Bitcoin Rockets 201,435% in One of Wildest Liquidation Imbalances

A massive 201,435% liquidation imbalance hit the Bitcoin derivatives market on Tuesday, as per CoinGlass. Ironically, this occurred just as Michael Saylor confirmed another multibillion-dollar expansion of Strategy holdings. The software firm revealed that it had purchased 4,048 BTC for $449 million, averaging $110,981 per Bitcoin.

However, rather than cheering the market, this announcement coincided with a sell-off, pushing the price of the main cryptocurrency below $109,000 and rattling leveraged positions across multiple exchanges at once.

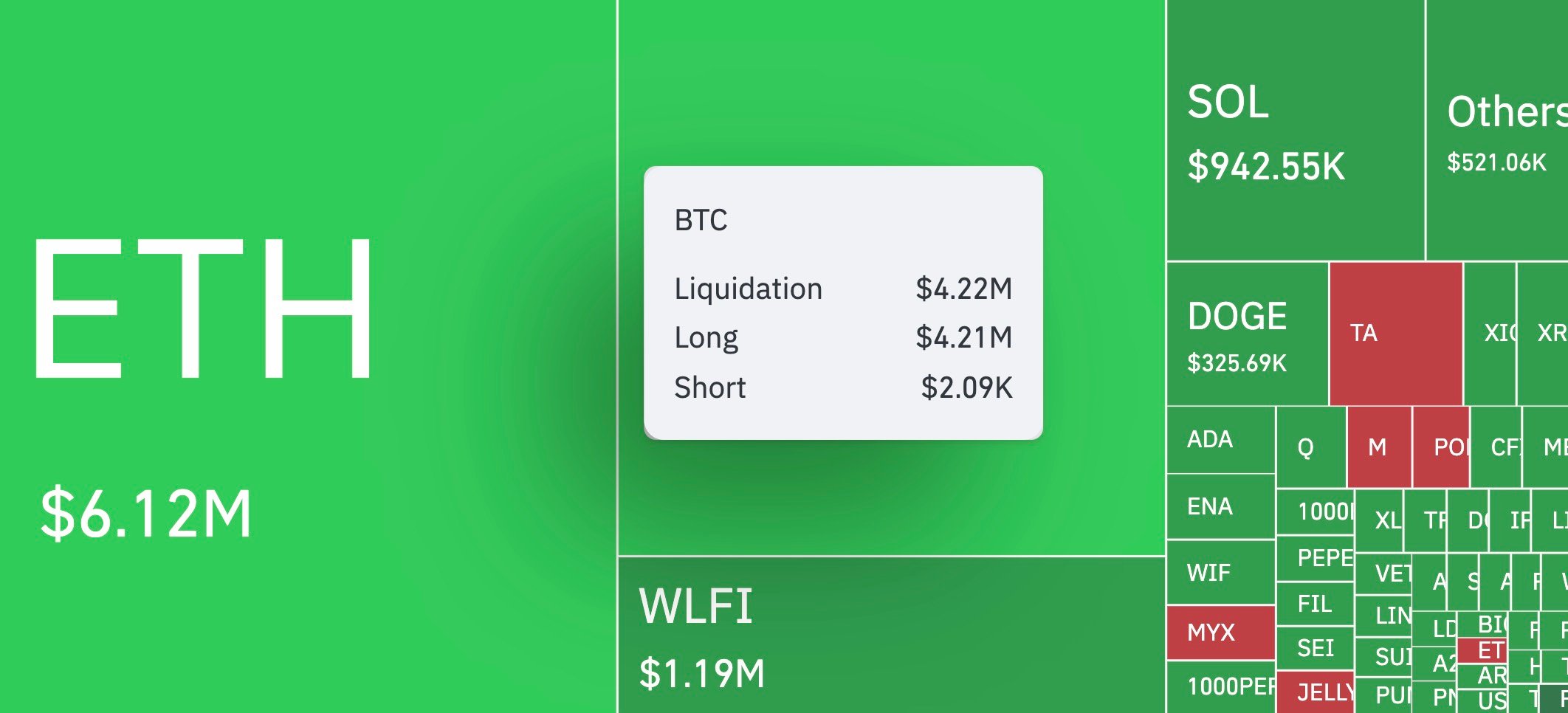

In an hour after the announcement, $4.21 million worth of Bitcoin longs were liquidated, compared to only $2,090 on the short side — that’s where the imbalance was hiding in plain sight.

It’s not an isolated event, though, as over the 24-hour period, more than $393.9 million in leveraged positions were liquidated, with long contracts taking the bigger hit at $292 million versus $101.8 million in shorts.

Whose margin call was most painful?

Binance saw the largest liquidation of the day: an ETH/USDT position worth nearly $9.8 million. The pressure extended well beyond Bitcoin itself, pulling altcoin markets into the storm.

Saylor’s company now holds 636,505 BTC at an average cost of $73,765 per coin, with the total stack valued at $46.95 billion. It’s still a 25.7% gain on paper for Saylor & Co.

A bottom line may be that despite massive spot accumulation from the likes of Saylor, the current price action of Bitcoin may be dictated more by derivatives positioning than corporate buying. And imbalance figures prove that point today.