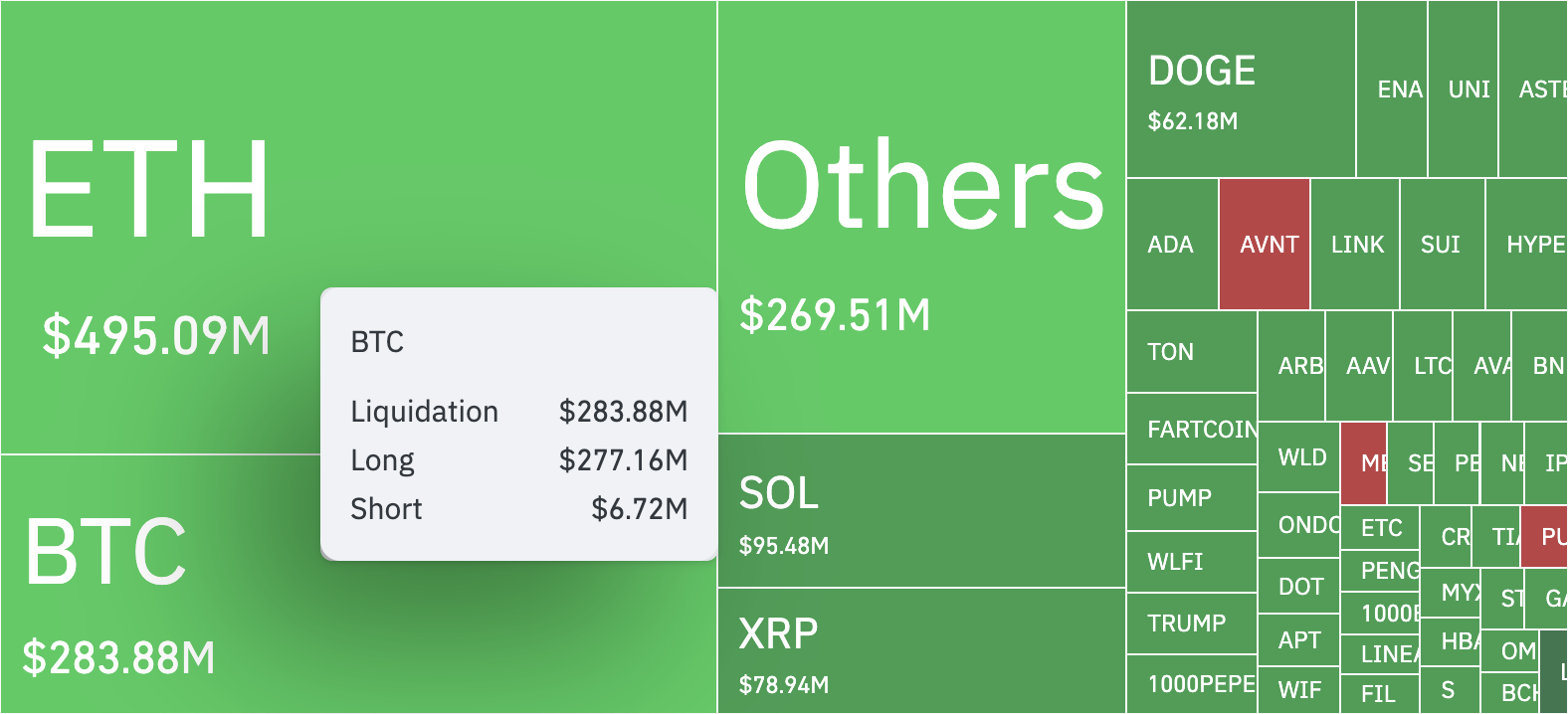

Bitcoin’s Sharp Decline Triggers $277 Million Long Liquidation Wave

Bitcoin (BTC) has tumbled 3% today, recording one of its steepest intraday declines in the past 11 days. The drop comes amid a broader pullback across the crypto market.

These sell-offs have triggered a wave of liquidations, hitting long traders the hardest. With bullish sentiment losing momentum, these investors risk seeing more losses.

Bitcoin’s Dip Sparks Liquidation Wave

BTC has seen consistent declines over the past few days. Today, it has extended its dip by 3% amid a sluggish start to the trading week.

This downtrend has triggered a significant wave of long liquidations in its futures market, totaling $277 million over the past 24 hours, according to Coinglass data.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Liquidations occur in a derivatives market when an asset moves against a trader’s position, forcing the position to be closed due to insufficient funds to maintain it. Long liquidations specifically happen when traders betting on a price increase are compelled to sell the asset at a lower price to cover their losses.

In BTC’s case, the recent price drop has pushed many positions past critical thresholds, triggering this forced selling.

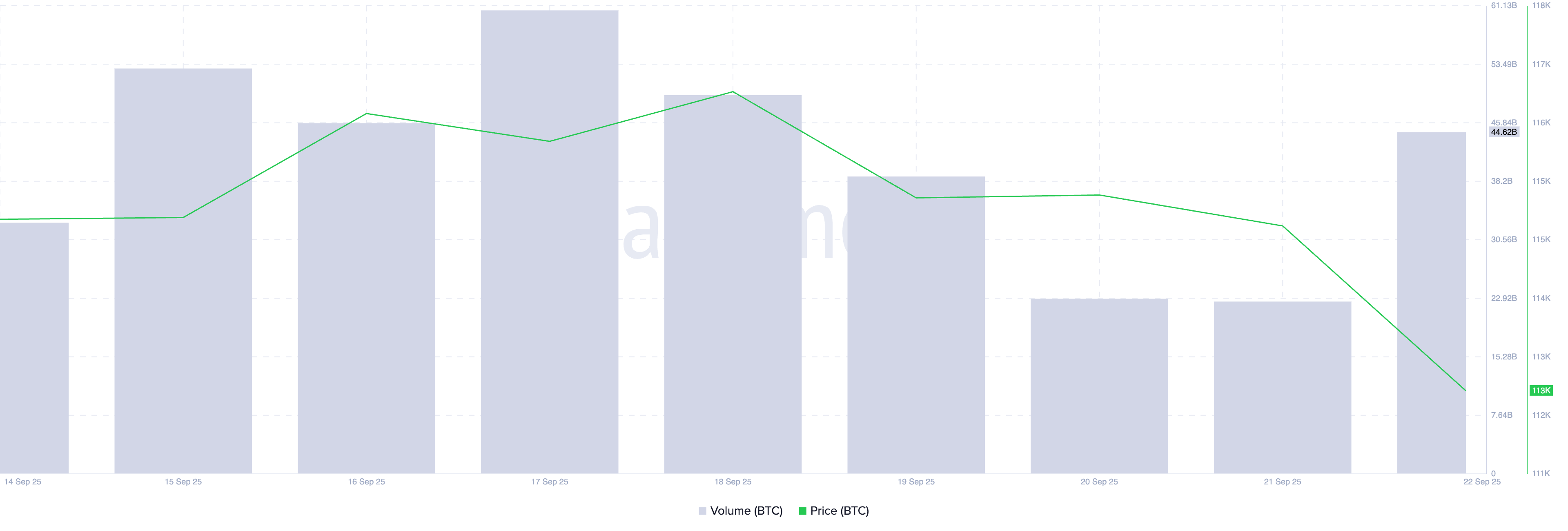

With on-chain data pointing to climbing bearish strength, more long positions are at risk of being liquidated. For example, per Santiment, BTC’s trading volume has rocketed by 90% in the past day, reaching $45 billion at press time.

When an asset’s price falls while its trading volume balloons this way, it signals that selling pressure is intensifying, and more participants are exiting positions.

For BTC, this raises the risk of further long liquidations and points to increased distribution, as holders may be offloading in anticipation of continued weakness.

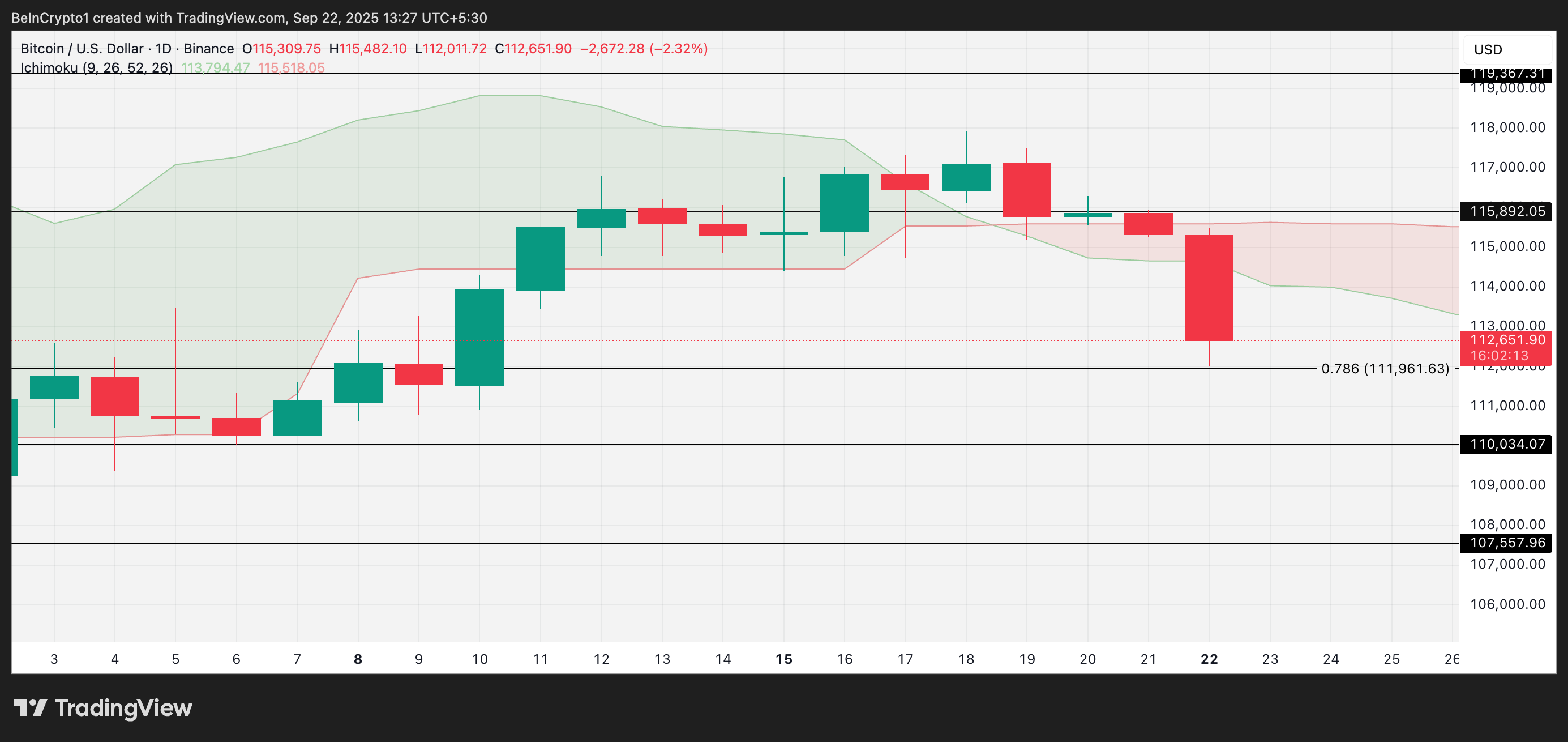

BTC Dips Under Ichimoku Cloud, Could Retrace Toward $110,000

BTC’s recent dip has pushed its price below the Ichimoku Cloud, with Leading Spans A and B now forming resistance at $113,797 and $115,518.

This indicator tracks the momentum of an asset’s market trends and identifies potential support/resistance levels. When an asset trades below this cloud, it reflects the bearish pressure in the market as demand stalls while selling pressure spikes.

If the trend continues, BTC risks falling below $111,961 and potentially retracing to the $110,000 region.

However, if new demand enters the market, its price could regain strength and climb toward $115,892.

The post Bitcoin’s Sharp Decline Triggers $277 Million Long Liquidation Wave appeared first on BeInCrypto.