Small BTC treasury firms face biggest stock crashes, losing up to 97% from highs

Treasury companies have all slid from their all-time highs. BTC buying is having a disparate effect on corporate buyers, and often those with smaller treasuries end up losing the most.

Buying BTC is not a universal benefit to treasury companies. Some of the smaller recent buyers, which added BTC to their balances for exposure, have seen the biggest drawdowns on their stock price.

As of September 25, entering the top 100 of BTC treasuries required 86 coins – and there is a smaller churn to the list. Only a few months back, even a company with 10 BTC could boast of holding a treasury.

However, there are different groups of companies, each having a different reaction to the BTC downturn. Even though some treasury company shares are down, there is limited demand for buying the dip, especially during the market weakness at the end of September.

Small treasury companies wipe out the most value

Next Technology Holding (NXTT) is the biggest loser of the entire list of treasury companies. NXTT shares are down 97.6% from their 52-week high. The treasury holds 5,833 BTC, which ranks the company at 17th place, right above KindlyMD.

Coinsillium, holding just 182 BTC, lost 96.8% of its market price. Satsuma technology, with 1,448 BTC, is in the third place, down 94.7% from its peak.

The London Bitcoin Company, a small-scale buyer with 85.97 BTC, is down 92.7% from its yearly peak.

Miners performed the best during the downturn

Companies with a mix of mining operations and treasuries fared the best. CleanSpark (CLSK) is down only 19.6% from its peak, boosted by its data center operations and generally profitable business. As Cryptopolitan reported, CleanSpark also secured a $100M credit line from Coinbase Prime.

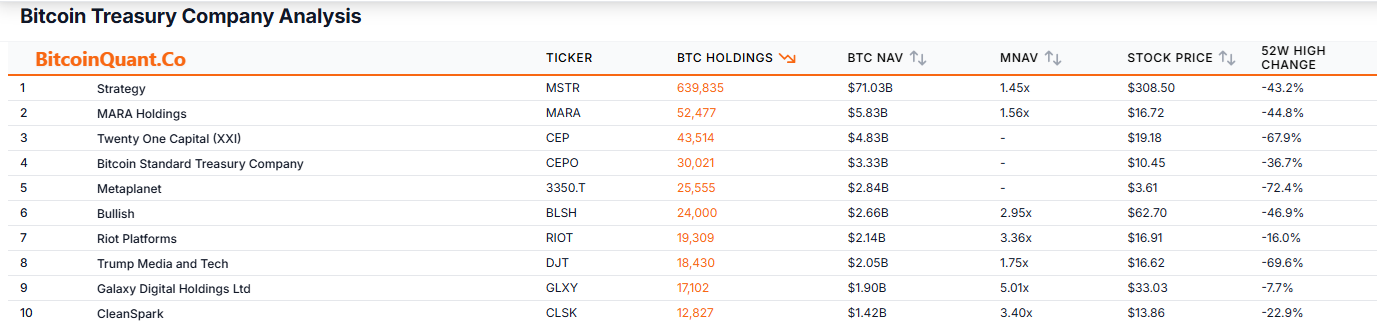

However, Mara Holdings is down over 40% from its peak, despite the mix of mining and a large-scale treasury of 52,477 BTC.

Top 5 treasury companies are down between 36% and 72%

The top treasury companies with the highest profile and most aggressive buying programs have suffered drawdowns between 36% and 72%. The setbacks happened even during BTC’s expansion. Currently, BTC is only down less than 14% from its peak, while treasury stocks are still in the red.

Strategy (MSTR) is down over 43% from its peak. Twenty One Capital (XXI) lost 67.4% from its yearly peak. Metaplanet (MTPLF) is the biggest loser with 72.4% from its peak. Treasury company stocks are now decoupling from BTC, with a drop in mNAV ratios.

While BTC has caused whales to buy the dip, treasury company stocks are not in demand during market downturns. The purchasing strategy flywheel effects come during peak times of enthusiasm for the shares, which feed into renewed BTC buying.

Treasury companies will now have to prove they can outperform ETFs or the outright buying of crypto. The biggest threat is for leaders like MSTR or MTPLF to completely decouple from the crypto market’s trend.