Bitcoin Price Hints at a 2% Dip Before Resuming $120,000+ Journey

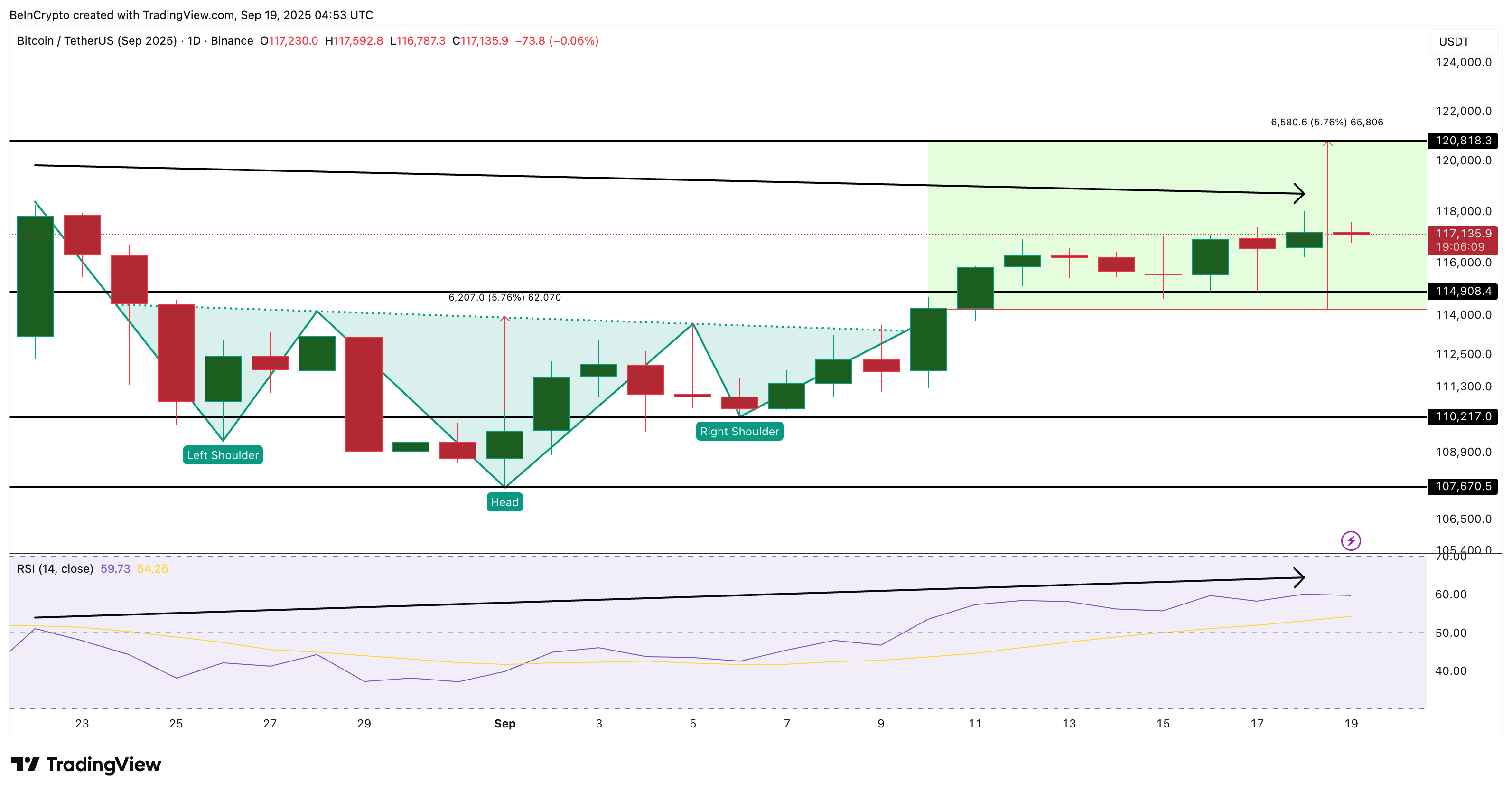

Bitcoin price is holding steady after its breakout earlier this month. At press time, it was trading near $117,100, up 1.3% in the past 24 hours and 3% over the week. The breakout from a head-and-shoulders pattern on September 10 still points higher, with a first target of $120,800.

But not everything is smooth. Two on-chain red flags, selling from large balance groups and younger coin holders, hint at a possible 2% correction before the rally resumes.

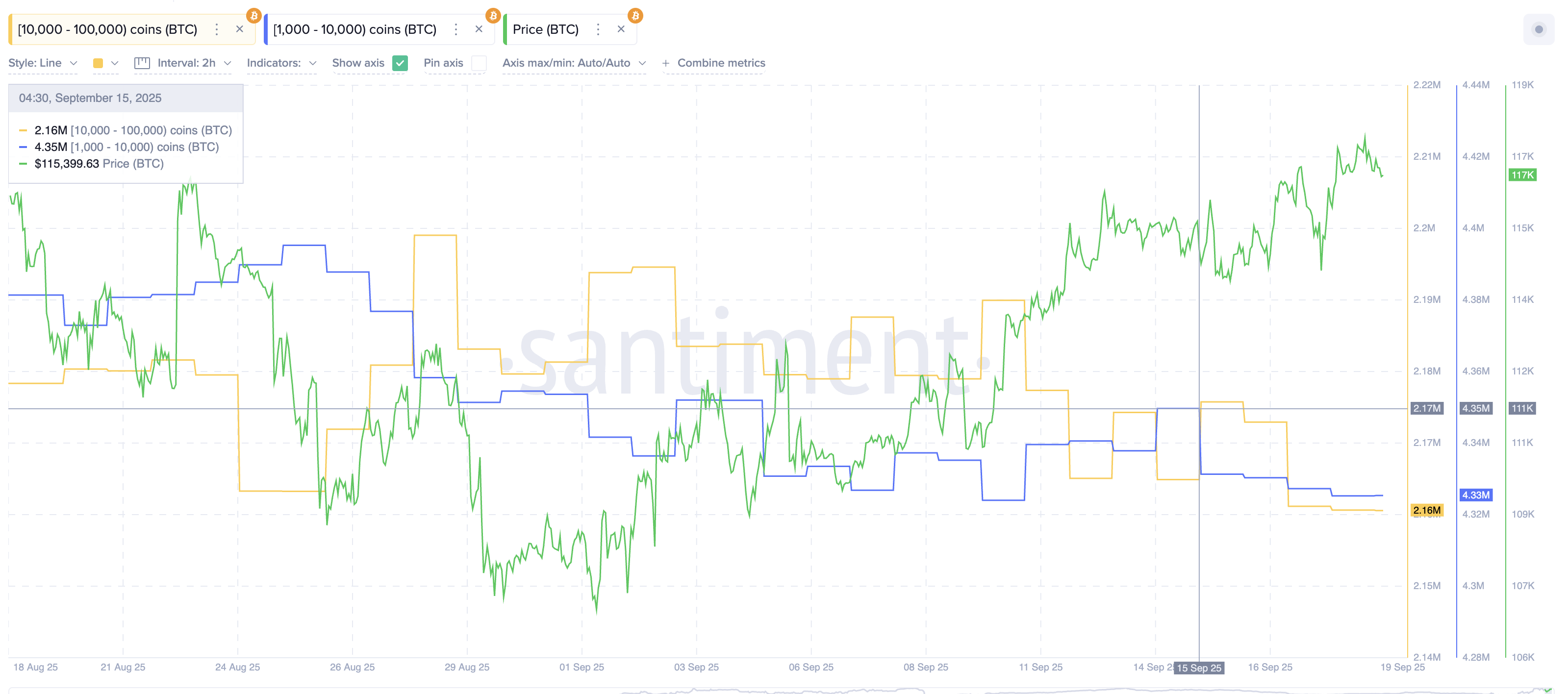

Selling Pressure Builds From Large Balance Groups

Two of Bitcoin’s biggest wallet groups have trimmed their holdings since September 15. These groups are often referred to as “whales” and “sharks” — wallets holding 1,000–10,000 BTC and 10,000–100,000 BTC, respectively.

- The 1,000–10,000 BTC group dropped their holdings from 4.35 million BTC to 4.33 million BTC.

- The 10,000–100,000 BTC group fell from 2.17 million BTC to 2.16 million BTC.

That’s a net outflow of about 30,000 BTC in just four days. With today’s Bitcoin price above $117,000, nearly $3.5 billion worth of BTC has been trimmed from holdings.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Such drops often signal that large investors are booking profits or preparing for volatility.

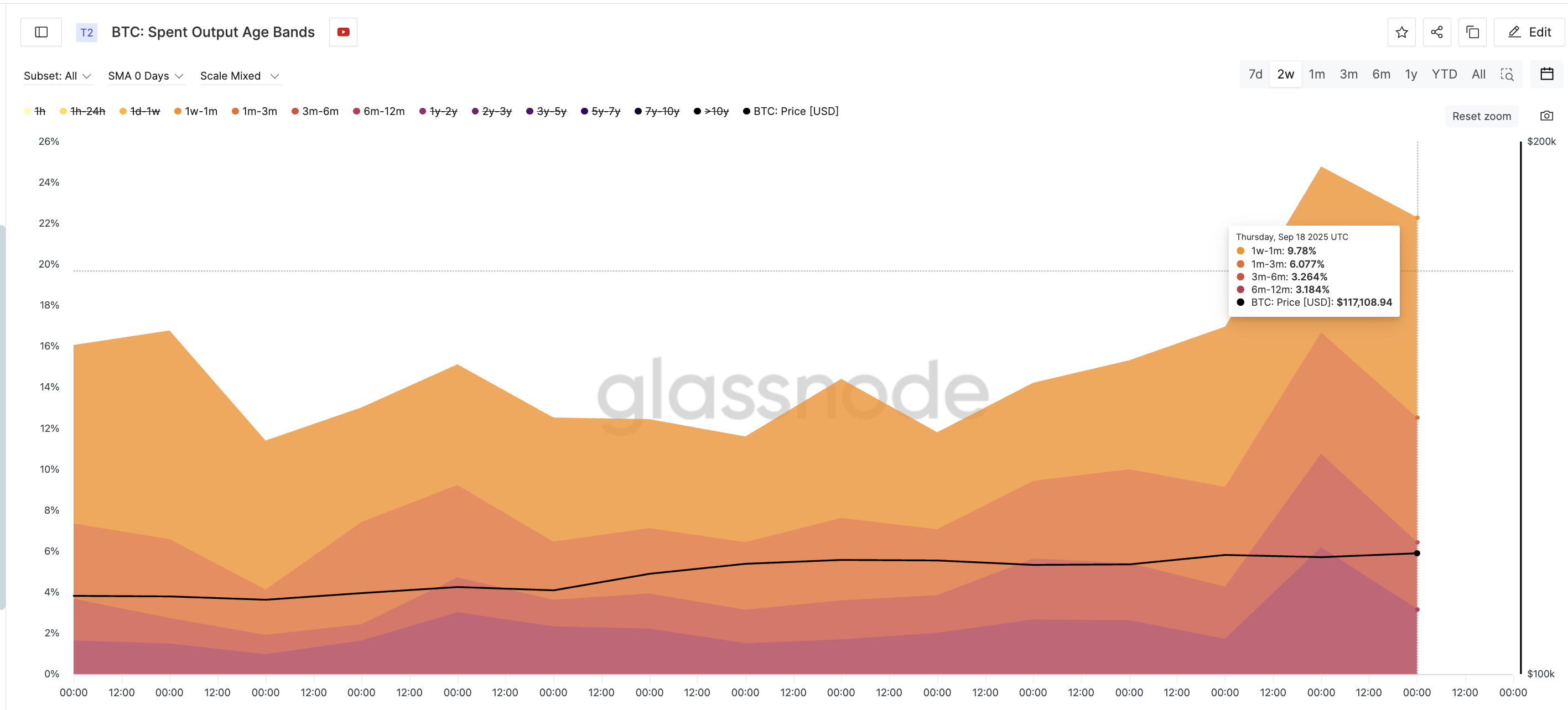

Younger Coins Show Fresh Selling

Another key on-chain signal confirms the picture: Spent Output Age Bands. This metric shows what percentage of coins from different “age groups” are being moved or sold. In other words, it tracks how much of the supply last moved weeks or months ago is now being spent again.

Over the past two weeks, every younger age cohort has increased its share of spent coins:

- 1 week to 1 month holders: rose from 8.72% to 9.78%.

- 1 to 3 month holders: rose from 3.67% to 6.08%.

- 3 to 6 month holders: rose from 2.04% to 3.26%.

- 6 to 12 month holders: rose from 1.64% to 3.18%. (relatively younger considering BTC’s history)

These cohorts are considered “younger” because they bought or moved their coins within the last year. Unlike long-term holders who keep Bitcoin for multiple years, younger holders are quicker to sell into Bitcoin price rallies.

The rise across all four bands means more short- to mid-term holders might be cashing out. This aligns with the selling already visible from the big balance groups, forming a clear picture of near-term supply pressure.

Bitcoin Price Chart Still Points Higher, But With Risks

Despite the selling signs, the broader technical setup remains bullish. Bitcoin broke above an inverse head-and-shoulders pattern on September 10, and the breakout level has held since then. As long as the Bitcoin price stays above $114,900, the immediate upside target remains at $120,800.

However, a dip toward $114,900 looks more realistic in the short term, as RSI data has flashed another risk. Between August 22 and September 18, Bitcoin’s price formed lower highs while RSI made higher highs.

This hidden bearish divergence often signals that momentum is slowing, leaving room for a brief 2% pullback (the immediate and strongest support level).

Yet, if the Bitcoin price dips under $114,900, the pullback could stretch further toward $110,000. A daily close under that level would weaken the bullish structure.

The post Bitcoin Price Hints at a 2% Dip Before Resuming $120,000+ Journey appeared first on BeInCrypto.