Here are key dates to watch as Bitcoin bull cycle approaches the end

As Bitcoin (BTC) consolidates around the $110,000 level, technical indicators suggest that the asset’s current bull cycle may be nearing its conclusion.

According to prominent online analyst TradingShot, the maiden cryptocurrency is approaching a potential market peak in late 2025, to be followed by a significant correction into 2026.

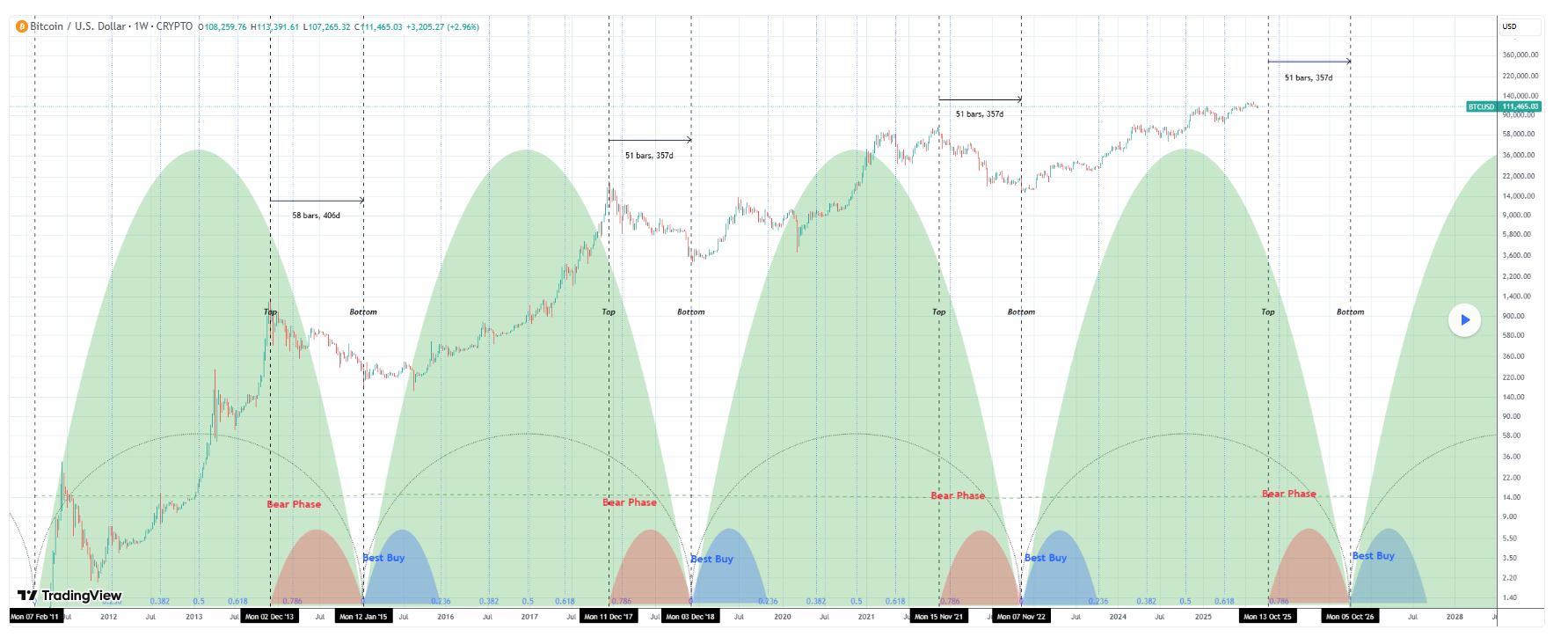

In a TradingView post on September 5, the analyst noted that historical data shows Bitcoin’s market structure often follows a recurring rhythm of tops, bear phases, and cycle bottoms. Each super cycle has tended to top out near the 0.786 Fibonacci time extension before entering a prolonged downturn.

Based on current cycle measurements, the next major top could occur during the week of October 13, 2025. This timing aligns with previous cycles that peaked shortly before transitioning into their respective bear phases.

The analysis further suggests that the bear phase may begin after December 1, 2025, when the 0.786 Fibonacci marker is reached. If cycle symmetry holds, the bear market could extend until the projected super cycle bottom on October 5, 2026.

At that point, the best long-term buying opportunity is expected to emerge, consistent with past patterns where cycle lows provided favorable entry points ahead of the next major rally.

Bitcoin key price levels to watch

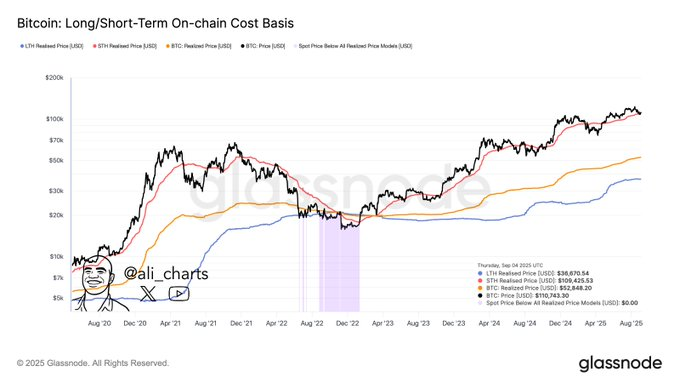

On the other hand, on-chain data shared by Ali Martinez highlighted key metrics for assessing the health of Bitcoin’s current bull market.

Historically, downtrends begin when the price falls below the Short-Term Holder realized price, with deeper reversals forming once it slips under the Long-Term Holder realized price. These levels represent the average cost basis of recent buyers versus long-term investors.

As of September 6, 2025, Glassnode data shows the Short-Term Holder realized price at $109,400 and the Long-Term Holder realized price at $36,700.

With Bitcoin trading just below record highs, $109,400 has become the critical support to watch, while $36,700 remains the deeper structural floor that has historically aligned with cycle bottoms.

Bitcoin price analysis

By press time, Bitcoin was trading at $110,774, down about 1.7% in the last 24 hours, though still up 1.5% on the week.

For markets to gain reassurance that the rally is sustainable in the coming weeks, Bitcoin must hold the $110,000 support, a crucial level to watch.

Featured image via Shutterstock