Gryphon approves reverse merger with American Bitcoin, Nasdaq ticker ABTC

Gryphon Digital Mining, a publicly traded Bitcoin miner based in Las Vegas, Nevada, has received final shareholder approval to merge with American Bitcoin, a mining company linked to US President Donald Trump’s family.

Shareholders approved the stock-for-stock merger on Wednesday, with the company announcing the decision on Friday. As part of the deal, a reverse five-to-one stock split and new listing are scheduled for 5:00 pm ET on Sept. 2.

Once the reverse split is complete, the combined entity will adopt the American Bitcoin name and begin trading under the ticker symbol “ABTC.”

The reverse stock split will cut the company’s outstanding shares to about 16.6 million from 82.8 million, excluding any new issuances related to the transaction.

The merger, first reported by Reuters earlier this week, follows an initial agreement in May under which American Bitcoin would go public by merging with Gryphon.

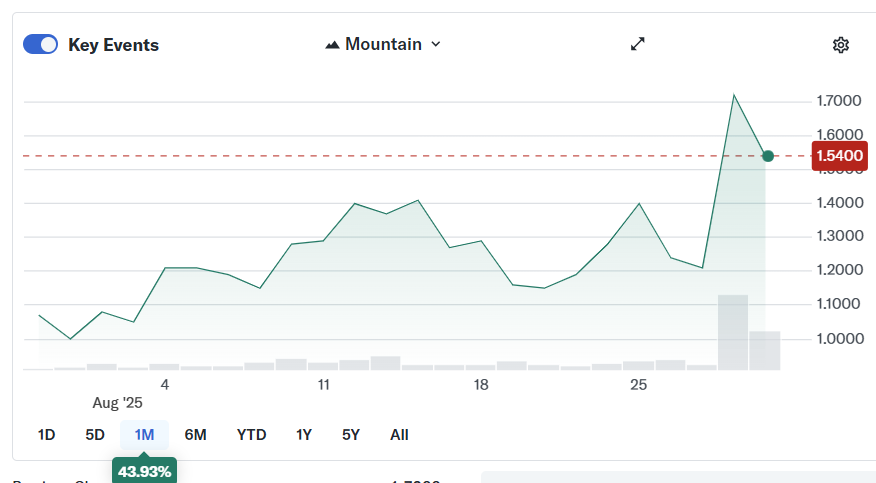

After an initial surge on merger news, Gryphon’s stock dropped more than 10% on Friday, partially retracing Thursday’s 41% rally.

Related: Tether plans to open-source Bitcoin mining OS; CEO says ‘no need’ for 3rd party vendors

American Bitcoin’s origins and strategy

American Bitcoin debuted in March, when Trump’s sons, Donald Trump, Jr. and Eric Trump, rebranded American Data Center under the new name. The venture was launched as part of Hut 8, a digital asset mining and infrastructure company.

At launch, American Bitcoin positioned itself as a “pure-play” Bitcoin mining company, with plans to accumulate a large Bitcoin (BTC) treasury.

Its merger with Gryphon Digital Mining offers a fast track to public markets by leveraging Gryphon’s existing Nasdaq listing, eliminating the need for a separate initial public offering.

Theoretically, the deal also combines Gryphon’s low-cost mining infrastructure with American Bitcoin’s aggressive BTC accumulation strategy, creating a more scalable and investor-friendly platform.

While American Bitcoin has verifiably disclosed holdings of 215 BTC, estimates from BitcoinTreasuries.NET suggest the total could be as high as 1,941 BTC.

The move comes as more public companies pursue aggressive strategies to expand their Bitcoin reserves. Collectively, they now hold 989,926 BTC, with Michael Saylor’s MicroStrategy accounting for nearly 64% of the total.

Related: Trump-linked American Bitcoin seeks Asia acquisitions to boost BTC holdings: Report