Stablecoins need consumer protections to unseat incumbents: Crypto exec

Stablecoins won’t unseat incumbent payment platforms, including Visa and Mastercard, until the blockchain tokens feature robust consumer protections, according to Guillaume Poncin, chief technology officer of payment company Alchemy.

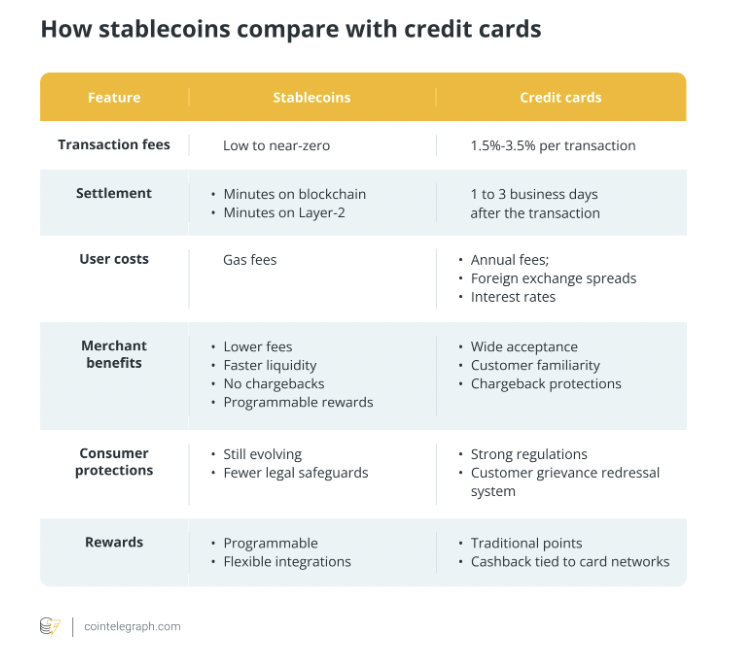

Traditional payment companies offer chargebacks, fraud protection, disputed transaction resolution and credit features that consumers have come to expect. Stablecoin projects must integrate these features to attract the everyday person, Poncin told Cointelegraph.

Consumer protection features can be embedded directly in smart contracts, while stablecoin issuers and payment platforms can fund their own insurance pools for payouts in cases of fraud, Poncin said. He said traditional payment rails and stablecoins will merge:

“I expect every major payment processor will integrate stablecoins, and every bank will issue its own. The future is one where traditional rails are enhanced by blockchain’s efficiency and new use cases. For cross-border payments and emerging markets, stablecoins are already winning.

For domestic retail, we will see hybrid models combining instant settlement with consumer protections,” he said.

Stablecoins offer 24/7, cross-border settlement at a fraction of the cost of traditional bank transfers, making them more practical for remittances and international commerce. This gives stablecoins a competitive advantage over payment card providers in these markets.

Related: Coinbase says stablecoins not draining bank deposits, calls it a ‘myth’

Banking industry weighs the potential effects of stablecoins on the legacy system

Crypto industry executives, commercial banks and market analysts continue to argue the effects of stablecoins on incumbent financial institutions in payments and banking.

Banks and their allies in the US Senate pushed back against stablecoin regulation in March during the debate over the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) bill in the US.

At the center of the pushback was the potential for stablecoin issuers to share some of the yield from the US government securities that back their tokens with customers, which was prohibited in the final bill.

US Senator Kirsten Gillibrand argued that yield-sharing opportunities would kill the traditional banking system and the bank lending that homebuyers and small businesses depend on.

Gillibrand asked the audience at the DC Blockchain Summit in March: “If there is no reason to put your money in a local bank, who is going to give you a mortgage?”

However, Jamie Dimon, CEO of financial services giant JPMorgan, recently said that he is not worried about stablecoins replacing banks, adding that each has its own consumer base and will continue to coexist.

“There’ll be people who want to own dollars through a stablecoin outside the US, from bad guys to good guys to certain countries where you’re probably better off having dollars and not putting into the banking system,” Dimon told CNBC.

Magazine: TradFi is building Ethereum L2s to tokenize trillions in RWAs: Inside story