburn’s dashboards.

Since BNB’s token generation event, net supply of BNB has been cut down from 202 million to 141 million today.

Then finally, there is Bitcoin.