$17 billion in Bitcoin shorts will be liquidated if BTC hits this price

It appears that Bitcoin (BTC) is knocking on the door of a monster short squeeze.

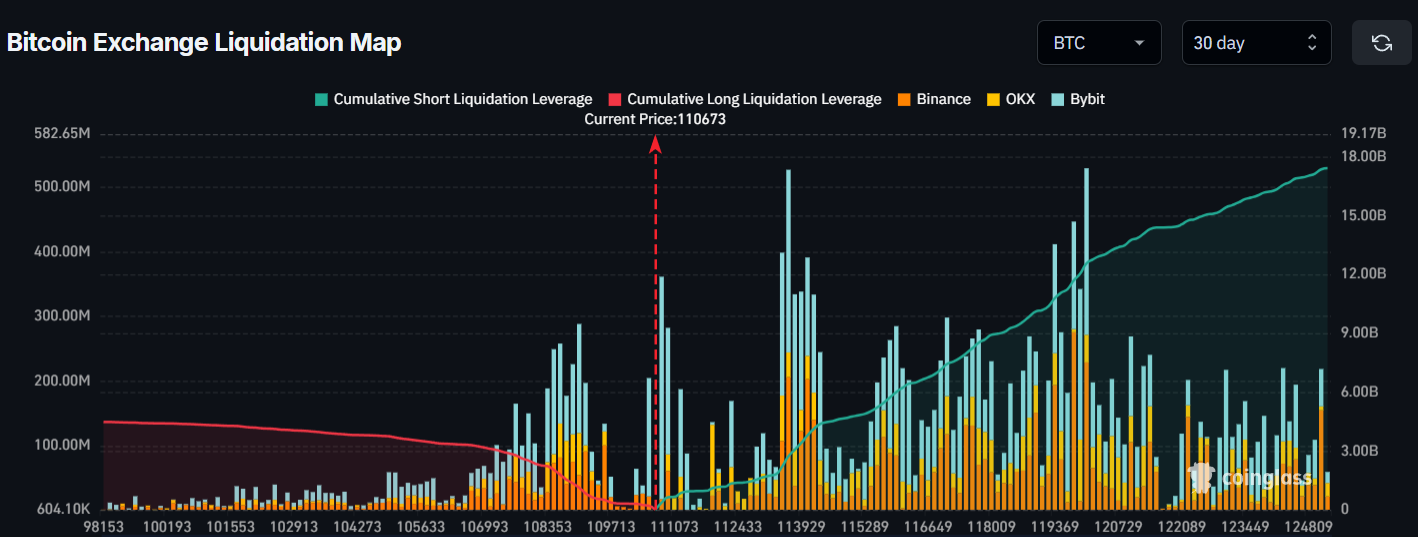

According to the Bitcoin heatmap, if the asset surges past $125,000, we could see $17 billion in short positions liquidated on major exchanges like Binance, Bybit, and OKX, based on Coinglass data retrieved by Finbold on August 29.

On the chart below, the rising green curve on the right signals short liquidation leverage, rising steadily and suggesting mounting pressure.

Any move further upward from around $113,000 risks triggering a cascade of forced liquidations, trapping late sellers, and propelling the price higher.

Will Bitcoin rebound?

The world’s largest cryptocurrency slipped today, trading at $110,673 at the time of writing, and traders are expecting further downside after failing to hold key support.

Analyst Michaël van de Poppe noted on Thursday, August 28, that liquidity levels in the $110,000–$108,000 range could be tested next if selling pressure continues. The day after, Bitcoin indeed dropped to levels at around $110,000.

However, the analyst further implied that the correction would be followed by a rebound:

“If Bitcoin can’t hold above $112K, we’ll probably face a very ugly correction across the board. Probably the final one and then we’re up only for the coming period.”

#Bitcoin couldn’t hold $112K and we continue to fall.

I think we’ll be seeing some lower numbers, which will reset $ETH back to neutral and would provide a massive opportunity for the markets. pic.twitter.com/iaabrm9J4D

— Michaël van de Poppe (@CryptoMichNL) August 29, 2025

It is still hard to tell what the near future holds, but the next few days are shaping up to be critical for BTC as investors are now awaiting the release of the Personal Consumption Expenditures (PCE) index, the Federal Reserve’s preferred inflation gauge.

The data could heavily influence Bitcoin in the following weeks, especially due to fears that President Donald Trump might push the central bank to manage U.S. debt more aggressively.

Featured image via Shutterstock