Bitcoin Price Prediction: Will Profit-Taking Drag BTC to $105K?

- The Bitcoin price prediction is based on whether ETF demand surpasses selling pressure.

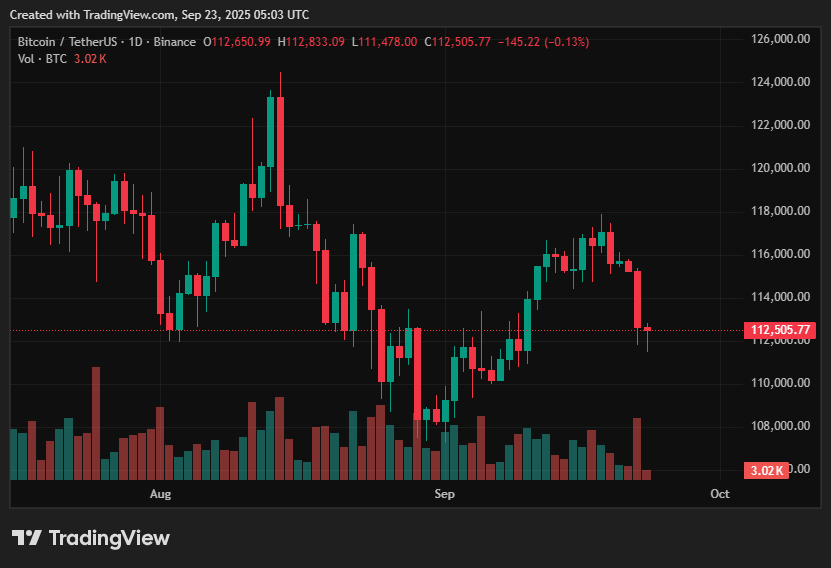

- Bitcoin is currently trading around $112.7k, with a consolidation range of $112k-$115k.

- ETF inflows remain a major driver, albeit recent flows have been erratic.

- Upside potential: A break above $115k might go to $118k-$122k.

- Downside risks: A break below $112k might result in a drop to $108k, with $105k as an extension.

- Profit-taking and September’s weak seasonality raise bearish risks.

The Bitcoin price prediction narrative is again in focus as Bitcoin trades around $112.7k today, holding near key support levels after last week’s sharp retracements.

Traders are weighing ETF flow dynamics, Fed policy signals, and broader macro sentiment while leveraged positions continue to amplify intraday volatility. Large liquidations below $113K reminded the market of how quickly momentum can shift in either direction.

Institutional buying via spot ETFs remains the key structural story, but headline flows have become less consistent: weeks with big net inflows were followed by days of small outflows as markets reacted to Fed direction. This push-and-pull between long-term institutional accumulation and near-term profit-taking is shaping the Bitcoin outlook, as traders debate whether BTC can hold current ground or slip toward lower supports.

Table of Contents

Current BTC Price Scenario

Bitcoin has been trading in a low-to-mid six-figure range, with technical support at around $112k and resistance at $115k. Price tested and briefly broke $113k amid recent volatility before settling back near $112.7k, indicating that the current consolidation is short but fragile. Market participants are intently monitoring order flow and ETF activity to determine who will absorb selling at current prices.

On-chain and market-structure signals portray a mixed picture: exchange net outflows and earlier weeks of ETF accumulation indicate that some supply is being held back, but on-chain indications also show pockets of profit-taking and increased altcoin rotation on days when BTC is down. These elements work together to form a limited trading corridor in which momentum indicators can swiftly flip.

Upside Outlook

A strong break over $115k would likely flip short-term sentiment bullish and trigger momentum buying toward $118k-$122k, with higher objectives anticipated by experts if ETF flows resume. Historically, when ETFs have pumped sustained weekly inflows, Bitcoin (BTC) has tended to push through local barriers as dealers and institutions pursue accumulation.

Such an upward trend would most likely necessitate both (a) increased visible ETF demand and (b) a reduction in liquidation risk across derivatives. Macro factors, like as lower-than-expected inflation figures or clearer rate-cut guidance, might intensify that trend by increasing risk-on flows into cryptocurrency. Under those conditions, BTC could sustain higher levels, with the BTC price forecast extending beyond near-term resistance levels.

Downside Risks

Failure to defend $112K would expose BTC to a quick retest of $108K, where prior whale accumulation was observed. If this level gives way under strong selling pressure, cascading liquidations could drag BTC toward the $105K projection, especially if leveraged longs are flushed out en masse. Analysts have cautioned that technical momentum is already softening as RSI cools and funding rates normalize.

September also has a reputation for seasonal weakness in cryptocurrency. When combined with long-term holders’ profit-taking tendencies, this further dampens upside expectations and raises the possibility that any breakdown may accelerate. A cautious approach is still recommended until buyers reassert themselves with higher ETF inflows and unambiguous spot demand.

BTC Price Prediction Based on Current Levels

The current tactical range to monitor is $112k-$115k. If BTC clears and maintains above $115k on greater volume and renewed ETF absorption, the path to $118k-$122k becomes the most likely scenario in the coming weeks, with tail-risk upside if institutional buys surge once more. This is the constructive scenario supported by coverage, which signals continuing inflows and lower currency balances.

In contrast, a decisive collapse below $112k would support the bearish scenario and lay the way for a rapid test of $108k, with $105k a potential extension target if deleveraging intensifies. Traders should monitor ETF daily flows, derivatives open interest, and on-chain transfer activity for real-time indicators of breakout or collapse.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.