Banks should offer better rates to counter stablecoins: Bitwise CIO

US banks should give better rewards to attract and keep customers instead of griping about the threat that stablecoins pose to their profits, says Bitwise’s investment chief Matt Hougan.

“If local banks are worried about competition from stablecoins, they should pay more interest on deposits,” Hougan wrote on X on Tuesday.

He added that the banks are only worried because “they’ve been abusing depositors as a free source of capital for decades.”

Hougan’s comments come as Citi claimed last month that yield-bearing stablecoins could spark a wave of bank withdrawals, and as US banks have lobbied Congress to tighten up US stablecoin laws around paying yield.

Hougan slams “first-order thinking”

Hougan said that “scare articles about stablecoins destroying local lending markets are absurd,” in response to a Bloomberg report on Monday discussing workers being paid in stablecoins and the possible effect on banks.

Bloomberg’s report said smaller community and regional banks face a new competitive threat from stablecoins because they depend on customer deposits for lending, unlike large banks that can access wholesale markets.

The report compared yield-bearing stablecoins to the emergence of money markets in the 1970s, which offered a higher-yield alternative to conventional savings accounts, resulting in a rush to withdraw funds from banks.

Hougan added that the speculation that credit would “dry up” if stablecoins were allowed to compete with banks was “classic first-order thinking.”

Hougan said banks may provide less credit if they have fewer deposits, but people with stablecoins will provide credit directly to borrowers through decentralized finance applications.

“The loser here is bank profit margins. The winner here is individual savers. The economy will be just fine.”

Stablecoin yields outcompete savings accounts

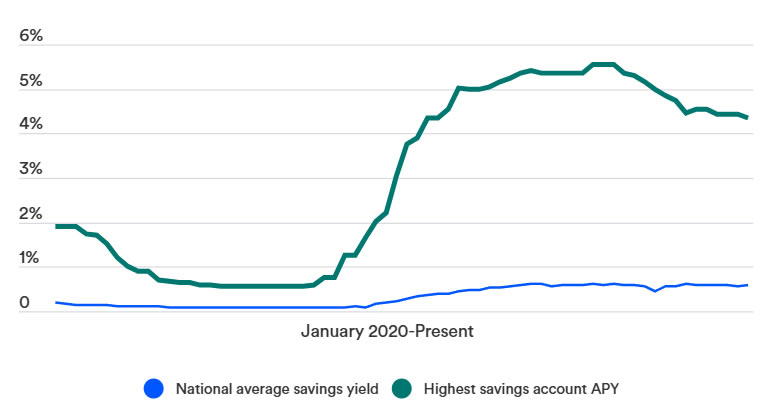

Some stablecoins offer up to 5% on deposits on certain crypto platforms, a far more attractive rate than the US national average savings rate of just 0.6% and still above the best offered high-interest rate of 4%, according to Bankrate data.

Related: Yield-bearing stablecoin supply surges after GENIUS Act

When inflation and bank charges are considered, consumers often lose money by leaving cash sitting in a bank over time without a yield.

Stablecoin proponents have said the tokens offer other advantages over banks, with faster transaction speeds at a lower cost, while having no holding fees.

Banks lobbied against stablecoin yields

Last month, the banking industry lobbied to prevent stablecoin issuers from offering yields, claiming that there is a “loophole” in the stablecoin-regulating GENIUS Act.

The crypto industry pushed back against banks’ concerns, warning that revisions to the legislation would benefit traditional banks while stifling innovation and consumer choice.

Magazine: Bitcoin may sink ‘below $50K’ in bear, Justin Sun’s WLFI saga: Hodler’s Digest