Asia Morning Briefing: BTC Treasury Demand is Weakening, CryptoQuant Cautions

Good Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

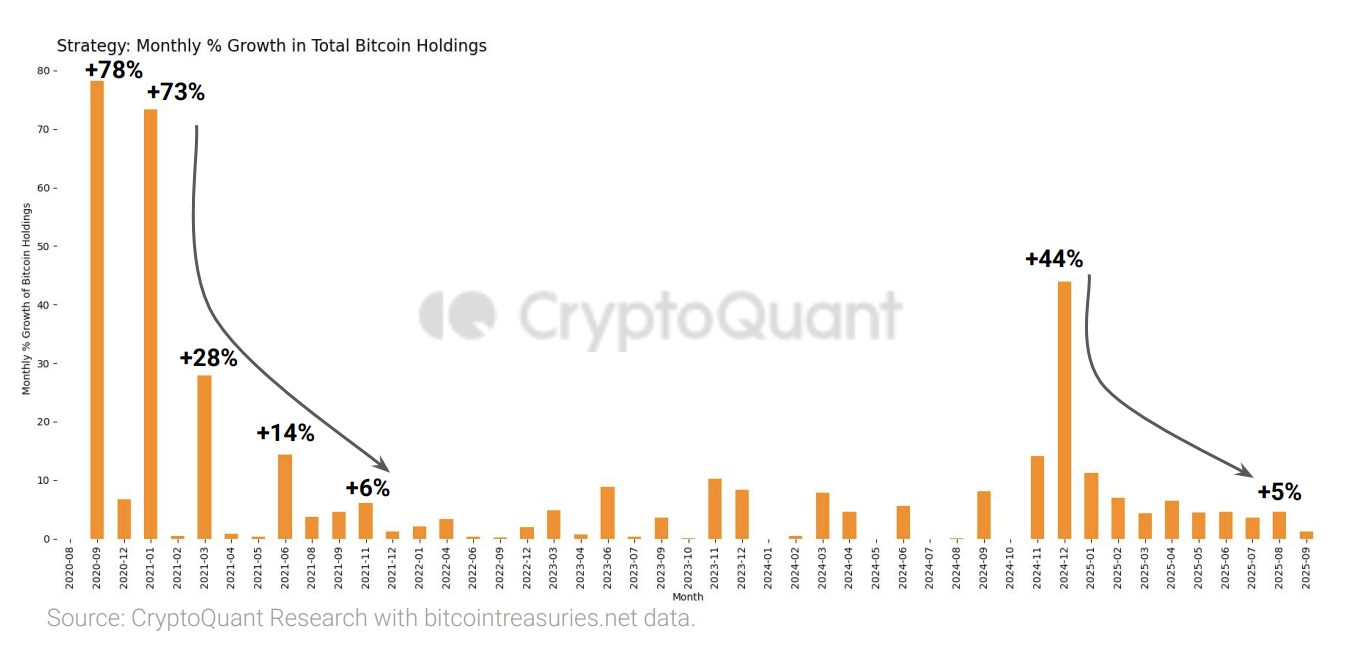

Bitcoin treasury companies were the talk of the town during the recent BTC Asia conference in Hong Kong, and onchain data shows they hold more than ever in their virtual coffers, but a new report from CryptoQuant highlights that they are being a bit more cautious in their crypto buys.

CryptoQuant data shows aggregate BTC treasury holdings hit 840,000 BTC this year, led by Strategy with 637,000 BTC.

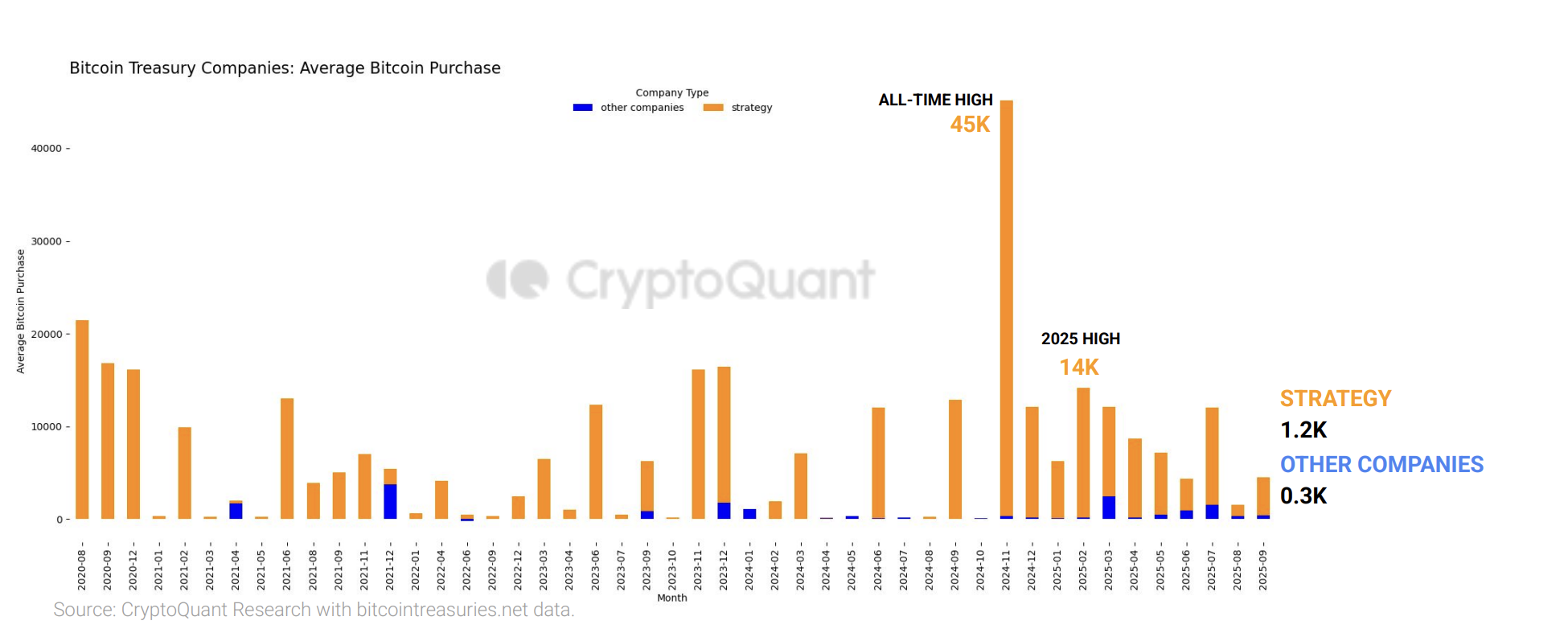

Yet the average purchase size has collapsed: Strategy bought just 1,200 BTC per transaction in August, while other firms averaged 343 BTC. Both figures are down 86% from early 2025 highs, signaling smaller, more hesitant buys that suggest liquidity constraints or waning conviction.

The numbers show a striking divergence. Transaction activity is near record levels, 53 deals in June and 46 in August, but each deal involves far less bitcoin.

Strategy acquired only 3,700 BTC in August compared to 134,000 BTC at its peak last year, while other treasury firms slipped to 14,800 BTC from highs of 66,000 BTC.

The decline in average deal size suggests treasuries are still active but unwilling to commit large blocks of capital, reflecting both liquidity constraints and a more cautious market psychology.

All of this should be considered a concern for investors, as BTC’s price growth in the second quarter of the year was largely driven by accumulation by treasury companies, CoinDesk Indices data shows.

By late August 2025, institutions were absorbing more than 3,100 BTC a day against just 450 mined, creating a 6:1 demand-supply imbalance that underscored how relentless institutional buying was driving bitcoin’s price higher, CoinDesk reported at the time.

This slouching demand raises the risk that the current price strength may be less sustainable if treasuries continue buying cautiously rather than at scale.

That’s not to say that there isn’t growth in the BTC Treasury sector. It’s just smaller.

Bitwise reports that 28 new treasury companies were formed in July and August alone, collectively adding more than 140,000 BTC.

Meanwhile, Asia is emerging as the next front for digital asset treasury companies as Taiwan-based Sora Ventures has launched a $1 billion fund to seed regional treasury firms, with an initial commitment of $200 million.

Unlike Metaplanet, Asia’s largest public treasury firm with 20,000 BTC on its balance sheet, Sora’s vehicle will pool institutional capital to support multiple entrants.

Whether Asia’s new wave offsets the shrinking bite sizes of incumbents in accumulation is now the central question for the next phase of bitcoin adoption – and where the price is going.

Market Movement

BTC: Bitcoin remains resilient around the $110K–$113K range, supported by expectations of Federal Reserve rate cuts, increasing institutional inflows via ETFs, and improved market sentiment amid macroeconomic uncertainty

ETH: Ethereum is trading near the $4,300 level. Its short-term weakness, with a 3.8% weekly decline, is ascribed to ETF outflows and seasonal subdued trading in September. However, longer-term outlook remains positive, buoyed by institutional interest, growing staking activity, and speculative forecasts targeting $4,600–$5,000 if resistance breaks

Gold: Gold is rallying to record levels amid a combination of weak U.S. jobs data, heightened Fed easing expectations, a soft U.S. dollar, political and economic uncertainty, and continued central bank accumulation of bullion.

Nikkei 225: Asia-Pacific stocks mostly rose Monday, with Japan’s Nikkei 225 up 1.5% after Prime Minister Shigeru Ishiba resigned following pressure from his election defeat.

Elsewhere in Crypto

- Chainlink CEO Sees Tokenization as Sector’s Rising Future After Meeting SEC’s Atkins (CoinDesk)

- Why SharpLink’s CEO Thinks Bitcoin Creator Satoshi Nakamoto Will Return (Decrypt)

- The Funding: Why crypto VCs are betting on prediction markets now (The Block)