First Chinese CNH stablecoin debuts as global race heats up

The first regulated stablecoin tied to the international version of the Chinese yuan (CNH) meant for foreign exchange markets, and a South Korean won (KRW) stablecoin launched this week as the global stablecoin race heats up.

Financial technology company AnchorX debuted its AxCNH yuan-pegged stablecoin on Wednesday at the Belt and Road Summit in Hong Kong, according to Reuters, following a regulatory pivot in China embracing stablecoins for international markets.

The stablecoin is meant to facilitate cross-border transactions with countries in the Belt and Road initiative, an infrastructure project building physical roads linking China to the Middle East and Europe, and establishing maritime trade routes with other regions.

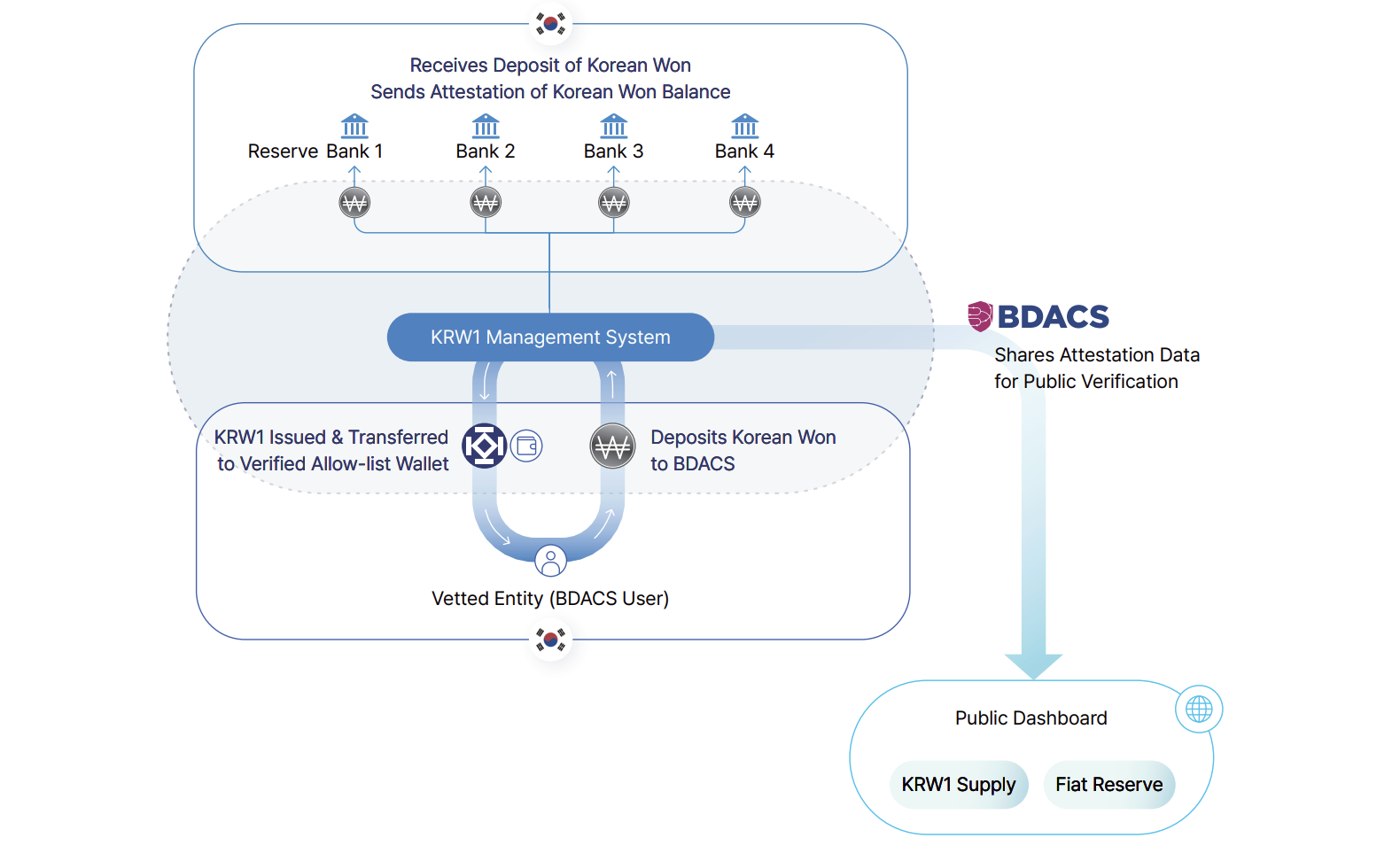

BDACS, a digital asset infrastructure company, also announced the launch of KRW1, a Korean won-pegged stablecoin, on Thursday.

Both KRW1 and AxCHN are overcollateralized stablecoins, meaning that they are fully backed 1:1 by fiat currency deposits or government debt instruments held by a custodian.

Stablecoins are now a sector with geo-strategic importance, as sovereign governments rush to place their fiat currencies on digital rails to increase demand for their currencies internationally, in the hopes of offsetting inflationary effects from currency printing.

Related: Tether to launch USAT, names ex-Trump adviser as CEO

The interplay between stablecoins, fiat currencies, inflation, and government debt

The legacy financial system is slow, requires robust infrastructure that may not exist in developing areas, and features currency controls in certain jurisdictions that hamper demand for fiat.

Placing fiat currencies on blockchain rails, which operate 24/7 and feature near-instant, cross-border settlement, increases international demand by making fiat more accessible to the average person, which can offset price increases caused by currency inflation.

Currency inflation results in price increases because the demand for the currency is not proportional to the additional supply created through money printing.

Overcollateralized stablecoin issuers like Tether and Circle help solve this problem by buying government debt instruments and cash assets to back their digital fiat tokens and then making the tokens accessible to anyone with a mobile phone and a crypto wallet.

In essence, these companies provide an avenue for most individuals around the globe to become indirect bond buyers, boosting the market for those assets, lowering yields on state-issued debt, and reducing the government’s debt-service burden.

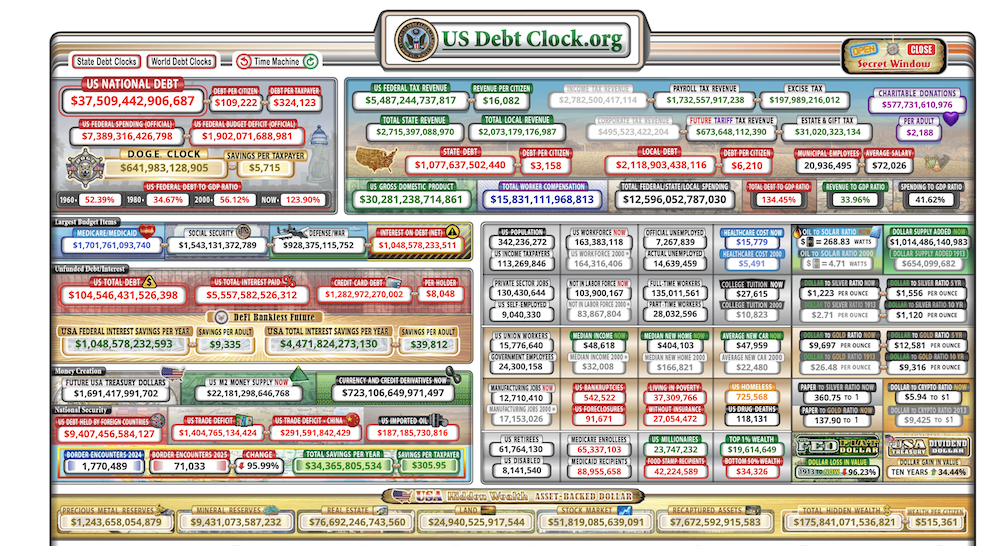

Tether is now one of the largest US Treasury bill holders in the world, surpassing developed countries, including Canada, Norway, and Germany.

Anton Kobyakov, an advisor to Russian President Vladimir Putin, recently said that the US government is attempting to offset its $37 trillion debt with stablecoins and gold to boost confidence in the declining US dollar.

Magazine: Bitcoin vs stablecoins showdown looms as GENIUS Act nears