Machine learning algorithm predicts Bitcoin price for end of Q3, 2025

We are less than seven days away from the end of the third quarter, and Bitcoin (BTC) is still struggling to recuperate following a wave of sell-offs earlier this week.

Currently trading at around $111,600, the world’s largest crypto is down more than 5% on the weekly chart, having lost over $120 billion in market cap in the past seven days.

Bitcoin’s price is down 1.39% in the last 24 hours, with a 26.27% increase in trading volume ($61.35 billion) over the same time frame.

AI predicts Bitcoin price for end of Q3, 2025

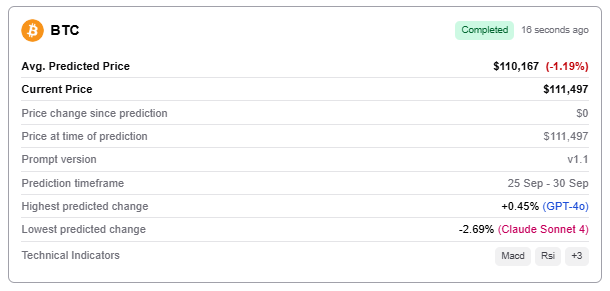

Finbold’s AI Signals, an artificial intelligence (AI) tool that integrates large language models (LLMs) with momentum-driven market indicators, has generated an average BTC price heading into the quarter’s close. Based on the prediction, the cryptocurrency might trade at $110,167, implying a 1.19% dip from the current levels.

GPT-4o was the most bullish of the models used in the analysis, pointing to a price of $112,00 (+0.45%), while Claude Sonnet 4 and Grok 3 projected it would drop to $108,500 (-2.69%) and $110,001 (-1.34%), respectively.

As mentioned, Bitcoin has been having a hard time since a wave of forced liquidations earlier this week erased $1.5 billion from leveraged positions. However, the risk factor has also been amplified by Fed Chair Jerome Powell’s warnings of a “no risk-free path” for monetary policy during his September 23 speech at The Crowne Plaza in Warwick, Rhode Island.

“There is no risk-free path. If we ease too aggressively, we could leave the inflation job unfinished and need to reverse course later to fully restore 2%. If we maintain restrictive policies for too long, the labor market could soften unnecessarily,” said Powell.

Altcoins mirrored Bitcoin’s decline, with Ethereum (ETH) down 4% to $4,010, its seven-week low. Right now, exchange-traded funds (ETFs) remain a key driver, as Bitcoin ETFs recorded $241 million in net inflows on Wednesday, September 23, compared to Ethereum ETFs, which saw over $100 million in outflows.

Featured image via Shutterstock