Why Bitcoin’s Small Gains Could Be Hiding a Bigger Breakout

The leading coin, Bitcoin, has managed to post a modest 0.28% gain over the past 24 hours, a slight move against the backdrop of a broader market dip and fading bullish sentiment.

While the price action looks subdued, key on-chain metrics suggest that demand is quietly building beneath the surface, laying the foundation for stronger upside in the near term.

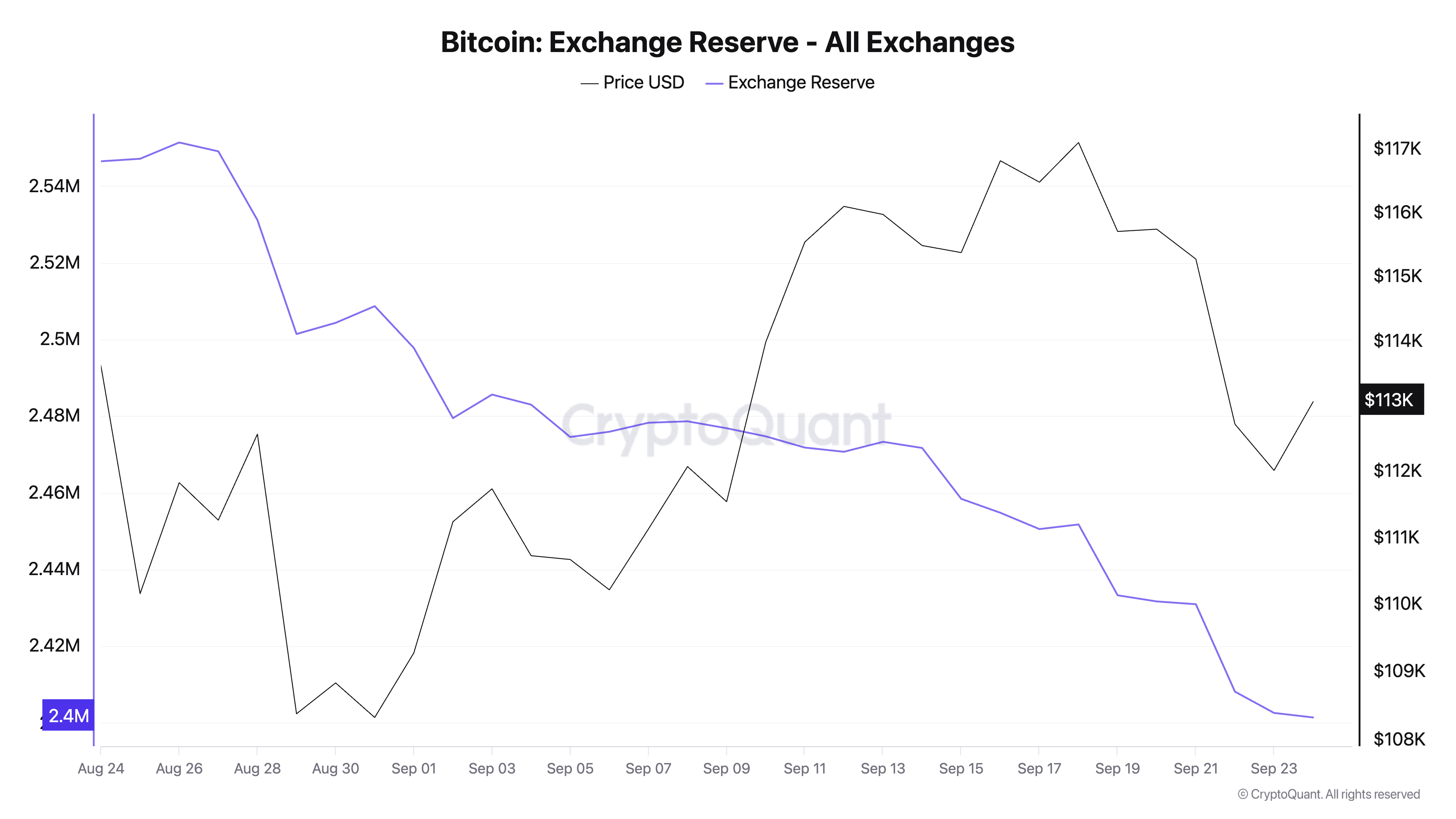

Exchange Reserves Plunge to YTD Low

One of the most notable signals is BTC’s exchange reserve, which continues to fall. According to CryptoQuant, it plunged to a year-to-date low of 2.4 million on Tuesday.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

BTC’s exchange reserves measure the amount of coins held on centralized trading platforms. A sustained drop indicates that fewer coins are available for immediate sale, suggesting that investors are transferring assets into cold storage or holding them long-term.

Despite its lackluster price performance, the steady dip in BTC’s exchange reserves over the past few weeks highlights that traders maintain conviction even as the broader market shows signs of weakening sentiment.

This quiet withdrawal from exchanges suggests that holders remain confident in BTC’s long-term prospects, reducing immediate selling pressure.

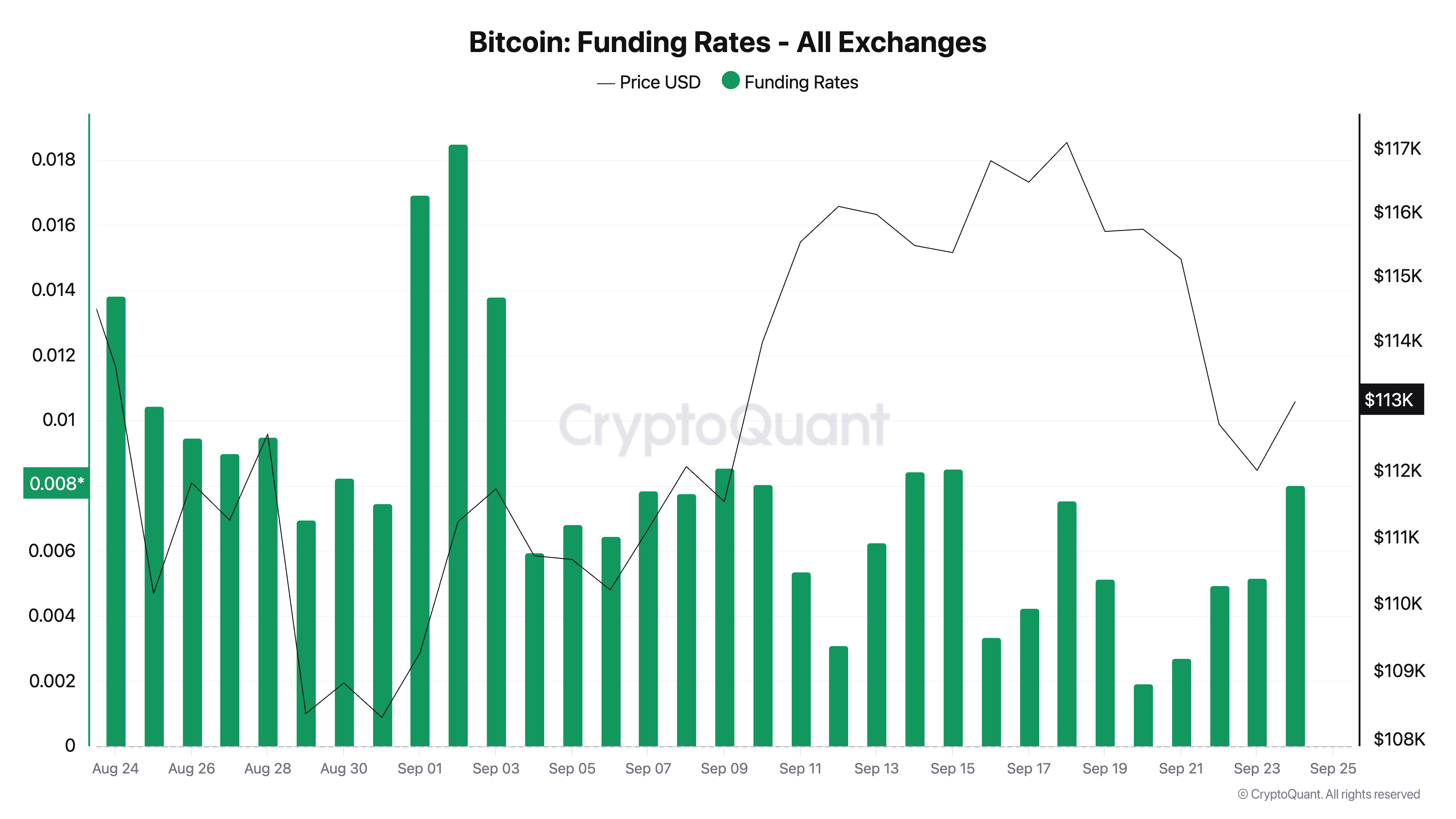

Furthermore, BTC’s funding rates across major exchanges remain positive, indicating that futures traders continue to lean bullish. At press time, this stands at 0.079.

The funding rate is used in perpetual futures contracts to keep the contract price aligned with the spot price. When the rate is positive, long traders are paying shorts, signaling that most traders are leaning bullish. Conversely, negative rates indicate shorts are paying longs, suggesting a bearish tilt.

Currently, BTC’s funding rates remain positive but moderate. This shows that while traders hold a slight bullish bias, they are not taking on aggressive leverage. Such positioning reduces the risk of sudden liquidations and suggests cautious optimism. This could give BTC the stability it needs to build on its recent gains.

Bitcoin Support Holds — Could a Climb to $115,000 Be Next?

If buyers capitalize on this underlying support, BTC could extend its climb in the near term, rallying to $115,892.

However, if market weakness deepens, the current rally may stall, leaving BTC to resume consolidating or trigger a dip below the support floor at $111,961.

The post Why Bitcoin’s Small Gains Could Be Hiding a Bigger Breakout appeared first on BeInCrypto.