ARK Invest buys $4.4M in BitMine stock as its treasury crosses 2M ETH

Cathie Wood’s ARK Invest bought more shares in Tom Lee’s Ether treasury firm BitMine as the crypto treasury hit a milestone in Ether holdings.

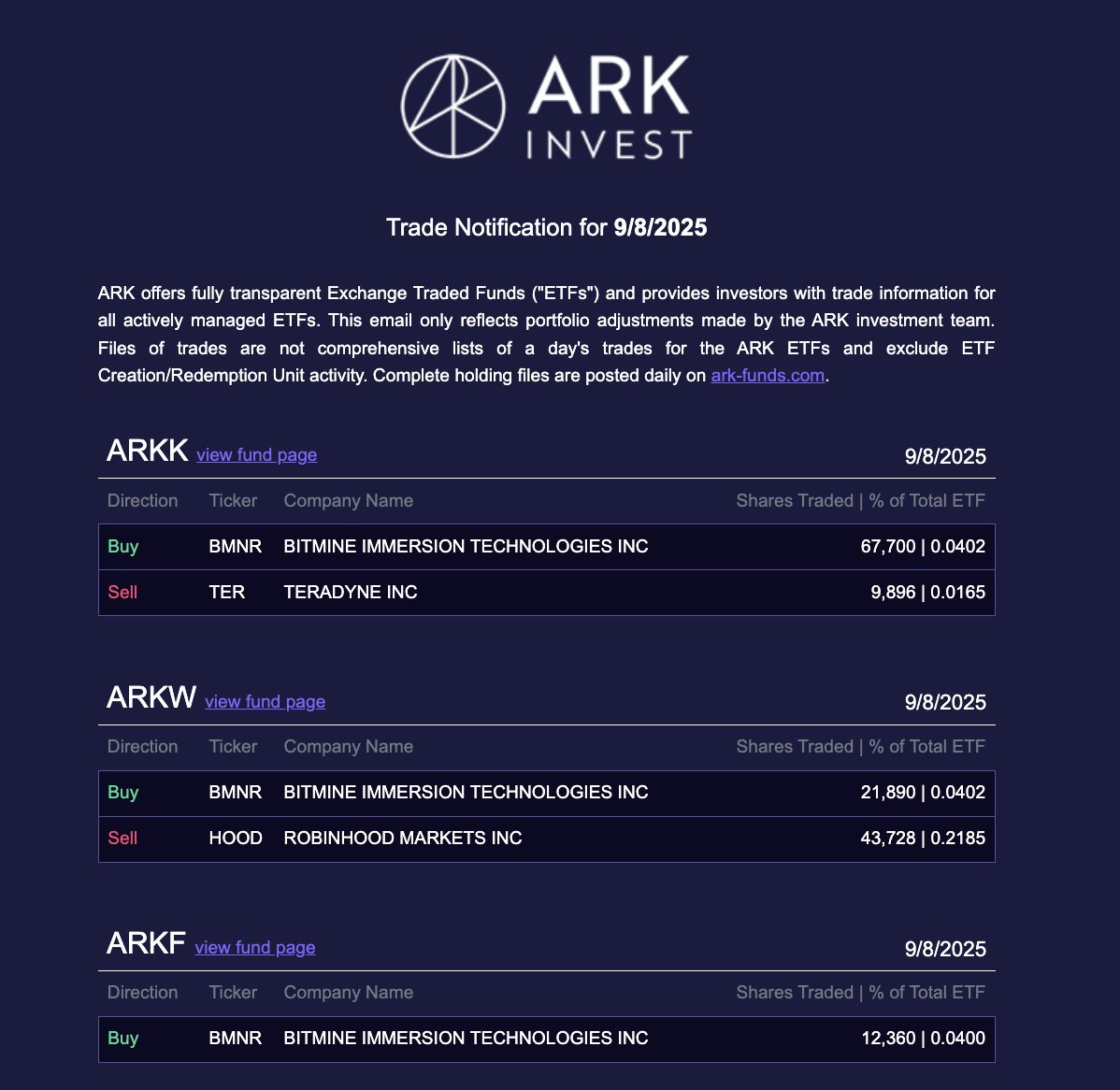

ARK Invest purchased 101,950 shares worth around $4.4 million in BitMine Immersion Technologies (BMNR) on Monday, spread across three funds: The Ark Innovation ETF, which now holds a 2.6% allocation to BitMine, the Ark Next Generation Internet ETF and the ARK Fintech Innovation ETF, which holds similar allocations.

The three funds combined currently hold 6.7 million BitMine shares worth a total of $284 million, according to the fund prospectuses.

Wood’s investment funds have been increasing their exposure to BitMine since it started accumulating Ether (ETH) as a treasury asset in April.

BitMine shares traded up 4.1% on the day to reach $44.10 in after-hours trading, according to Google Finance. The stock has gained a whopping 460% since the beginning of the year.

BitMine hits Ether holdings milestone

The move came on the same day that Tom Lee-chaired BitMine announced that its total holdings have now surpassed 2 million ETH, worth around $8.9 billion.

In just five months, the company has accumulated 1.7% of Ether’s supply and is the world’s largest Ether treasury company, holding 42% of the entire 4.9 million ETH that corporations have collected to date.

The buying is likely to continue as BitMine is only 34% toward its target of 5% of the Ether supply.

“We continue to believe Ethereum is one of the biggest macro trades over the next 10-15 years,” said BitMine chairman Tom Lee.

Meanwhile, Ether prices have stagnated so far this month, trading within a tightly rangebound channel.

Tom Lee bullish on Fed cut

Lee was also bullish about the prospect of the Federal Reserve cutting interest rates next week.

“Fed cutting interest rates will have dual positives of lowering interest rates, particularly mortgage rates could fall, [and] boosting biz confidence,” he told CNBC on Monday, adding that this will be supportive of equities, particularly small-caps, and crypto.

Futures prediction markets indicate that there is an 89.4% probability of a 25 basis point cut and a 10.6% chance of a larger 50 basis point cut.