$241 Million Pours Into Bitcoin ETFs, but Ether ETFs Stay in the Red

Bitcoin ETFs reversed their two-day losing run with $241 million in inflows, led by Blackrock’s IBIT. Ether ETFs, however, continued their outflow streak, shedding $79 million across five funds.

Bitcoin ETFs Bounce Back as Ether ETFs Mark Third Day of Outflows

After two straight sessions of redemptions, bitcoin exchange-traded funds (ETFs) finally flipped the script midweek. Fresh demand lifted the asset class back into green territory, even as ether ETFs remained stuck in a string of outflows.

Bitcoin ETFs recorded $241 million in net inflows, halting the outflow streak. Blackrock’s IBIT carried the bulk of the momentum with $128.90 million, followed by Ark 21Shares’ ARKB at $37.72 million and Fidelity’s FBTC at $29.70 million.

Bitwise’s BITB contributed $24.69 million, while Grayscale’s Bitcoin Mini Trust added $13.56 million and Vaneck’s HODL chipped in $6.42 million. No outflows were seen, underscoring the strength of the rebound. Total value traded reached $2.58 billion, with net assets climbing to $149.74 billion.

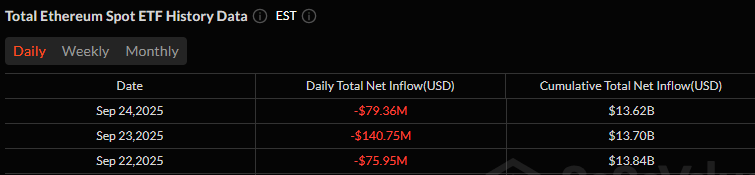

Ether ETFs, on the other hand, extended their losses into a third consecutive session with $79.36 million in outflows. Fidelity’s FETH led the red tide at $33.26 million, while Blackrock’s ETHA followed closely with $26.47 million. Grayscale’s ETHE lost $8.91 million, Bitwise’s ETHW slipped $4.48 million, and 21Shares’ TETH rounded off with $6.24 million in exits. Total value traded stood at $971.79 million, with net assets holding at $27.42 billion.

The sharp divergence underscores a split in investor sentiment, with bitcoin ETFs regaining traction just as ether ETFs struggle to find steady ground. The next few days could prove decisive in determining whether bitcoin’s rebound gains momentum or ether remains weighed down by persistent selling pressure.