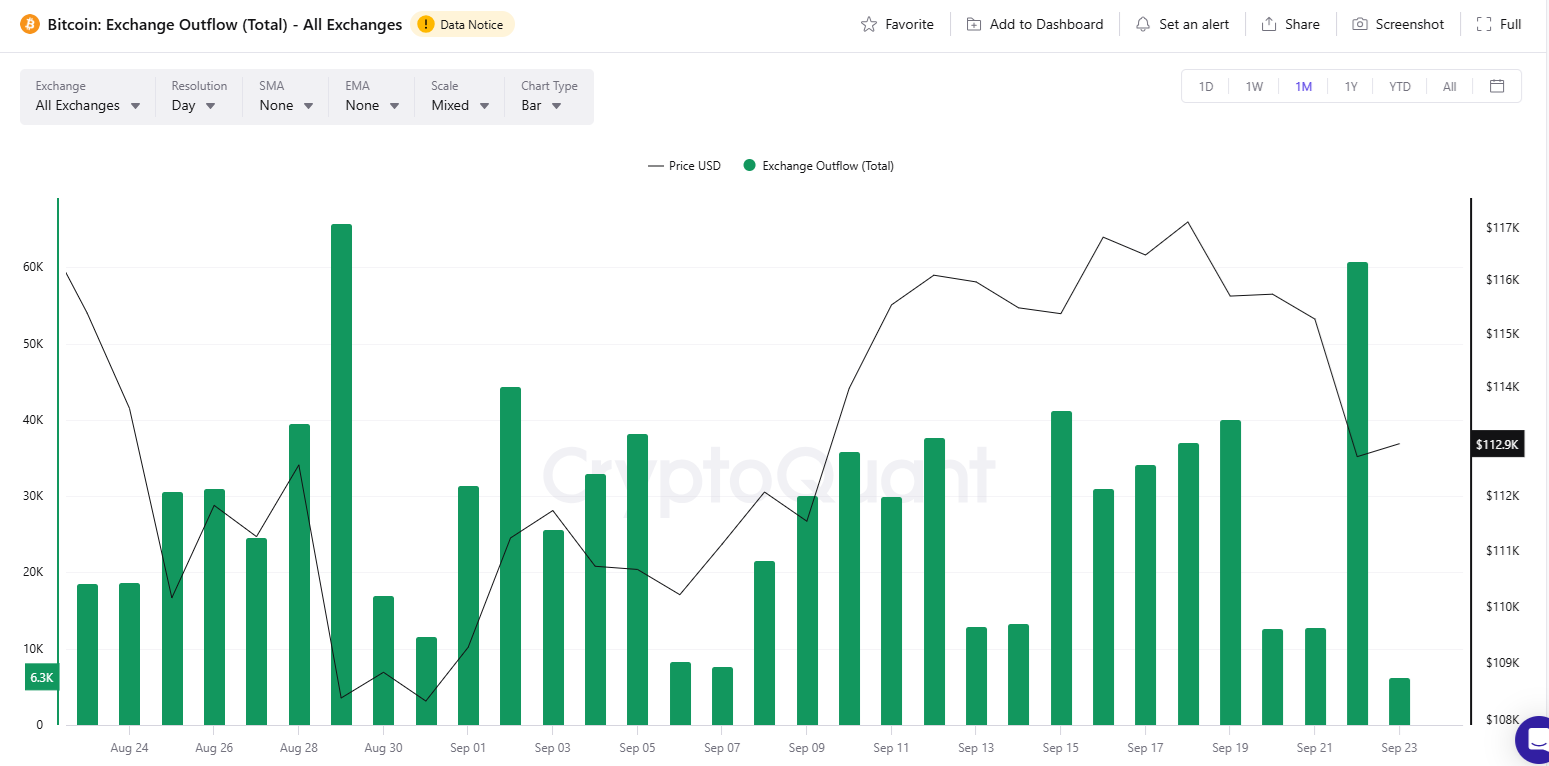

Bitcoin outflows climb to one-month high after drop to $112K

Following the recent BTC slide to the $112,000 range, exchange outflows expanded to a one-month peak. Despite liquidations and some selling pressure, there are signs of whales buying the dip.

Despite the BTC dip to the $112,000 range, exchange outflows accelerated. This may be a sign of renewed accumulation, as whales buy the dip.

Following the recent liquidation cascade, which expanded into the biggest deleveraging event for the year, BTC still showed signs of resilience. The recent exchange outflows took out 60,775 BTC out of exchanges, suggesting price pressure may ease, and that some of the coins were redistributed.

A similar peak outflow happened on August 29, following a BTC price dip. At that time, 65,795 BTC were taken off the markets.

BTC also had more days of exchange outflows in the past week, despite the weakening price. Inflows were distributed to small whale wallets with 1K-10K BTC, with additional flows to shark wallets, which continue their ongoing expansion.

Top whale wallets with over 10K BTC, some belonging to exchanges, were redistributing their coins. In addition to the general trend of accumulation, specific whales have accelerated their buying behavior.

Sentiment for ‘buying the dip’ has also returned, alongside indicators of strategic whale repositioning. For now, the trends do not translate into a fast recovery for BTC, as the market price consolidated around $113,058.

Who is selling BTC?

At around $112,000, BTC may be feeling selling pressure, as some of the new buyers may want to cut losses in the event of a drawdown.

BTC is showing highly active on-chain movements, with recent flows suggesting more coins are changing hands. Based on Hodl Waves data, selling originated from newer wallets, created 1-3 months ago.

In the past two weeks, BTC survived the apparent selling pressure, as strategic traders offloaded coins in September. Predictions of a dip under $100,000 did not materialize. However, this time around, the fear and greed index dipped to 47 points, indicating fear, down from a recent neutral position.

BTC rebuilds open interest

BTC open interest immediately recovered from around $38B up to $39.3B following the recent liquidation event. The accumulation renewed long positions, despite the large-scale long liquidation on Monday. Over 64% of positions are long on BTC.

Separate whales are returning to long positions on Hyperliquid. BTC is more balanced on the derivative DEX, with just 54% of positions going long. However, the biggest position as of September 23 is a BTC short, with a notional value of $303M.

Based on the liquidation heatmap, long positions have accrued all the way down to $108,000 per BTC, while short positions are rebuilding above $113,800. The Coinbase premium index remains positive, while at the same time futures markets are trading at a discount to spot BTC.

At the current price range, BTC is down around 8.8% from its all-time peak, during a cycle where even the biggest drawdowns did not erase more than 20% from the price. Even without enthusiasm for a market top, BTC whales are showing strategic repositioning, signaling a long-term outlook.