Crypto Market Capitalization Inches Back Over $4 Trillion as US GDP Surprises on Upside

Crypto markets consolidated on Thursday, pushing total capitalization just over $4 trillion as the midweek rally held firm.

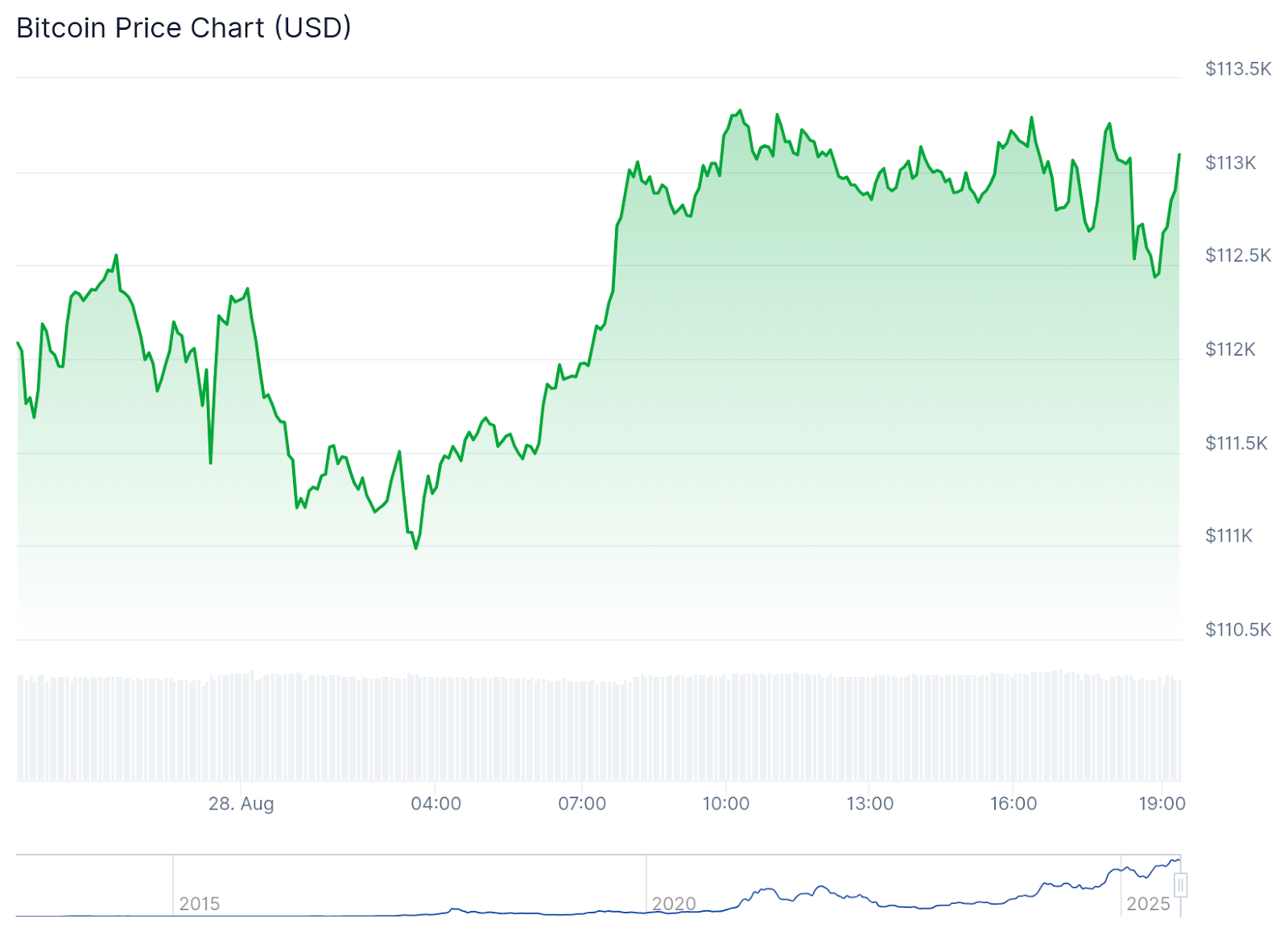

Bitcoin (BTC) jumped 0.9% to $113,073, while Ethereum (ETH) slipped by about 1.8% to $4,553. Solana (SOL) led gains, up 2.7% to $214.51, following continued interest from corporate treasury strategies, while XRP (XRP) remained steady at $3.01 and BNB (BNB) dipped 1% to $873.77.

At the same time, roughly $256 million in leveraged positions were liquidated, with ETH traders taking the biggest hit at $91 million. BTC accounted for $37.25 million, while SOL saw about $30 million liquidated, according to CoinGlass.

ETF Flows and Derivatives

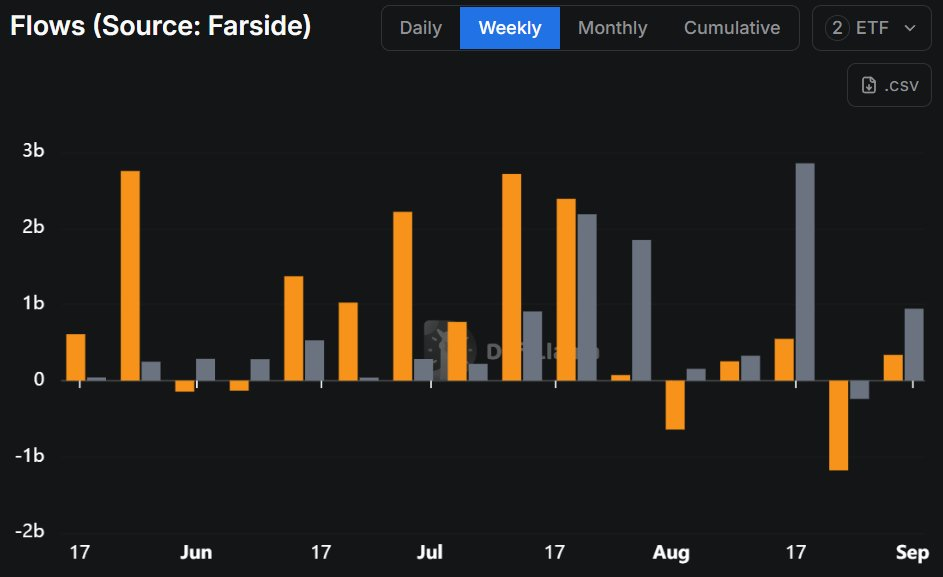

Institutional appetite still seems to be leaning toward Ethereum as spot Ethereum ETFs attracted over $309 million on Wednesday alone, boosting total assets above $30 billion and marking the sixth consecutive week that ETH inflows have outpaced Bitcoin, per Farside.

Some are looking beyond just crypto ETFs, though. As The Defiant reported earlier, Geoffrey Kendrick, Standard Chartered’s global head of digital assets research, notes that Ethereum treasury companies have bought 2.6% of all ETH since June.

When combined with ETF inflows over the same period, that figure rises to 4.9%, double Bitcoin’s fastest accumulation pace in late 2024. Kendrick expects treasury firms to eventually hold 10% of all ETH, with Tom Lee’s BitMine alone aiming for 5%.

Meanwhile, spot Bitcoin ETFs added $81.25 million, bringing total holdings to $144.57 billion, showing steady but smaller gains compared to Ethereum.

Macro Update

Markets got a boost Thursday morning after the government reported that the U.S. economy grew faster than expected in Q2. Real GDP jumped 3.3% annualized, bouncing back from a 0.5% drop in Q1. The pickup was largely thanks to fewer imports and stronger consumer spending, though weaker investment and exports may have capped some of the gains.

Meanwhile, Nvidia posted Q2 fiscal 2026 results. The company reported record revenue of $46.7 billion, up 6% from the previous quarter.

However, even with strong results, Nvidia’s stock dropped about 3% in after-hours trading, likely pressured by uncertainty over future chip sales to China, Reuters reported.