Former Coinbase, Jump, Citadel quants land $20M for onchain HFT platform

Web3 startup aPriori has raised $20 million to expand its trading infrastructure platform, which aims to bring high-frequency trading (HFT) onchain and address technical and market challenges in decentralized finance (DeFi). The raise comes as institutional investors show growing interest in DeFi as an alternative source of yield.

The round included participation from Pantera Capital, HashKey Capital, Primitive Ventures, IMC Trading, Gate Labs and others, bringing the company’s total funding to $30 million.

Founded in 2023, the San Francisco–based company was started by former quant traders and engineers with experience at Coinbase, Jump Trading and Citadel Securities.

The aPriori platform aims to tackle several challenges in onchain markets, including wide spreads, miner extractable value (MEV) leakage and toxic order flow. In traditional finance, toxic order flow refers to trading activity that exposes market makers or liquidity providers to adverse selection risk.

APriori joins a growing group of startups working to bring institutional-grade trading infrastructure onchain. Earlier this year, Theo raised $20 million from backers including Citadel, Jane Street and JPMorgan to develop high-frequency trading and market-making strategies onchain.

Other platforms taking a similar approach include Aevo (formerly Ribbon), which focuses on derivatives and options infrastructure, the decentralized exchange dYdX, and Cega, which is developing structured products for onchain markets.

Institutional momentum toward onchain markets continues to grow

Favorable regulatory developments, the perceived benefits of blockchain technology and growing yield opportunities in DeFi have encouraged more institutions to move into onchain markets. This shift has created greater demand for institutional-grade trading infrastructure.

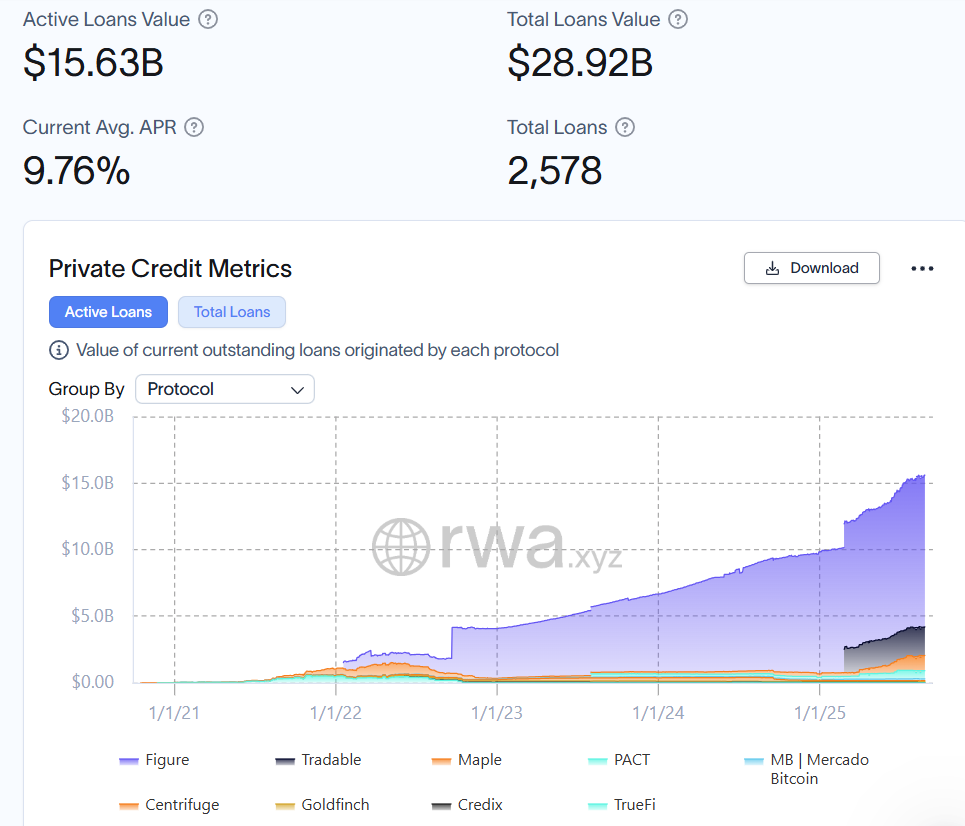

Decentralized markets have also shown signs of offering higher returns than traditional money markets, drawing in yield-seeking institutional investors. For instance, RWA.xyz reports that tokenized private credit markets currently deliver an average annual percentage rate (APR) of 9.76%.

This segment of the tokenization market is valued at approximately $15.6 billion, representing more than half of all onchain tokenized activity.

At the same time, large institutions are experimenting with crypto-aligned strategies. JPMorgan Asset Management, for example, recently committed up to $500 million to Numerai, an AI-driven hedge fund that crowdsources trading models.

Numerai, which launched one of the first native tokens in 2017, reflects how quantitative finance and blockchain are beginning to converge.